Impending US Dollar Peak Should be Catalyst for Gold Price

Commodities / Gold and Silver 2015 Jan 30, 2015 - 12:47 PM GMTBy: Jordan_Roy_Byrne

Gold has performed very well under the circumstances of declining inflation and a surging US$ index. Since 2014 the US$ index is up nearly 18% while Gold is up 3%. Since Gold's November low the US$ index is up over 10%. Had we known that at the time, we'd have thought Gold would be headed for $1000 and not the $1300 it recently hit. At present, the US$ index appears ripe for a correction or major pause in its uptrend. Given that Gold is priced in US$ and that Gold has shown strength in real terms, sustained US$ weakness could be a major boon for Gold and precious metals as a whole.

Gold has performed very well under the circumstances of declining inflation and a surging US$ index. Since 2014 the US$ index is up nearly 18% while Gold is up 3%. Since Gold's November low the US$ index is up over 10%. Had we known that at the time, we'd have thought Gold would be headed for $1000 and not the $1300 it recently hit. At present, the US$ index appears ripe for a correction or major pause in its uptrend. Given that Gold is priced in US$ and that Gold has shown strength in real terms, sustained US$ weakness could be a major boon for Gold and precious metals as a whole.

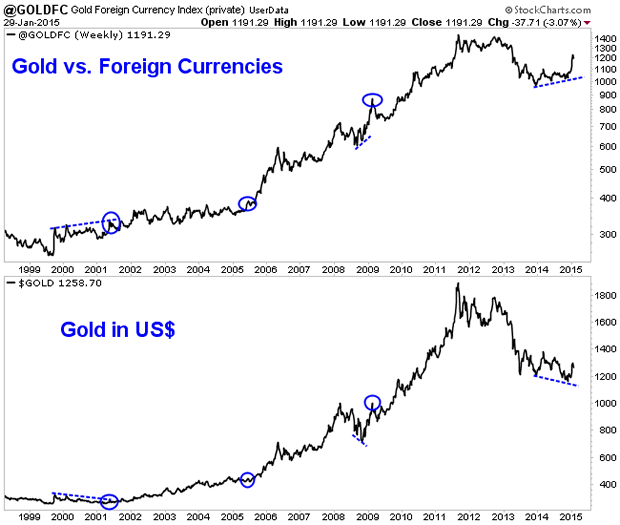

Before we get to the US$, I'd like to provide a comparison of Gold and Gold charted against foreign currencies. To create the foreign currency index we simply took US$ data and inverted it. Thus, we are charting Gold against the currency basket that comprises the US$ index. Over the past 15 years strength in Gold relative to foreign currencies has often preceded Gold strength in US$'s. Gold priced against foreign currencies bottomed in December 2013 and reached a 21-month high last week.

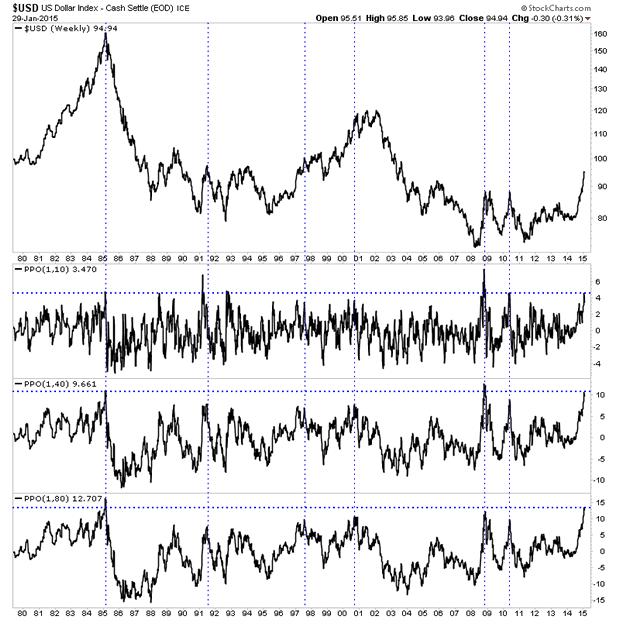

Let's take a look at the US$ index. We plot the index and its distance from its 10, 40 and 80-week exponential moving averages. A market's distance from various moving averages can signal overbought and oversold conditions. We highlight the points at which the US$ index has been most overbought. Considering the three oscillators as a whole, the US$ index is arguably at its third most overbought point since the US$ floated in 1971. The other times were at its peak in early 1985 and during the 2008 financial crisis.

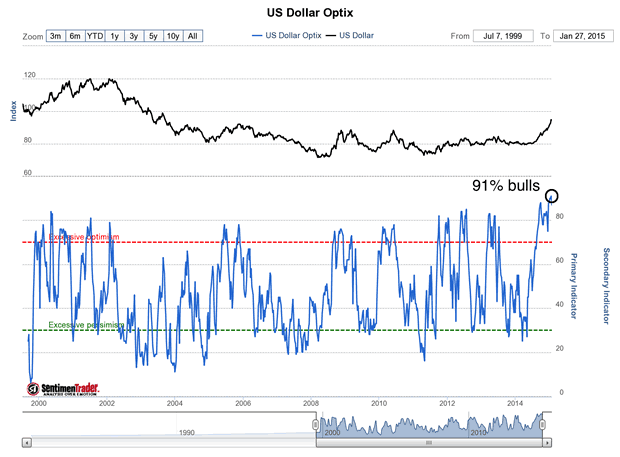

Meanwhile, sentiment on the US$ has reached a major extreme. Public opinion charted below (from sentimentrader.com) recently hit 91% bulls. That is the highest in 15 years. We should also note that the daily sentiment index for the US$ index hit 98% bulls a few weeks ago. That is the highest reading since May 2010. The US$ peaked a month later.

Gold has performed very well amid tremendous US$ strength and could get a further boost if and when the US$ weakens. The US$ index is extremely overbought and sentiment is extremely bullish. At the least it figures to correct or consolidate for a while. That could be Gold's chance to begin its next leg higher and force the bears to capitulate. While recent correlations have been atypical, I find it hard to believe Gold doesn't perform well if the US$ corrects. In the days and weeks ahead, the key support levels are GDX $20 and Gold $1240 to $1250.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.