Bitcoin Price in Tense Territory

Currencies / Bitcoin Jan 10, 2015 - 05:59 AM GMTBy: Mike_McAra

We read on Reuters that BitStamp had confirmed their exchange would go online during the day today:

We read on Reuters that BitStamp had confirmed their exchange would go online during the day today:

Bitstamp, one of the largest exchanges for the digital bitcoin currency, said it would resume trading later on Friday after suspending operations because of a security breach on Sunday.

Bitstamp had suspended its service after the breach resulted in the loss of around 19,000 bitcoins with a value of some $5 million.

"Trading will resume during the day today," Damijan Merlak, one of Bitstamp's two Slovenian founders, told Reuters in an emailed message on Friday.

On Wednesday Bitstamp had said it expected that trading could resume within 24 hours and added that customers would not lose money because of the breach and that security would be increased.

Merlak said various institutions from the European Union and the United States were investigating the security breach without naming them. The Slovenian police told Reuters it was not involved in the investigation.

Last February, Bitstamp claimed that developers had come up with a solution to thwart cyber attacks against its platform after Mt. Gox, once the world's biggest bitcoin exchanges, lost an estimated $650 million worth of the virtual currency when its computer system was hacked.

The Bitstamp breach represented a small fraction of its total bitcoin reserve and the majority was held in secure offline systems, the Slovenia-based firm posted on its website.

The process of getting the website back up and running is taking more than was initially expected but if it does indeed come back today and customers are able to access their funds, this would be a very reassuring development. We also have to take a closer look at the price of Bitcoin at this moment – it might move after the site is back on. This is not sure but definitely something you should pay close attention to right now.

One possible scenario is that following the reboot of BitStamp, we might see a period of selling as people frustrated with the exchange call it quits. If there is a strong pull to transfer bitcoins into fiat, we might see a selloff.

For now, we focus on the charts.

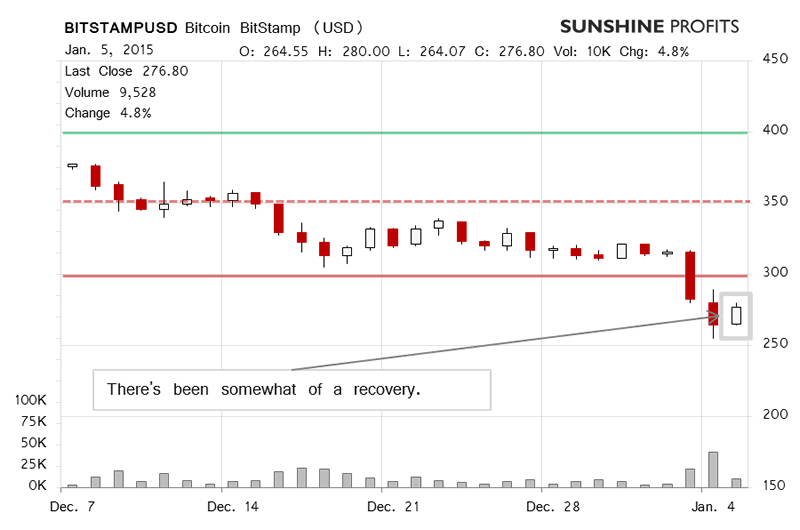

Still now changes on BitStamp and our previous comments remain valid:

“Since nothing has changed here, we still haven’t seen a decisive indication coming from BitStamp. But since the exchange currently is not a reliable source of present market prices (as there is no trading going on), we might not see a bearish confirmation here even if the situation actually becomes even more bearish. Because of that, we need to focus on other exchanges now.”

Will Bitcoin go up if BitStamp comes online? It might, but it is also possible that there will be selling pressure since some of the BitStamp customers will liquidate their accounts. Also, it seems that the BitStamp problems haven’t had a tremendous effect on the price of Bitcoin. As such, it is possible that the market is not really moved much by what is going on with BitStamp.

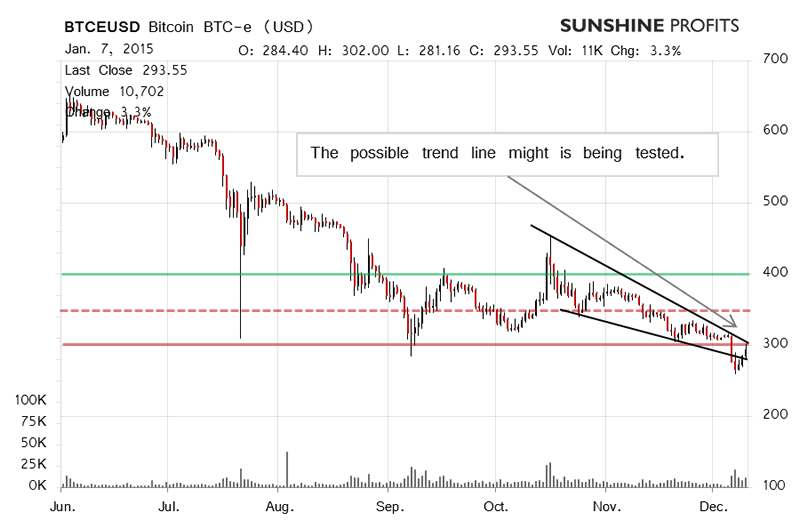

On the long-term BTC-e chart, the situation remains at a possibly important point. Yesterday, we wrote:

We see that Bitcoin is now between two possible trend lines, one based on local lows, one on local highs. Actually, the break below the former line is tested at the moment of writing. Yesterday, following the release of our alert, Bitcoin trading picked up and the volume ended up being higher than on the day before.

(…)

(…) Bitcoin shot up to $300 (solid red line in the chart) but retraced below this level before the end of the day. Bitcoin ended the day higher but without a decisive break to the upside. Today (this is written after 10:15 a.m. ET) we’ve seen mostly moves to the downside but the move hasn’t been strong. We still have only seen two closes above the possible declining trend line, so the situation doesn’t really seem bullish.

If Bitcoin opens up the way for further depreciation by retracing back to $260, we might see a slide possibly to $200. The alternative, in our opinion, would be stabilization around $300. In our opinion, there hasn’t been enough change to close the hypothetical speculative short positions and we still are inclined to bet on lower prices.

These comments are still very much up to date. Yesterday, Bitcoin ended lower than it had opened, erasing Wednesday’s gains but the overall volume was lower than on Wednesday. It was a day of depreciation but not a decisive fall.

Today, Bitcoin has gone up slightly (this is written around 9:00 a.m. ET) and the volume has been similar to what we saw yesterday. This situation actually provides us with possible hints.

First of all, the recent prevailing move has been down, even though we saw a rebound within it. The days of depreciation were also the days of highest volume and the rebound took place on falling volume. It was also followed by a day of depreciation. As such, it seems that Bitcoin is very close to moving lower once again. Unless we see a strong move above $300 (solid red line in the chart), we will be inclined to bet on further declines to follow.

Summing up, we still think speculative short positions are the way to go now.

Trading position (short-term, our opinion): short speculative positions, stop-loss at $312, take-profit at $203.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.