US Stock Bubble Bursts As The US Fed Begins To Shrink Its Balance Sheet

Stock-Markets / Stocks Bear Market Sep 24, 2015 - 12:30 PM GMTBy: I_M_Vronsky

All serious students of economics well know there are several factors that can inflate stock values…and even cause them to soar beyond common sense and corresponding fundamentals. However, there is one factor that dwarfs all others in its disproportionate material effect on pumping up stock prices beyond all historical and reasonable metrics: AND THAT IS EXCESSIVE GROWTH IN THE FED’S BALANCE SHEET.

All serious students of economics well know there are several factors that can inflate stock values…and even cause them to soar beyond common sense and corresponding fundamentals. However, there is one factor that dwarfs all others in its disproportionate material effect on pumping up stock prices beyond all historical and reasonable metrics: AND THAT IS EXCESSIVE GROWTH IN THE FED’S BALANCE SHEET.

One must recall that the S&P500 Stock Index suffered a bear market loss from 2007-2008…including the first two months of 2009. During this bear market the S&P500 plunged well more than 55% by the time it finally bottomed in first week of March 2009. Subsequently, the Fed relentlessly pumped up its Balance Sheet…with a view to stem the horrific two year rout in US stock prices.

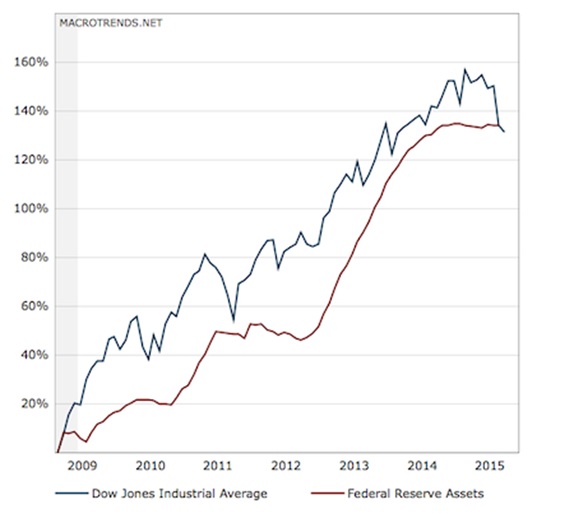

Below is chart showing the Fed’s Balance Sheet Asset Growth super-imposed on the S&P500 Index from 2009-2015 (Courtesy of ZEAL.com).

So what happened in March 2009 to spur and fuel the S&P500 Stock Index relentlessly upward during the next 6 years…rising from 650 to over 2100 by mid-2015…an astounding increase of +223%? SIMPLE! The US Fed dramatically increased the amount of its Total Assets via the financial sorcery called Quantitative Easing (QE), which swelled the Fed’s Balance Sheet to a level never before seen in US history. In effect the Fed printed money, which in effect mushroomed financial liquidity…which was snapped up by Wall Street to pump stock prices up to astronomically (i.e. unsustainable) record high levels.

The following puts this into perspective…it is an excerpt from pundit Michael Kosares erudite editorial at USAGOLD:

"A recent working paper by the vice president of the St. Louis Federal Reserve Bank finds that after six years of quantitative easing that swelled the Fed's balance sheet to $4.5 trillion, 'casual evidence suggests that QE has been ineffective in increasing inflation' and only seems to have boosted stock prices. Complaints once in the realm of conspiracy theorists wearing tin foil hats are now being embraced by the Wall Street establishment. In a note to clients, Deutsche Bank analysts warned that 'the fragility of this artificially manipulated financial system was exposed' and that 'the only thing  preventing another financial crisis has been extraordinary central bank liquidity and general interventions from the global authorities.'"

preventing another financial crisis has been extraordinary central bank liquidity and general interventions from the global authorities.'"

