Why Markets Ignored Weaker Payrolls

Stock-Markets / Financial Markets 2015 Apr 13, 2015 - 07:13 PM GMTBy: Sam_Kirtley

For so many years markets have been used to focusing overwhelmingly on US employment, with the Fed emphasizing that return to full employment was key to their monetary policy plans. However, with employment data printing strongly for some time now the focus has shifted away from employment, meaning that the monthly NFP print that traders had been living and dying by is no longer as relevant. The disinflationary impact of lower energy prices and the lack of wage inflation is now the main focus for the Fed, and therefore those factors have replaced NFP as the key metrics that set market tone.

For so many years markets have been used to focusing overwhelmingly on US employment, with the Fed emphasizing that return to full employment was key to their monetary policy plans. However, with employment data printing strongly for some time now the focus has shifted away from employment, meaning that the monthly NFP print that traders had been living and dying by is no longer as relevant. The disinflationary impact of lower energy prices and the lack of wage inflation is now the main focus for the Fed, and therefore those factors have replaced NFP as the key metrics that set market tone.

What Payrolls?

Last week we noted with some concern that the lowest NFP print since December 2013 was a warning shot to Fed hawks and could see a future hikes delayed. However the initial (expected) reaction to the data was swiftly reversed and it now appears the market is happy to look through the weaker print.

Oil has been a big driver of this. The spike towards $55 made the market nervous about inflationary pressures increasing and coupled with a few timely Fed speeches has led the market to think that Yellen may look through the latest print.

As we discussed last week, the Fed is focused on the medium term picture and therefore a one off data print will not change their plan of action, just as a $5 swing in the oil price will not alter the course either. The key is the medium term trend of the data as this will drive monetary policy and the major moves in markets.

Lower oil prices have had a disinflationary impact. The move from $100 to $50 no doubt has reduced the Fed’s eagerness to hike, particularly with the ripple effects on the US economy from the energy sector slowdown. However oil prices have stabilized and therefore the trend is no longer down, it is simply range bound. A break up above $55 and a sustained move to $60 would see that range bound trend turn into an upwards trend. This would reignite inflation expectations and provide some much needed relief to struggling high cost energy companies.

The Fed can handle one or two weak payrolls prints. After all, although this was the lowest print since December 2013, let us not forget that following that December 2013 print the Fed proceeded to taper QE purchases through 2014 and continue to signal that hikes were coming in 2015. We believe that this is still the Fed’s game plan. Policy normalization will begin this year, with September the most likely starting point.

June, July, Sep, does it matter?

At the margin the decrease in likelihood of a June hike out to later this year does impact markets, but from a macro viewpoint this is a tactical shift in the trades we will make, not a strategic one. Whether the Fed hike in June, July or September impacts the timing and entry levels of the trades we are looking at, but does not alter the way we want our portfolio to be positioned.

A shift in the start of tightening until 2016 would have a meaningful impact though. This would reignite the case of loose monetary policy trades such as buying gold. However given that this would take a serious shift in the economic landscape we will for now focus on our preferred trading strategy for a Fed lift off this year.

Gold To Triple Digits

As a function of monetary policy, gold prices will face significant downside pressure with the Fed hiking rates. At the height of QE gold prices reached over $1900 and although at $1200 it may look as though they have fallen far enough, we note that prior to QE2 gold prices were around $1000, which is where we see them returning too.

At $1200 we see the next $200 move as lower and therefore favour core short positions. As we approach the seasonally weak period for the yellow metal beginning with “Sell in May and Go Away”, we have a preference for selling out of the money call spreads which give positive theta over the summer doldrums. The time will come to buy high gamma downside options, but we think one will get a better opportunity to do enter these trades. As discussed above, the June/Sep timing issue is important tactically but the overall strategy remains the same.

Equities Biased Higher With Volatility Contained

There are numerous arguments that the beginning of the Fed’s tightening cycle will send stocks lower, since they have only rallied on loose monetary policy and the massive amount of financial stimulus in recent years. We disagree for two main reasons.

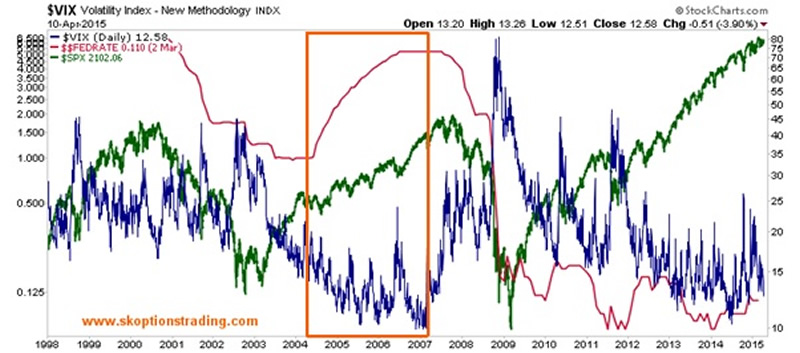

Firstly the Fed has taken great care to stress that policy normalization will be cautious, patient and data dependant. If the economic data turns sour they will not be hiking and thus they are unlikely to raise rates whilst stocks are falling. Secondly the world has changed since the global financial crisis and global central banks act much more swiftly to deliver accommodative policy conditions than they have in the past. Volatility will be contained during the hiking cycle, potentially even more than it has been in the past.

Therefore another trade we like is selling medium term downside protection on the S&P 500. We would add to such positions with any spike in the VIX towards 17 and are comfortable with reasonably aggressive positions in this area, more so than our positions selling topside protection in gold.

Opportunities Yet To Come

With the first quarter of 2015 behind us, we think that the major moves this year are yet to get underway. Therefore there are many trading opportunities ahead and the key will be identifying and positioning ones portfolio for them. The recent market reaction to non-farm payrolls reinforces the need to look beyond the headline prints, and dig below the surface of how markets appear to the underlying currents likely to shape major trends in 2015. We have discussed our preference for selling downside protection on the S&P 500 and topside on gold; however for more details on what trades we are making and when, please visit www.skoptionstrading.com to subscribe.

Disclaimer:

www.skoptionstrading.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.