Bitcoin Price Stands Still but the Outlook Might Have Changed

Currencies / Bitcoin Jan 07, 2015 - 03:31 AM GMTBy: Mike_McAra

Briefly: short speculative positions, stop-loss at $312, take-profit at $203.

Briefly: short speculative positions, stop-loss at $312, take-profit at $203.

BitStamp, one of the popular Bitcoin exchanges, posted an update on its website, giving customers more information on the recent security breach and its consequences:

We have temporarily suspended Bitstamp services. Bitstamp customers can rest assured that their bitcoins held with us prior to temporary suspension of services on January 5th (at 9am UTC) are completely safe and will be honored in full.

On January 4th, some of Bitstamp's operational wallets were compromised, resulting in a loss of less than 19,000 BTC. Upon learning of the breach, we immediately notified all customers that they should no longer make deposits to previously issued bitcoin deposit addresses. To repeat, customers should NOT make any deposits to previously issued bitcoin deposit addresses. As an additional security measure, we suspended our systems while we fully investigate the incident and actively engage with law enforcement officials.

This breach represents a small fraction of Bitstamp's total bitcoin reserves, the overwhelming majority of which are held in secure offline cold storage systems. We would like to reassure all Bitstamp customers that their balances held prior to our temporary suspension of services will not be affected and will be honored in full.

We appreciate customers' patience during this disruption of services. We are working to transfer a secure backup of the Bitstamp site onto a new safe environment and will be bringing this online in the coming days. (...)

It's good to see that BitStamp is giving their customers an update on the current state of affairs. Still, no coins should be transferred to the exchange until the current situation is fully resolved. If the information provided by the exchange is correct, then the losses due to the possible hack would not be substantial. We would have to see the service resumed and possibly an independent audit of the resources of BitStamp before proclaiming that all is "back to normal."

The market hasn't been moving much. This might mean that the new info from BitStamp has so far failed to drive the market decisively in any direction. Yes, Bitcoin has recovered somewhat from the bottom but the move has been relatively weak. More on that later on in the alert.

For now, let's focus on the charts.

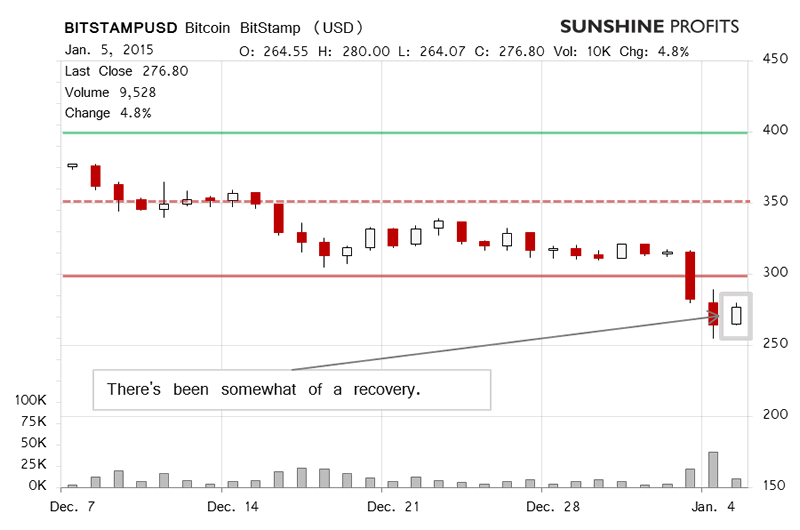

On BitStamp, we haven't seen any change since the moment when our previous alert was written. This is because trading died out yesterday on the exchange following the issue of the first notice about the problems BitStamp encountered. Compared with yesterday, the above chart is updated with yesterday's close. If you recall, yesterday we wrote:

It would seem to us that Saturday and Sunday could have been, at least in part, driven by the security problems at BitStamp (this is our opinion). Today, we've seen a move up (this is written around 11:00 a.m. ET). This rebound is what makes the current situation less clear than just plain "very bearish."

A move up could mean that the decline of the recent days was mainly driven by the BitStamp problem. On the other hand, the volume today has been markedly weaker than yesterday or on the day before. This could suggest that this is a counter-trend rally, to be followed by more declines. This actually the scenario we're inclined to bet on but we would like to see today's close lower than it is now.

Since nothing has changed here, we still haven't seen a decisive indication coming from BitStamp. But since the exchange currently is not a reliable source of present market prices (as there is no trading going on), we might not see a bearish confirmation here even if the situation actually becomes even more bearish. Because of that, we need to focus on other exchanges now.

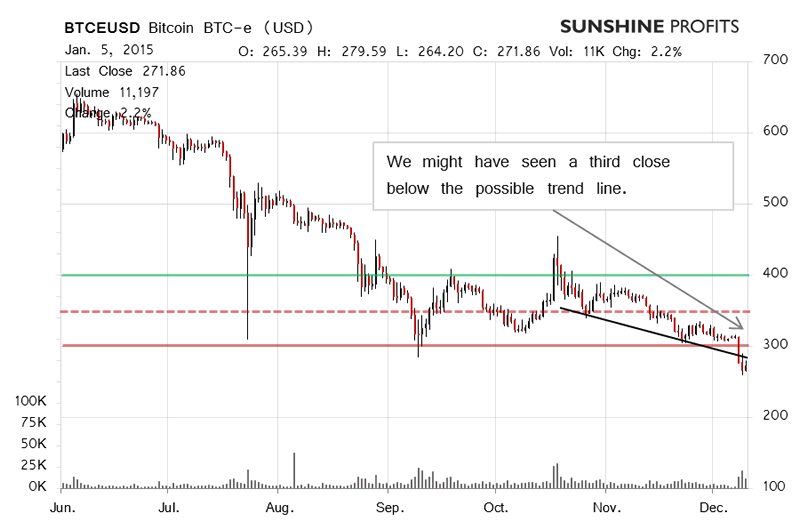

On the long-term BTC-e chart, we just saw an interesting development. Bitcoin might have closed a third consecutive day below a possible trend line. Combine that with the recent slump, the significant volume during the slide and the not so significant volume during the rebound and what we might be looking at is a countertrend move up. But there's more.

The move today (this is written around 8:00 a.m. ET) has been flat and the volume has been meager, at least compared with the last couple of days. Let's recall what we wrote yesterday:

Bitcoin touched $260 yesterday and possibly broke below a declining trend line. We've seen a rebound today but it hasn't really been that strong, with Bitcoin going as far as $280 before giving up some of the advancements. This might suggest the continuation of the move down. Before getting on the short side of the market, we would like to see how the events will develop today. If Bitcoin doesn't move up decisively, we might suggest short hypothetical positions.

At the moment, the critical thing to consider is whether today's move up will hold up. We don't expect Bitcoin to go up immediately but we would like to see how the action plays out today and possibly how tomorrow starts before making a move.

The move up has not been erased but it hasn't continued either. The picture now is of a correction to the upside running out of steam. In such circumstances, and with an additional cue from a third close below the possible declining trend, it seems that Bitcoin might be open to more depreciation, in our opinion.

Summing up, we support short speculative positions at the moment (Bitcoin at $271.91 on BTC-e).

Trading position (short-term, our opinion): short speculative positions, stop-loss at $312, take-profit at $203.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.