Why We Can’t Handle A Stocks Bear Market - State Budgets Will Implode

Stock-Markets / Stocks Bear Market Aug 26, 2015 - 12:58 PM GMTBy: John_Rubino

Back when society’s balance sheet was reasonably solid, the occasional bear market was no big deal. A 20% drop in the average S&P 500 stock would scare investors and lead to slight declines in consumer spending and government capital gains tax revenue, but the overall economy would barely notice such a minor speed bump.

Back when society’s balance sheet was reasonably solid, the occasional bear market was no big deal. A 20% drop in the average S&P 500 stock would scare investors and lead to slight declines in consumer spending and government capital gains tax revenue, but the overall economy would barely notice such a minor speed bump.

But that was then. Like a person with an impaired immune system, today’s developed world is so highly leveraged that a shock of any kind risks catastrophic complications. Which is why governments and central banks now meet every incipient crisis with quick infusions of newly-created cash and lower interest rates. We can’t risk letting markets be markets any more.

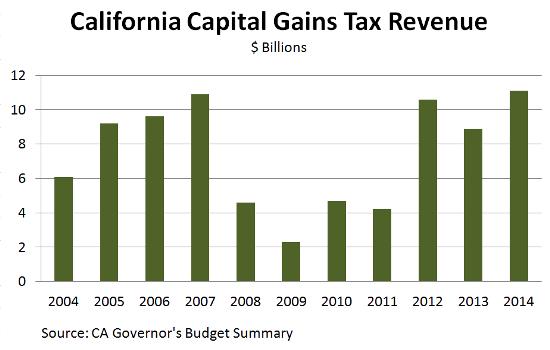

Among the many things that might go wrong if equities fluctuate normally, state and local budgets that depend on capital gains revenues and sales taxes (both of which tend to fall in bear markets) would take a potentially serious hit. From today’s Bloomberg:

Recovering U.S. State Budgets Run Headlong Into Stock Declines

The gradual recovery of U.S. state budgets, which collectively anticipated 3.1 percent more revenue this year, may be reversed by stock market declines that imperil income taxes, their largest source of money.Since 2011, states have been restoring education, health care and other programs slashed during the recession, and the trend was forecast to continue this year, according to the National Association of State Budget Officers in Washington.

Monday’s 3.9 percent decrease in the Standard & Poor’s 500 Index, continuing the index’s worst downturn since the financial crisis in 2009, spells trouble for states like California whose reliance on capital-gains taxes makes them vulnerable to swings in equity markets. The market correction comes after a rout in oil prices that has stung states including Alaska and Texas that rely on revenue from petroleum production.

“Before the last week-and-a-half or so, states have been in the best relative fiscal health since the end of the Great Recession,” said Arturo Perez, fiscal program director for the National Conference of State Legislatures in Denver. “This is a big game of wait-and-see.”

In surveys of fiscal officers from all 50 states conducted between February and April, the budget officers group found that states were expecting to spend 3.1 percent more in the year that began July 1, a slower rate of growth than the 4.6 percent in the year that ended June 30.

U.S. stocks fell the most in almost four years after China unexpectedly devalued the yuan Aug. 11, which raised concerns about the depth of the the slowdown in the world’s second-largest economy. The slump in Chinese equities hammered emerging-market assets and sank commodities from oil to metals.

The state with the most at stake may be California, where slumping income tax collections during the recession in 2009 led to credit downgrades by Standard & Poor’s, Moody’s Investors Service and Fitch Ratings, pushing the most-populous state to the ratings basement. California is uniquely vulnerable because more than 11 percent of revenue last year came from taxes on capital gains, the highest proportion in the country, according to its Finance Department.

“The market correction that we’re seeing is a harsh reminder California’s revenue base is susceptible to that,” Petek said. “Until they can somehow reduce their reliance on capital gains related tax revenues, they will be better off looking at that from a cautious standpoint.”

A dip in revenue on Wall Street could weigh on New York’s budget, which in fiscal 2014 raised about $13.2 billion, or about 19 percent of total collections, from corporate and personal income levies on Wall Street firms and their workers.

The budget for the fiscal year that ends March 31 anticipates a 5.8 percent increase in personal income-tax revenue after it increased 3.2 percent in fiscal 2015. Corporate tax growth, which includes bank taxes, was projected to be almost flat.

California is a big state so it spends a lot of money, probably about $113 billion in the current fiscal year. Still, a capital gains swing from 2014 to 2009 levels would blow a fairly painful $8 billion hole in its budget.

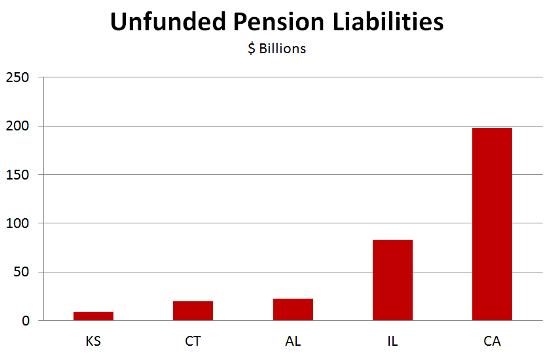

And the current correction, if it turns into something more extreme, would send already-high unfunded pension liabilities into the stratosphere. This would, in a world of honest governance, require either massive cuts in benefits or equally massive infusions of taxpayer cash, with all the attendant turmoil that that implies. Some representative state pension liabilities:

So today, a bear market related fall-off in capital gains would cause a double crisis, cutting pension fund investment returns (and thus raising the level of underfunding) and cutting tax revenues, diminishing states’ ability to even keep up with their current pension funding schedule.

In the scenario that keeps governors up at night, the spike in unfunded liabilities raises interest rates on the municipal bonds states and cities issue to cover day-to-day spending, throwing budgets even further out of balance and sending the worst offenders into a death spiral that ends in default. See Illinois for a glimpse of other states’ future in the next bear market.

That market perturbations are no longer tolerable explains Europe’s reaction to Greece’s crisis — years of negotiations and debt acrobatics when a strong, confident currency union would have just kicked the miscreant out. And it explains China’s serial yuan devaluations, multi-hundred-billion-dollar equity buying program, and sudden cuts in interest rates and bank reserve requirements. Managing markets has become a full-time job for elected officials whose predecessors barely used to pay attention.

And it will only get worse. Every intervention either involves more debt up front or encourages more borrowing in the future. Leverage and fragility go up, making the next crisis that much more dangerous and intervention that much more necessary.

By John Rubino

Copyright 2015 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.