Don't be Fooled by the Recent Equity market Rallies. Its a Bear Market, Stupid!

Stock-Markets / Stocks Bear Market Oct 02, 2015 - 04:17 PM GMTBy: Brian_Bloom

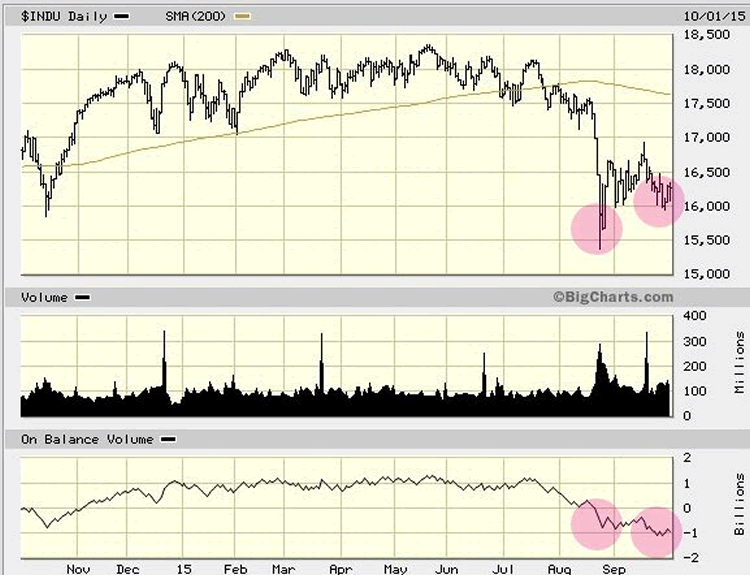

The daily chart below, of the Dow Jones Industrial Index, shows a significant technical non-confirmation: The On Balance Volume segment of the chart has been falling in the face of a rising Index, which indicates that sellers have been taking advantage of rising prices in the past couple of weeks to increase the rate at which they have been offloading their stocks.

The daily chart below, of the Dow Jones Industrial Index, shows a significant technical non-confirmation: The On Balance Volume segment of the chart has been falling in the face of a rising Index, which indicates that sellers have been taking advantage of rising prices in the past couple of weeks to increase the rate at which they have been offloading their stocks.

Moving from a microscope to a telescope, and taking a 100 year view, there are four alternative possible outcomes to what is happening on the world’s financial markets in general, and on Wall Street in particular:

1. Exponential blow-off leading to total collapse of organised society

2. Sideways churning for 10-15 years before we come to understand that “disruptive” technologies have changed the very nature of the economic game.

3. Fall to around 10,000 followed by long term consolidation and then ditto understanding

4. Fall to around 4,000 before the leaders of society, world-wide, come to their senses and widespread destructive damage has occurred in the process.

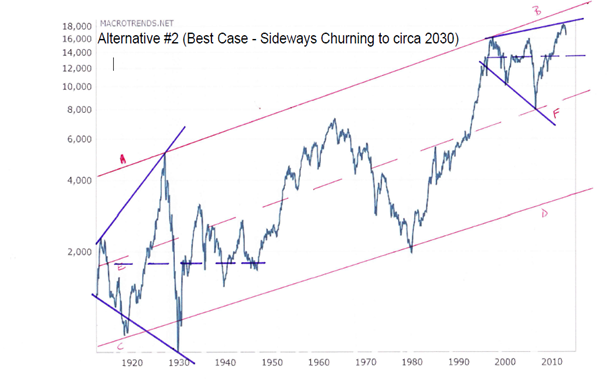

Probabilities attaching to the four alternative outcomes above will be a function of one’s orientation on a spectrum of pessimism to optimism. Alternative #2 is shown in the chart below. Note the bearish Broadening (Bugle) Formation that has been emerging since Alan Greenspan hit the monetary gas pedal.

Of interest, this logarithmic scale chart has been adjusted for inflation and line E-F shows a compound growth rate of 1.6% p.a. vs a background planetary wide population growth rate of 1.4% p.a. over the same time period. So much for Central Bank “management” of the economy.

The cut-to-the-chase fact is that standards of living have generally improved because technological improvements have led to greater bang-for-one’s-buck in real dollars. Central Banks have provided monetary grease to the economic wheel by consciously engineering an inflationary environment.

The implication of inflation to those who chose to participate in the game of Monopoly can be seen in the following example:

Assuming inflation of (say) 5% p.a., if you bought a property in 1920 for $1 million, it would be worth $103 million in 2015. If you bought the property with 90% borrowed funds and you charged net (after tax) rental on that property of 3% of the market value, you would be earning an annual net rental of $3.1 million p.a. (and growing). Your original $100,000 investment would be worth one thousand times what you invested, the debt would have long ago been repaid, and you would be earning north of 300% p.a. on your original investment, and growing.

The above would have occurred because those who “capitalised” on inflation would have benefited disproportionately more than those who did not. On the other hand, ordinary workers would have benefited even if their salaries had merely kept pace with inflation because real costs of products would have generally fallen at the same time as the quality of those products have generally risen. Arguably, it was a win/win situation until the point was reached where the status quo became unsustainable.

Why did it become unsustainable?