FiscalTimes/Anthony Mirhaydari/8-24-2015

"Policymakers responded to the financial crisis with easy monetary policy and low interest rates. The critics — including us — argued against 'solving a debt crisis with more debt.' Put differently, we said that QE was necessary, but not sufficient for a recovery. We are now coming to the moment of reckoning: central bankers look naked, and markets have nothing else to believe in."

Alberto Gallo, head of credit research, Royal Bank of Scotland:

"We shouldn't pass on the bill for the tasks that are facing us now to future generations. . . Being in favor of more debt and a further flooding of the markets with central bank money is neither original nor serious. Too much growth in credit does not solve any structural problems, but leads to financial and debt crises."

Wolfgang Schaeuble, Germany's finance minister:

"Over the past few months we have detailed the systematic deterioration in the internals of the stock market. This trend recently reached depths historically seen only near major market tops."

Dana Lyons, J. Lyons Fund Management:

"One thing I learned from Dow Theory is that once the primary trend starts its course, nothing will stop it. The primary trend of China and the world economy has turned negative, much to my disappointment. I believe the primary trend of the stock market and the economy has also turned down."

Richard Russell, Dow Theory Letters:

"The printing of money has a very limited impact on creating wealth."

Marc Faber, The Gloom, Doom and Boom Report, 9/2/2015:

"Uncertainty should not bother you. We may not be able to forecast when a bridge will break, but we can identify which ones are faulty and poorly built. We can assess vulnerability. And today the financial bridges across the world are very vulnerable. Politicians prescribe ever larger doses of pain killer in the form of financial bailouts, which consists in curing debt with debt, like curing an addiction with an addiction, that is to say it is not a cure. This cycle will end, like it always does, spectacularly."

FINALLY, after six years the Federal Reserve has turned the easy money taps off (i.e. QE stopped). This is bad news for investors, since the low-interest-rate environment is generally recognized as being the fuel that has propelled the stock market increasingly higher. However, no more QE has much more dire ramifications, because the banking sector is lethally hemorrhaging at this moment.

Major Global Banks Are Cutting Many Tens Of Thousands Of Jobs; Huge Deflationary Implications

The world’s biggest financial institutions are presently firing tens of thousands of workers. Here are a few examples:

- Barclays plans to cut more than 30,000 jobs

- Deutsche Bank to cut workforce by 25%...roughly 23,000 jobs

- HSBC recently announced plans to lay off worldwide up to 50,000 employees by 2017

- UniCredit Group plans to cut around 10,000 jobs in the Euro Union

- JPMorgan Chase said last month it was cutting 5,000 jobs

- Royal Bank of Scotland: Up to 30,000 RBS Layoffs Planned

- Bank of America to layoff 16,000 in 2015…and hundreds of BOA branches are closing

- Wells Fargo Layoffs Just Getting Started with 1,100 job cuts on the books

- TD Bank Toronto is the latest of the big Canadian banks to dole out pink slips to staff

- Citigroup says it is cutting 4,500 jobs over the next few quarters

Likewise, other big international banks cannot be in better shape, since they’re all operating in the same zero-interest rate and low-growth world. This begs the question: Who knows national economies better than THE BANKS?! Moreover, these banks well know: Financial history is testament that Bear Markets eventually and inevitably follow Bull Markets. And this time around…it’s Katie-bar-the-door…as the bears are already coming!

Like Yogi Berra might express it: “It’s 2007-2008 déjà vu all over again!”

By I. M. Vronsky

Editor & Partner - Gold-Eagle

www.gold-eagle.com

Founder of GOLD-EAGLE in January 1997. Vronsky has over 40 years’ experience in the international investment world, having cut his financial teeth in Wall Street as a Financial Analyst with White Weld. He believes gold and silver will soon be recognized as legal tender in all 50 US states (Utah and Arizona having already passed laws to that effect). Vronsky speaks three languages with indifference: English, Spanish and Brazilian Portuguese. His education includes university degrees in Engineering, Liberal Arts and an MBA in International Business Administration – qualifying as Phi Beta Kappa for high scholastic achievement in all three.

© 2015 Copyright I. M. Vronsky - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.