Negative Interest Rates and Gold

Commodities / Gold and Silver 2015 Sep 25, 2015 - 01:18 PM GMTBy: Alasdair_Macleod

I shall briefly address the impact of negative interest rates, should they occur, at the end of this report, after looking at this week's trading.

I shall briefly address the impact of negative interest rates, should they occur, at the end of this report, after looking at this week's trading.

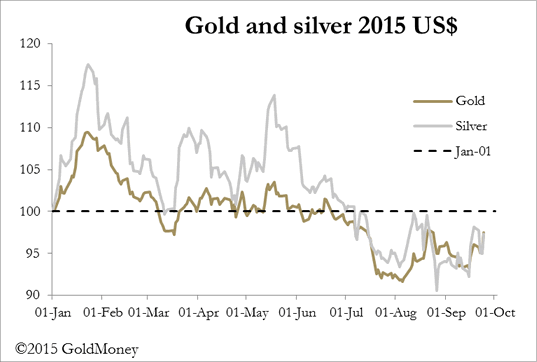

The week started with a slow downwards drift for precious metals on Monday and Tuesday before a sharp two-day rally, taking the gold price up $33 (nearly 3%) by yesterday afternoon. There was very little gold-related news to trigger this rally, only the deterioration of other markets. For bulls of precious metals it really has been a case of patience being rewarded.

Those who have followed the advice of the major investment houses must be badly bruised. For them, equities should be wending their bullish way and gold challenging the $1,000 level. The evidence is mounting that to continue with this investment philosophy will likely be increasingly costly.

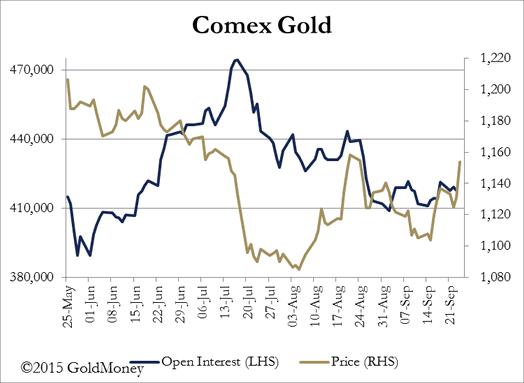

On the futures markets, Open Interest in precious metals shows little sign of turning up, so on this basis we cannot claim there is much evidence of buying yet. The gold price and Comex OI are shown in the chart below.

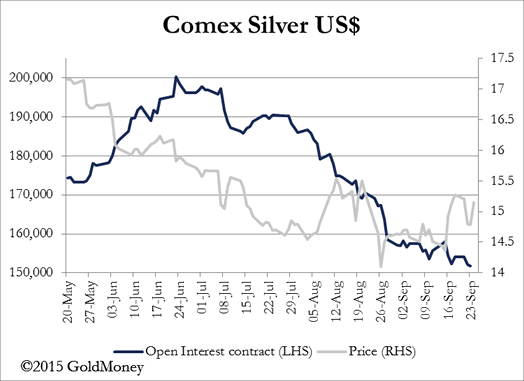

The disparity between OI and the gold price has been evident since the low in early-August, so in that context this week's rally is nothing new. Silver's open interest continues to drift lower, while the price is trending higher, telling a similar story.

The message appears to be that the bears are gradually closing their short positions in both metals, hence the divergence between open interest and price performance.

We may see some confirmation of this in the Commitment of Traders Report due out tonight UK time. It is a few weeks since the Managed Money category (hedge funds) was net short, with a record level of shorts outweighing their longs.

There are good fundamental reasons for the bears to close, even though the dollar itself has strengthened. The Fed's about-face on raising interest rates has alerted markets to the danger for the US economy of an emerging markets slump. Furthermore, the collapse in Glencore's shares suggests there are substantial commodity-related bad debts around the world within an estimated $6 trillion debt total. Suddenly, you can forget rising interest rates and it is now "risk on".

There is also growing chatter about the possibility that negative interest rates may be imposed by major central banks, if the slump in emerging markets threatens to lead to price deflation in the west and Japan. Negative interbank rates would obviously be good for precious metal prices, because the bullion houses will find it more costly to hold dollars than gold and silver, reversing the standard position in paper markets.

Unfortunately for them, physical liquidity of all precious metals is probably too low for such a switch to take place with major market disruption.

Next week

Monday. Japan: Leading Index. US: Core PCE Index, Personal Income, Personal Spending, Pending Home Sales.

Tuesday. UK: Nationwide House Prices, Consumer Credit, Mortgage Lending. Eurozone: Business Confidence, Consumer Confidence. US: S&P Case Shiller Home Price.

Wednesday. Japan: Construction Orders, Housing Starts, Industrial production. UK: Current Account, GDP Growth Rate (Final). Eurozone: Core Inflation, Unemployment. US: Mortgage Applications, ADP Employment.

Thursday. Japan: Tankan Index. Eurozone: Markit Manufacturing PMI. UK: Markit Manufacturing PMI. US: Jobless Claims, Construction Spending, Vehicle Sales.

Friday. Japan: Household Spending. UK: Construction PMI. Eurozone: PPI. US: Non-Farm Payrolls, Factory Orders.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2015 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.