Surprisingly, it was not the actions of the Central Banks so much as the forces of mathematics. If, for the sake of discussion, real unit costs of producing (say) a motor car fell by (say) 15% every time accumulated output doubled, a point would eventually be reached where the “next” doubling of output would result in production output that would be greater than the market’s capacity to absorb it, given that the market was only growing at 1.6% p.a.

The mathematical “Rule of 70” is fairly simple to understand:

Divide the number 70 by the percentage rate at which any organism is growing (or shrinking) and the result is the number of years the total size of the organism will take to double (or halve). So, if the human population continues to grow at around 1.4% p.a., it will take 70/1.4 = 50 years for the global population to double. By contrast, if the “real” (inflation adjusted) cost of producing a motor car falls by 15% every time production doubles then, eventually, the unit cost will fall to a point where it can’t fall any further in a meaningful time frame. Alternatively, the number required to double accumulated output will have reached a multiple of the number of people in the world who can afford to buy it. At that point, the benefit of inflation falls away for the average worker, but it remains for the capitalist. From that point forward, wealth is transferred to one segment of the population (the so-called 1%) without any concomitant benefit to the other segment.

Piercing the veil of debate and obfuscation, that is where the world’s smokestack-powered economy is today (if we haven’t already passed it). It follows that Central Banking and inflation have become anachronisms and a new economic dynamic will emerge.

As a person who is fundamentally optimistic I believe that anyone with an IQ of 100 or greater will be smart enough to understand the implications of the above analysis and, when enough people get to understand where we are really at in the world economy, pressures will emerge to kick out the Central Bankers and restructure the global economy to become a “steady state” economy on a per capita basis – free of monetary inflation. This will result in technological efficiencies and advancements being shared more fairly between entrepreneurs (who have the vision to initiate change) and professionals (who apply themselves to implementing that change) and artisans (whose day-to-day efforts serve to manifest that change). The relative benefits will (on a basis of fairness) flow in proportion to the risks taken and to the quality of value-add input.

So, let’s put it in simple English: Financial speculators are about to face a cold reality that there is no such thing as a free lunch. Financial Engineering and associated trading of doubtful-value pieces of paper, for profit, is in its death throws. From this point forward, progress will flow from “value-add” activity. (The word “progress” has been emphasised for the benefit of the short sellers.)

The Dow Theory Sell signal that emerged some weeks ago told us that the Bull Market on Wall Street was over, and the sell signal on the On Balance Volume chart above is telling us that the Plunge Protection Team (with back-up from the Federal Reserve) is impotent – just as the Chinese central authorities do not have the power to turn the Shanghai index into a magic pudding or a magic beanstalk that grows to the sky. There is no such thing as a free lunch. If you want to preserve your wealth then sell your overpriced assets. If you think you are smart enough to prevail over simple mathematics, then I wish you good luck.

Welcome to reality.

On a more positive note, it is my view that the emerging Artificial Intelligence revolution – which has been associated with what has come to be known as “disruptive” technologies (that have introduced new ways of doing things) will facilitate a migration from the historical growth oriented economic model to a future steady-state oriented economic model. The disruptive technologies will allow real unit costs to fall even faster than 15% every time accumulated volume doubles. Moore’s Law, for example, anticipates 100% increase in computing power every two years, which – in the case of “smart” motor vehicles powered by electric motors (basically an i-Pad on wheels) – will lead to the price of electric vehicles coming within the affordability range of even the poorest of people who, already today, typically own a smart-phone.

But here’s the thing: A motor car today costs around US$22,000 on average. The sensors and integrated circuits that will facilitate the Artificial Intelligence revolution will cost cents, not dollars let alone hundreds or thousands of dollars. The Artificial Intelligence revolution will not drive revenue growth; it will drive a cost implosion. At a structurally lower cost per unit, huge volumes of output will be required to maintain GDP, let alone grow it. That is why a “Best Case” outcome will be 10 to 15 years of running ever faster to stand still – to the point where we are able to tread water and still live comfortable lives.

The extent of investor pain that will be generally felt by those who are predisposed to want to protect the status quo will be a function of their pig-headedness. The harder they fight against simple mathematics, the more savage will be the Bear Market – until option 4 above materialises and forces them to submit to the only logical alternative to the extinction of a significant proportion of the human race.

Ultimately, there are only two possible outcomes from the perspective of organised society:

1. The unwashed masses will join together to crush the greedy

2. The power of the greedy will overcome the combined might of the unwashed masses and the result will be a savage contraction in the population of the planet.

In this analyst’s view, the smartest thing an ordinary person could do now would be to cash in one’s chips, leave the gambling table and reorganise one’s financial affairs so that one’s cost of living is lower than one’s income. “Debt” in a world of deflation will be a killer. If your personal balance sheet has a large portfolio of assets and also a high debt:equity ratio, then you have very little time left to reorganise those affairs. If you haven’t already done so then, if you do not move with a sense of urgency, you are about to discover that “leverage” is a two way street: It compounds financial gains on the way up and it compounds financial losses on the way down.

Brian Bloom

Author, Beyond Neanderthal and The Last Finesse

Links to Amazon reader reviews of Brian Bloom’s fact-based novels:

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2015 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.