We're All Hedge Funds Now!

Stock-Markets / Financial Markets 2015 Mar 21, 2015 - 10:23 AM GMTBy: John_Rubino

As negative interest rates spread from Switzerland, Japan and Germany to the rest of the developed world, people with money to invest face some life-defining choices.

As negative interest rates spread from Switzerland, Japan and Germany to the rest of the developed world, people with money to invest face some life-defining choices.

Retirees who need to generate 6% to avoid dipping into principal can't get there with bank CDs. Pension funds that have promised an 8% return in order to meet obligations to future retirees can't get anywhere near that with government bonds. Same thing for insurance companies and money market funds, whose business models require positive returns with low risk.

This presents these guys with a dilemma: Either become something radically different or cease to exist. In effect, they have to become hedge funds.

A retiree, for instance, can either stop being a retiree -- that is, go back to work -- on invest a lot more aggressively to meet the required 6% return. That means loading up on equities and junk bonds, either blithely because she doesn't know what they are (only that they've been going up) or with trepidation because she's aware that every five or so years these things tend to crash.

Public companies are finding that building new factories doesn't pay nearly as well as borrowing money and using the proceeds to buy back their own common stock. Pension funds, meanwhile, have more options, though the end result is the same. They can, like our hypothetical retiree, load up on equities, as Japanese pension funds are reportedly doing...

Japan Pensions Sell Record $46 Billion Bonds to Buy Stocks

(Bloomberg) -- Japan's public pension funds, which include the world's biggest, accelerated their push to dump local bonds and invest the money abroad to a record pace.The $1.1 trillion Government Pension Investment Fund and its smaller peers almost doubled net sales of Japanese government bonds to 5.56 trillion yen ($46 billion) in the fourth quarter, the most in Bank of Japan figures dating back to 1998. They bought an unprecedented 2.39 trillion yen of foreign stocks and bonds. Selling of JGBs and buying of overseas securities has continued for six straight quarters.

GPIF posted its largest investment gain in almost two years last quarter after shifting more money into stocks from Japanese bonds, as it came under government pressure to boost returns to cover payouts for the world's fastest-aging population. The Federation of National Public Service Personnel Mutual Aid Associations, last month said it will boost its investments in foreign stocks and bonds and cut exposure to domestic debt, matching the plan by GPIF.

...or they can wander even further into the "alternative" investing universe by hiring hedge funds to generate "alpha."

As Hedge Fund Returns Falter, Money Continues to Flow In

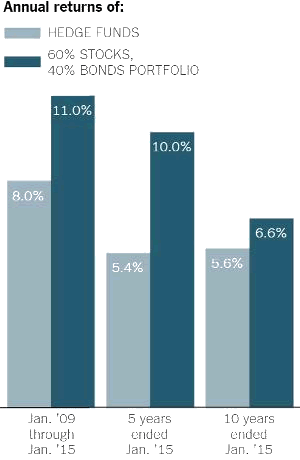

(New York Times) -- Another year, and another mediocre performance by hedge funds, to put it kindly. The Barclay Hedge Fund Index gained a meager 2.89 percent in 2014, while the Standard & Poor's 500-stock index gained over 13 percent and the Barclays United States Aggregate Bond Index rose over 5 percent.Even as their high fees have minted scores of new billionaires, hedge funds have now substantially underperformed a simple blend of index funds -- 60 percent stocks and 40 percent bonds -- for three-, five- and 10-year periods. And the 10-year numbers cover the period of the financial crisis and the sharp decline in stocks -- the very calamity that hedge funds are supposed to protect against.

No wonder Calpers, the giant California retirement system, withdrew from hedge funds last year. I assumed that by now, many other big pension funds and institutions would be following its lead.

Weak performance notwithstanding, "Investor interest in hedge funds has been continuously accelerating since the financial crisis," said Peter Laurelli, vice president for research at eVestment, "and it has really picked up during the past two years."

Mr. Laurelli mentioned two factors driving the trend: still-agonizing memories of the financial crisis and the persistent low interest rate environment. While the sales pitches for different hedge fund strategies vary, many funds promise to address both issues by blunting the impact of another market crash, while generating higher returns than United States Treasury bonds.

Institutions are not only pouring more money into hedge funds, but they also appear to be engaging in a classic pattern of many individual investors, which is to chase returns and shun losers. Last year, investor money surged into so-called event-driven strategies, like those pursued by the activist investors William Ackman and Daniel Loeb, who have had a string of recent successes. (A net $42.5 billion flowed into event-driven strategies, according to eVestment.) And after six months of strong results after years of underperformance, managed futures strategies (which make bets on commodities and other futures contracts) gained $4 billion in January alone.

At the same time, long-short equity strategies (funds that take both long and short positions in stocks) faced $7.5 billion in net outflows in January after far underperforming the S.&P. 500 in 2014.

"Most hedge fund investors are momentum investors," Mr. Lack said. "The only data they have is performance data, so they chase returns. You don't have many consultants out there saying you should invest in out-of-favor hedge funds. But there's never going to be a good outcome with that approach.

There's an enormous amount of research that shows hedge fund returns aren't persistent. They revert to the mean. Of all the hedge funds I looked at, only 7 percent were consistently in the top 40 percent. What chance do you have of picking them?"

In the world of aggressive investing, retirees, corporations and pensions funds are all "dumb money." They don't this kind of thing regularly so they have no institutional or personal experience to draw upon. The result, for pension funds and retirees, is the quintessential beginner strategy of trend following, buying what was hot last year because that's where the biggest returns are being generated, while public companies are being even dumber, buying stocks on margin (i.e., with borrowed money) without regard for valuation.

Similar things happened during the previous bubble, when individuals became real estate speculators, pension funds embraced alternative investments, and corporations ramped up their share repurchase programs. All got creamed in 2008. Will this time around be any different? Definitely. It will be much worse because the numbers are so much bigger.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.