Investigating The U.S. GDP Deflator: Wildly Differing Results Depending on Your Choice

Economics / Economic Statistics May 01, 2015 - 04:46 PM GMTBy: Mike_Shedlock

As noted in Real Q1 GDP 0.2% vs. Consensus 1.0%; Disaster in the Details I got the first quarter GDP forecast details correct.

As noted in Real Q1 GDP 0.2% vs. Consensus 1.0%; Disaster in the Details I got the first quarter GDP forecast details correct.

However, a bit of self-assessment with differing GDP deflators shows my prediction of close to zero growth could easily have looked rather silly.

I asked Dough Short at Advisor Perspectives what the GDP would have looked like using various deflators:

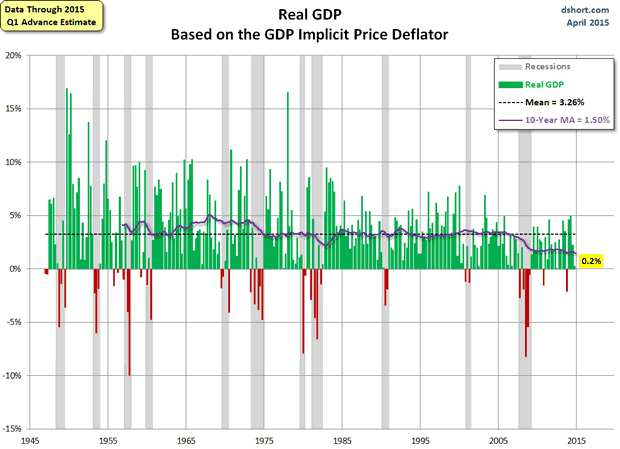

- GDP (Implicit GDP Deflator)

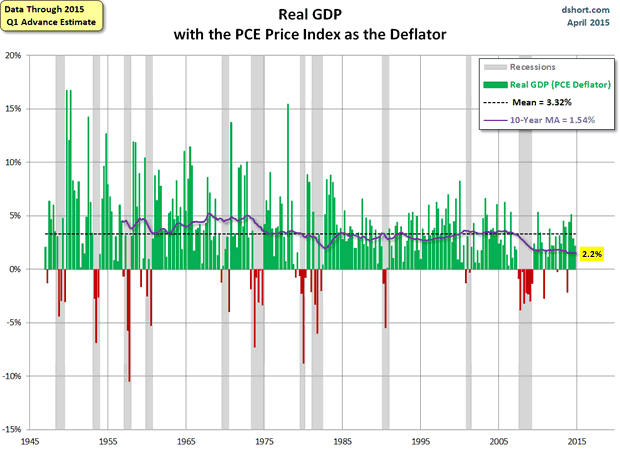

- PCE (Personal Consumption Expenditures)

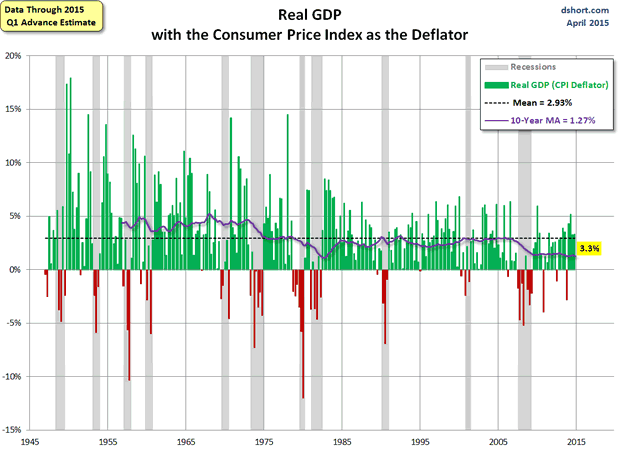

- CPI (Consumer Price Index)

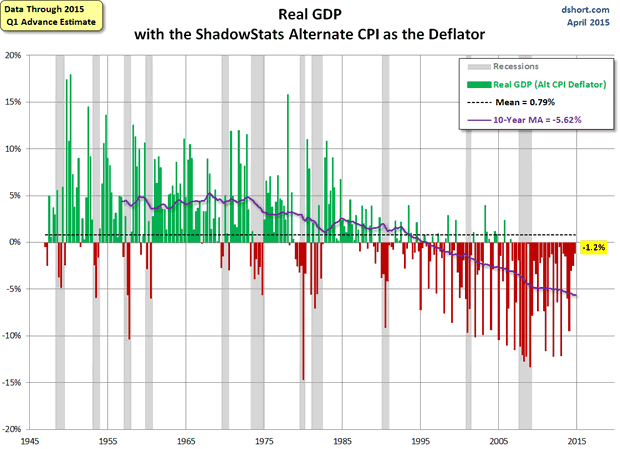

- Shadostats (Williams' Alternate CPI)

Charts are shown below.

Both Doug and I consider Shadowstats absurd, but we include it because many follow the number. For a recent critique of the measure please see Deconstructing and Debunking Shadowstats.

GDP Implicit Deflator (Official GDP)

GDP with PCE as Deflator

GDP with CPI as Deflator

GDP with Shadowstats CPI as Deflator

Results

- GDP (Implicit GDP Deflator): 0.2%

- PCE (Personal Consumption Expenditures): 2.2%

- CPI (Consumer Price Index): 3.3%

- Shadostats (Williams' Alternate CPI): -1.2%

Defending on your price deflator, GDP was between -1.2% and +3.3%. If you toss out Shadowstats, then the range is 0.2% to 3.3%.

That's still a damn wide range. People accuse the BEA all the time of manipulating the deflator to make things look good, but if they easily could have done that this month for far better results.

Over time, GDP is highest with the PCE and GDP implicit deflators. At least the BEA is consistent.

Mean GDP

- GDP (Implicit GDP Deflator): 3.26%

- PCE (Personal Consumption Expenditures): 3.32%

- CPI (Consumer Price Index): 2.93%

- Shadostats (Williams' Alternate CPI): 0.79%

Next quarter, because of rising energy prices, deflating GDP by the CPI will likely yield worse results than the GDP deflator. Some people will criticize the BEA because of it, while remaining silent about this quarter.

As it stands, rising energy prices and the strong dollar will place downward pressure on second quarter GDP no matter which deflator one uses.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2015 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.