Stock Market Still Vulnerable to Big Downside

Stock-Markets / Stock Markets 2015 May 11, 2015 - 08:51 AM GMTBy: Brad_Gudgeon

Last time I wrote, I was expecting a move to about 2064/65 or about a 2% drop into the 12.5 week cycle low. We got a 2.45% drop into May 6th, TD 13 of the 12.5 wk low. Our money flow indicators suggested more upside as they were washed out nicely and we went long the end of the day Thursday and got out on Friday and took 30 points out of the market (all provable on my web site).

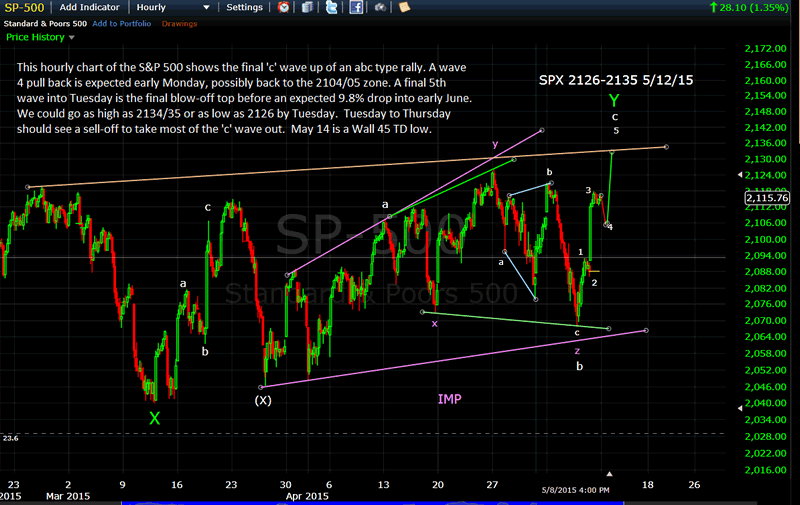

The next low I was looking for was the 16 TD low due Monday this week, and a minor pull back to SPX 2104/05 would not surprise me, but this being said, a new high by Tuesday looks to be in the cards. The 2126-35 zone or about 2130 is expected by Tuesday May 12. I think this is it. The MACD and Stochastics as well as Money Flow daily and the wave counts are giving me the signal of a drop similar to the Sept 19-Oct 15, 2014 drop or about 9.8% top to bottom (this is a proprietary read reserved for my subs).

The next cycle low is due May 14, the Wall 45 TD low. Watch this whole wave of buying (from last week) unwind into that date (or close). That, at least, is my expectation.

Below is an hourly chart of the wave counts going into Tuesday and the expected result.

We have Mercury sq. Neptune over the weekend at the same time Mars enters Gemini Monday. A minor pull back is due. May 14 sees Mars opp. Saturn, another low on the way down. My guess is, OPEX this month will be up.

I keep saying this is a trader's market. We made 19.1% in 3.5 weeks while the market went sideways, all provable. When markets fall, they get volatile too. Why someone would want to buy and still hold now is beyond me when they can have access to information (and even auto-trading) that can really help them out.

I'm not always right about my forecasts, but I make money anyway by applying the trader's edge: never get married to your position, always be willing to be wrong, never overtrade in a choppy market, and when you're right stay with it (I miss this one sometimes, I mean I sometimes get out too early by second guessing myself, but Jesse Livermore once said, "I never went broke taking a profit").

Silver is still in the process of bottoming slowly, IMHO. It could take a few more weeks to do this and then we could see a nice rally into August. Keep in mind, we are still in a bear market, but once silver bottoms in about a year and a half or so, I believe it will be the buy of the century (so does Goldman Sachs)!

Brad Gudgeon

Editor of The BluStar Market Timer

The BluStar Market Timer was rated #1 in the world by Timer Trac in 2014, competing with over 1600 market timers. This occurred despite what the author considered a very difficult year for him. Brad Gudgeon, editor and author of the BluStar Market Timer, is a market veteran of over 30 years. The website is www.blustarmarkettimer.info To view the details more clearly, you may visit our free chart look at www.blustarcharts.weebly.com Copyright 2015. All Rights Reserved

Copyright 2015, BluStar Market Timer. All rights reserved.

Disclaimer: The above information is not intended as investment advice. Market timers can and do make mistakes. The above analysis is believed to be reliable, but we cannot be responsible for losses should they occur as a result of using this information. This article is intended for educational purposes only. Past performance is never a guarantee of future performance.

Brad Gudgeon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.