Bitcoin Price Stays below $250

Currencies / Bitcoin Jun 23, 2015 - 05:52 PM GMTBy: Mike_McAra

In short: no speculative positions.

In short: no speculative positions.

Barclays is interested in the Bitcoin technology and has partnered with a Bitcoin exchange to explore blockchain technologies, we read on CoinDesk:

Barclays has signed off on a proof-of-concept to trial bitcoin technology.

Following an agreement with bitcoin exchange Safello, the UK bank says it will explore how blockchain technologies could bolster the financial services sector.

(…)

Schuil [Safello CEO] described the programme as a "mutual learning experience" for Barclays and Safello. While exact details of the pair's proof-of-concept are currently under wraps, he indicated Safello's bitcoin spending platform could reach an important demographic for the bank.

"Our target group are the millennials that banks find hard to reach, and we are doing it with a technology that they need to understand," he said, adding: "In that way and in other ways we are building a bridge between the traditional financial world and bitcoin."

This is yet another sign that banks are coming around to the conclusion that Bitcoin is a technology worth considering and they’re looking into opportunities to get to know more about digital currencies. So far this has been done either by investing in Bitcoin startups, partnerships or by internal work of research and development departments. Barclays is going for the starup option, possibly hoping to learn how exactly Bitcoin might be of use to the bank.

In the future, we expect even more banks to join this kind of activity. So far, we’ve heard about several instances but this is far from what might come in the next couple of years. It seems that we might hear about much more cases of Bitcoin development within banks.

For now, let’s focus on the charts.

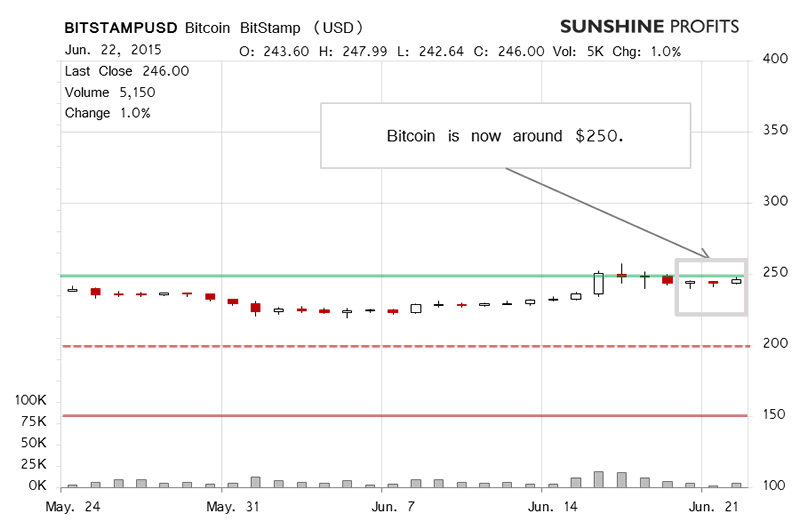

On BitStamp, we didn’t see much action yesterday. Bitcoin stayed below $250 (green line). The volume was higher than on the day before but not very high by any means. If you recall, yesterday we wrote:

So far it has turned out that sideway trading is what we’re seeing. This has also been the case today (…). The volume is already higher than it was yesterday but it isn’t really suggestive of strong action. At the moment, it still seems that we’re in the pause period after the recent move up. Declines might follow but we haven’t really seen the beginning of that.

This is still the case. We have seen depreciation today (this is written around 10:45 a.m. ET) but the volume hasn’t really been strong. Bitcoin is now below $250, the move is down and we haven’t seen very significant action? What does this all mean? It might mean that we’re seeing sideways trading after the recent local top. Our best bet is on more indecisive action followed by a move down below $240. If we see more weakness, we might suggest hypothetical short positions.

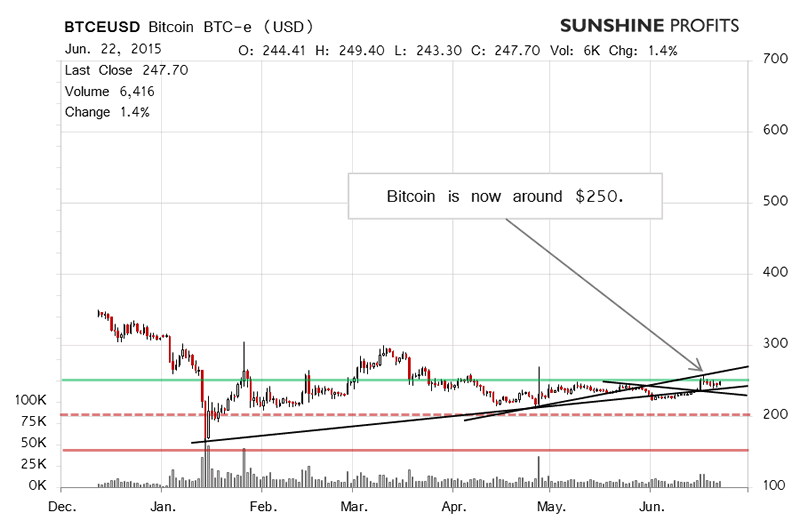

On the long-term BTC-e chart, we still see Bitcoin below $250 and a possible trend line. Yesterday, we wrote:

(…) there has been no meaningful action to the downside. Bitcoin seems to be down from a possible local top but there is a possibility of a sideway move now. We would still prefer to see more signs of a possible move down before considering shorts.

We still haven’t seen enough action to consider shorts at the moment. Bitcoin seems to be tipping and it might be in for more depreciation but the situation doesn’t quite favor short positions at present.

Summing up, we don’t support any speculative positions at the moment.

Trading position (short-term, our opinion): no positions.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.