The Stocks Bear Is At The Door, Part 1: Momentum Stocks Getting Crushed

Stock-Markets / Stocks Bear Market Feb 06, 2016 - 12:45 PM GMTBy: John_Rubino

One of the common transitions that bull markets go through as they age and die is a narrowing of leadership. As formerly strong sectors begin to stall out, investors shift into whatever is still looking good — that is, whatever still has upward momentum. Eventually capital becomes concentrated in just a few names. Then those stocks roll over and the game ends.

One of the common transitions that bull markets go through as they age and die is a narrowing of leadership. As formerly strong sectors begin to stall out, investors shift into whatever is still looking good — that is, whatever still has upward momentum. Eventually capital becomes concentrated in just a few names. Then those stocks roll over and the game ends.

This time around Big Tech was the final category of momentum play, and it ended up attracting astounding amounts of money from both the usual suspects like hedge funds and some new suckers like the Central Bank of Switzerland, now a major holder of Apple shares.

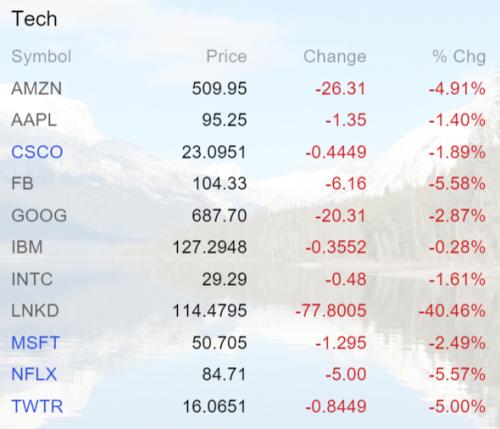

But now Big Tech has lost the Big Mo:

Amazon, for instance, tripled in 2015, and has now given back about half of that move. Google hit an all-time high very recently and is now falling like a stone. But today’s big story is LinkedIn, which is, as this is written, down 40% on disappointing forward guidance.

Here’s a piece from an analyst who offers a strategy for playing this sudden reversal of fortune:

Momentum Stocks Are Broken. How Do We Profit From It?

Momentum is a word that gets thrown around a lot. I personally like to measure momentum using a 14-period relative strength index (see here), but different people have different definitions. Fine. For today, we’ll argue that “momentum” stocks are those listed in the MSCI USA Momentum Index.https://www.ishares.com/us/literature/fact-sheet/mtum-ishares-msci-usa-momentum-factor-etf-fund-fact-sheet-en-us.pdf Looking at these stocks as a group, I think they are going to continue to get destroyed going forward, particularly relative to the rest of the market.

First of all, forget this whole FANG thing. I don’t know who made that up or why people like to limit it to just 4 stocks. I think it’s stupid. They have nothing to do with one another and there should be others included in the list. In fact, in November I wrote a piece about how FANG stocks are this cycles Four Horseman (See here) http://allstarcharts.com/is-fang-this-cycles-four-horsemen/ and was further evidence at the time that made us very bearish U.S. Stocks heading into December and January. That obviously worked out very well.

Secondly, the list of “Momentum” stocks, includes more than just these 4 FANG names, hence my use of the adjective stupid. Half the index basically consists of technology and consumer discretionary names: Google, Amazon, Facebook, Home Depot, Visa, Starbucks, McDonalds, etc. It’s a list of large and mid-cap stocks with relatively higher momentum characteristics. The way I see it, the last men standing in a bear market for U.S. Stocks.

Anyway, I think the main point I’m trying to make here is that these “momentum” stocks are done for, especially relative to the S&P500. Remember what happened to the Four Horseman in 2008? They all got destroyed. I would expect the destruction in this cycles’ version: FANG, as well as the rest of the momentum stocks to continue well into 2016.

This destruction can also be seen in the individual components. Amazon put in a beautiful failed breakout in late December, Google put in a beautiful failed breakout after its most recent earnings release. It certainly appears that Facebook is doing the same thing. There is an ongoing theme here that I love to see: Momentum stocks failing and breaking down. I believe this trend is here to stay and we want to be shorting momentum stocks very aggressively, particularly relative to the S&P500. I think for every dollar short $MTUM we can be long one dollar of $SPY.

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.