What Blows Up Next? Part 1: Resource-Based Economies

Economics / Brazil Jul 24, 2015 - 12:45 PM GMTBy: ...

MoneyMorning.com

The Great Recession and its aftermath was actually the best of times for countries with natural resources to sell. The US, Europe and Japan ran record deficits and cut interest rates to zero or thereabouts, sending hot money pouring into mining and energy projects around the world, while China borrowed (as it turned out) $15 trillion for an epic infrastructure build-out.

The Great Recession and its aftermath was actually the best of times for countries with natural resources to sell. The US, Europe and Japan ran record deficits and cut interest rates to zero or thereabouts, sending hot money pouring into mining and energy projects around the world, while China borrowed (as it turned out) $15 trillion for an epic infrastructure build-out.

The result was robust demand and high prices for raw materials like copper, oil and iron ore, and a tsunami of cash pouring into Brazil, Canada, Australia and the other resource producers. Conventional wisdom deemed these countries to be well-run and destined for ever-greater things, which led locals to borrow US dollars at cheap rates and invest in mines, factories and/or domestic government bonds with much higher yields. Good times and fat margins all around.

Then it turned out that the debts accumulated by the resource-consuming economies had created a headwind that they couldn't overcome. The Chinese build-out abruptly ended and the developed world failed to achieve escape velocity, causing the US dollar to soar and commodity prices to plunge. Oil, for instance, is down 21% just the last in last six weeks. while the Bloomberg Commodity Index is 42% below its recent high.

For a sense of what this means, pretend you're Brazil. During headier times your oil, iron ore and soybean exports created a generation of new millionaires and allowed your government to balance its budget. This in turn led your leaders to ratchet up spending and your entrepreneurs to borrow what now looks like an insane amount of US dollars.

Now your currency, the real, is plunging...

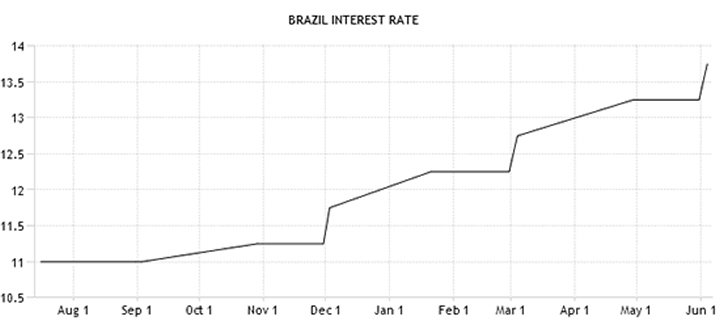

...while your interest rates are surging:

Among other things, this gives you: a ton of dollar-denominated loans that are deeply under water and will be defaulted upon soon; plunging tax revenues necessitating huge cuts in government spending and/or much higher taxes -- at exactly the wrong time; and hundreds mines and factories that aren't generating enough cash flow to cover their cost of capital and will soon fail.

Variations on this theme are playing out across the resource economy world, so depending on the country, it's crisis now (Argentina and Venezuela) or crisis in 2016 (nearly everyone else).

And that's if everything stabilizes around these levels. Let resource prices keep falling and/or the dollar rise further and we can replace "crisis" with "chaos."

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.