How Investors Can Leverage the Most Powerful Force in the Universe

Stock-Markets / Investing 2016 Feb 18, 2016 - 04:23 PM GMTBy: Investment_U

Andrew Gordon writes: Investing in the early days of an initial public offering (IPO) isn’t what it used to be.

Andrew Gordon writes: Investing in the early days of an initial public offering (IPO) isn’t what it used to be.

Last year’s IPOs are a shining example. Shares of tech companies that IPO’d in 2015 averaged around a 40% drop from their first-day closing price to current prices.

The kind of gains you would have gotten from Amazon (Nasdaq: AMZN) (over 35,000% since its IPO), Microsoft (Nasdaq: MSFT) (over 53,000%) and Apple (Nasdaq: AAPL) (nearly 16,000%) are nowhere to be found among newly minted public companies.

As my Early Investing co-founder Adam Sharp pointed out here on Monday, that’s mainly because companies are waiting longer to tap the public markets.

Private companies - especially the stronger ones - don’t have to go public to raise large amounts of money. Uber, for example, is now in the middle of raising $2.1 billion!

And I have no doubt it will get it.

The kind of growth that makes investors serious money is now taking place before companies go public.

It’s made possible by the power of compounding.

The Most Powerful Force in the Universe

Einstein was the one who said it. The most powerful force in the universe is compound interest.

We can see it in action when we look at the rapid growth stages of startup companies. It’s not uncommon for these firms to grow revenues by 100% per year for several years in a row.

In my evaluation of companies for the Startup Investor portfolio, I consider 50% the minimum growth rate I need to see before I even think about adding a company to the portfolio. (Startup Investor is a paid research service run by Adam and me. Unfortunately, membership is currently closed. But you can still learn all about the ins and outs of the private equity world by subscribing to our free e-letter, Early Investing. Click here to check us out.)

The vast majority of companies that make it to an IPO have a substantial period of exponential growth. This can make investors a small fortune. But they have to invest in the earliest stages of a company - way before an IPO takes place.

Because it is during these periods that valuations also go up exponentially.

The most successful early-stage investors are those who understand the power and exceptionalism of exponential growth, and how they shape a startup portfolio’s risk and reward profile.

Exponential Growth Is Hard

Let’s take robotics (but it could be any industry).

Some investors might find it appealing to invest in a company making a robot that will be 10% better than what’s currently available.

Investors who understand the exponential dynamic, however, would instead invest in a company making a robot that will be 10 times better - one that could make you a fancy French dinner upon request.

It’s a much higher, more difficult bar. If this company could indeed make such a robot - and at a reasonable cost - its sales would stand an excellent chance of compounding year after year at a viral pace.

These are big ifs. But if the company can do what it says it will... and you have this company in your portfolio? All your other investments can fail and you’ll still make a handsome profit.

Basically, this company will either experience great success... or fail spectacularly.

As for the other robot, the one that’s 10% better? It’s simply marking time until it is disrupted by superior technology. It likely won’t have a substantial period of viral growth. Perhaps it’s a 2X winner.

So we have a fairly wide range of returns from these two robotics companies.

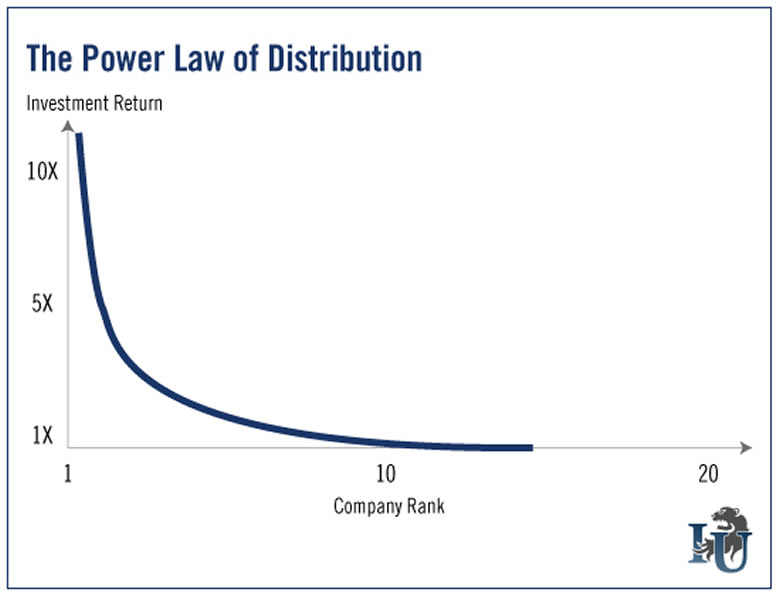

In a portfolio of startups, that’s typical. It’s called the power law of distribution (“distribution” is just another word for returns).

Returns are incredibly skewed, following the pattern shown in this chart...

The scary part? Most companies’ returns fall between 1X and 0.

And the part that trumps this scare: Companies that do well will do extremely well. They can earn you between 5X and 10X returns (and sometimes much more).

There’s just not many of them because - as I said - exponential growth is hard.

But the idea behind the power law is simple.

The small number of companies that do well will more than cover your losses and leave you with a fat profit.

Welcome to the world of startup investment - where your portfolio will have many more losers than winners, even some flat-out busts. But an exponential growth winner or two will make everything okay.

Ground-Floor Investing for Everybody

Everyday investors can now invest in this world and start a portfolio of their own, paying as little as $50 to $100 to invest in a startup. It’s all thanks to “ground-floor investing for everybody” rules issued by the government.

Early investing no longer means getting your first investment opportunity within the first or second day of an IPO, but years before a company goes public. You now have the option of investing in the earliest stages of a company - for example, when it’s raising its seed money.

As a general rule, venture capitalists aim to earn 10X their early-stage investments. They hope for much more and often get much less. But it’s those breakout investments that help even everything out.

To think exponentially means not worrying about the bucket with the busts in your portfolio. Instead, worry about putting a company or two in the “big winner” bucket.

Big ideas must turn into groundbreaking products that address huge markets before viral growth is even possible.

Fortunately, in the pre-IPO world - and only in the pre-IPO world - it is possible. Exponential growth does happen. And it’s what you need to focus on to be successful.

It’s the only approach that make sense - and dollars - for startup investors.

Good investing,

Andrew Gordon,

Co-Founder, Early Investing

Have thoughts on this article? Leave a comment below.

P.S. Investing in startups is new and frightening... I get it. But I can’t stress enough just how much money there is to be made here! If you’re having trouble getting up the courage to dive in, allow me to recommend our just-released report, “Startup Investing 101.” I personally worked for months to develop this “hit the ground running” guide to the startup investing world. It contains all the do’s and don’ts of startups - everything you need to know to get started. To learn more and pick up your copy, click here.

Copyright © 1999 - 2016 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.