ECB Putting Federal Reserve in a Bad Spot

Interest-Rates /

ECB Interest Rates

Oct 23, 2015 - 06:12 PM GMT

By: EconMatters

ECB Policy Press Conference

ECB Policy Press Conference

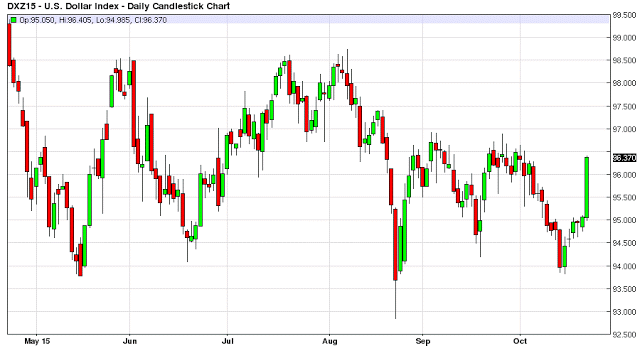

I was watching a little of the ECB policy press conference this morning and there were a lot of thoughts that came out of that event which I may write about at a later date. However after the ultra-dovish ECB decision to signal to financial markets that they are going to add more stimulus in December with more bond buying in order to weaken the Euro currency, the US Dollar is back up to the 96.30 area on the DX, and financial markets haven`t really thought about the implications of this move by the US Dollar.

Believe it or not: The Fed actually wants to raise rates now just to save face!

Reading between the lines the Fed wants to raise rates in December to get back the ounce of credibility they once had as they have reiterated their intention of raising rates this year, and with the financial market once again ‘healed’ they are going to sneak in a 25 basis point rate hike, (maybe a lame 10 basis point rate hike if they completely wimp out on the rate hike) just to keep their original word of raising rates in 2015.

Thanks A lot ECB, You just made the Fed`s job twice as hard

The problem is with the ECB slamming the Euro trying to purposefully weaken the currency the US Dollar is already back to levels that were causing emerging markets to freak out, and the Fed to lose their nerve to raise rates in September which they had done a good job building in market expectations for a rate hike.

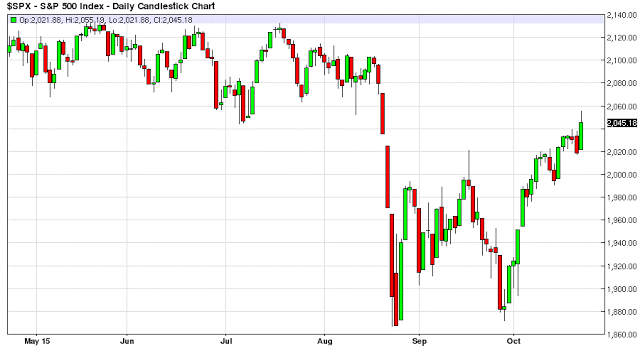

The market sold off for the first time on a dovish Federal Reserve Meeting, and Fed members took notice of that and immediately tried to reassure markets that they were still committed to raising rates in 2015. I actually think the Federal Reserve is going to try and sneak in a rate hike, and this is a mistake right now given what the ECB is going to do in December at its policy meeting with regard to adding even more stimulus.

Two Wrongs Cancel each other out right?

The Fed is going to ‘rectify their wrong’ of the last meeting and raise rates and lose twice with regard to disappointing market expectations, and the US Dollar Index will jump back above 98, and I expect a sizable market selloff as the Dollar continues to strengthen as the Forex markets get hit with a double whammy of a Dovish ECB Meeting and a Hawkish Federal Reserve Meeting this December. And given year end positioning the Federal Reserve couldn`t pick a worse time to raise rates. Hopefully they will just make another stupid excuse, and avoid raising rates - the lesser of the two evils. But given they have become a complete joke with their forecasts regarding hiking rates, saving face is probably more important for them right now. Therefore, Wall Street and financial markets are probably going to get screwed on this one, and end up taking one for the team!

Buy Some VIX Futures for December for Portfolio Protection

Expect a totally surprised market when the Federal Reserve raises rates at its December policy meeting. The financial markets are as about as far from ‘pricing in’ of any rate hike for the December Meeting as they could be and frankly, the marker reaction will be fun to watch this December. And I really can`t blame this one on them as the Federal Reserve has gotten just plain loopy at this point. And listening to the ECB panel trying to justify more stimulus of bond buying in their herculean fight to save ‘low’ inflation from damaging European citizens was just pure comedy beyond a Monty Python skit. And at this point it is almost becoming a requirement for Central Bankers to just be plain Dodgy, Comical, Squirming in their Seats, Stupid, In Denial, Blatant Liars who look like Meth Abusers being questioned at the Press Conferences like a criminal in an interrogation room at the police station – even they don`t believe their own ‘shit’ these days that comes out of their mouths.

Poor Mario Draghi: He didn`t look well

A piece of advice for Mario Draghi just speak the truth, the ECB wants to weaken the Euro to boost exports by making them more competitive in trade, and they want to monetize the debt by trying to raise inflation because all of Europe`s Debt to GDP Ratios are a severe threat to European Solvency – the relativity game in both cases!

At least with this answer I would trust your competence as someone capable of holding such a position – although I don`t agree that QE and Debt Monetization actually is sound policy as it becomes self-defeating in promoting inefficient allocation of capital, and is in the end deflationary over the long haul.

But when the reporter asked Draghi about why is low inflation such a bad thing for European consumers, and the panel trots out the argument of consumers delaying purchases crap, Draghi and company just come across as loopy, antiquated Meth induced pathologically untrustworthy and incompetent liars. Not the quality of individuals that should be in charge of monetary policy for the ECB!

Low Standards for Central Bankers: Isn`t there Performance Review for this crowd?

I think we should have the same standard that we have for Physicists, one can postulate all kinds of theoretical ideas, but when they fail in the experimental phase, they become set aside and replaced by better ideas that actually work in practical application in the field. Voodoo Economics of the last 25 years has failed, time to start promoting some economic ideas that actually work in the field. You know economic ideas that do a better job of more efficiently allocating capital to more productive purposes, as opposed to having large amounts of financial resources stuck as reserves in central banks and yield chasing electronic markets accumulating miniscule yields instead of promoting actual long term project growth for the world.

By EconMatters

http://www.econmatters.com/

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2015 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

ECB Policy Press Conference

ECB Policy Press Conference