Japan and US at G7 – Agree to Disagree

Currencies / Japanese Yen May 23, 2016 - 04:09 AM GMTBy: Dan_Norcini

The big Pow-Pow taking place in Japan with the G7 ( Group of Seven) finance ministers yielded what most of us already expected – no agreement whatsoever.

The big Pow-Pow taking place in Japan with the G7 ( Group of Seven) finance ministers yielded what most of us already expected – no agreement whatsoever.

I found Japanese Finance Minister Taro Aso’s remarks quite revealing. His view is that the recent movements in the Yen have been “excessive”. “The movement seen over the past several weeks can’t be described as ‘orderly,” he noted.

He noted that “one-sided, speculative trades” have been behind some of the move higher in the Yen. The Japanese find such things undesirable.

In their view, intervention can therefore be justified.

He further added that Japan prefers to see changes in the Yen of a gradual nature.

The US side, led by Treasury Secretary Jack Lew, believes that the movement in the Yen have been orderly.

I can see no way out of this impasse as they are not even close to agreeing!

What the US side apparently does not grasp, and which we have mentioned repeatedly here at this site, is that a weaker Yen is the lynch pin in the entire Prime Minister Abe economic recovery plan. Abe campaigned on this issue and MUST PERFORM if he is to stay in office. Take away a weak Yen and the entirety of his strategy for revitalizing Japan’s economy comes crumbling down. What do you think will happen to his party ( Liberal Democratic Party) at the voting booth if he fails? He knows that, Finance Minister Aso knows that and most everyone in the Abe administration knows that. Apparently the US delegation does not.

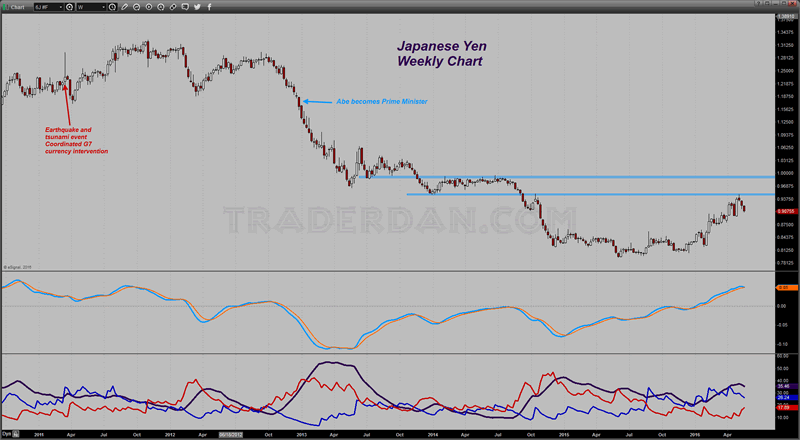

Take a look at the following intermediate term chart of the Yen.

The Yen had erased the entirety of its 2015 decline by the last week of April this year. The currency has drifted lower in May but still remains elevated after basically reaching its former floor in 2014.

Abe was elected Prime Minister by the Japanese legislature in late December 2012 as his party, along with their coalition partner, held a wide majority. You can see what happened to the Yen immediately after his taking of office; it plummeted sharply in the first half of 2013.

My guess is that if the Japanese were to try intervention, knowing how risky it is because of the current view of the US that it is not warranted, they will probably wait until it pushed closer to the top of the congestion zone formed in the first half of 2014. That would be up to near the level of the “penny yen”. Their economy did pretty well in 2013 and the first half of 2014, so they can probably tolerate the Yen up near the “penny” level, but anything beyond that would be unacceptable to them.

If the Abe administration/Liberal Democratic Party has to pick between staying in office or angering the Americans, it will choose the former and deal with any backlash later. There is an old saying in life in general, “It is better to ask forgiveness than to ask for permission”. That would be the path they would undoubtedly choose if the Yen were to continue to strengthen.

Fortunately for them, the Fed sounded that hawkish note in their FOMC minutes which took some of the wind out of the Yen as the Dollar began moving up.

You can see the predicament these Central Bankers have gotten themselves into. If the Fed turns dovish, the Dollar drops and the Yen rallies. That in turn brings added political pressure on the Abe administration to intervene, especially if the profits of major Japanese corporations such as Honda, Toyota, etc, begin to suffer as a result of lost business due to Yen strength.

The flip side is that the US benefits because commodity prices move higher and inflation picks up ( at least at the wholesale level when it comes to commodity prices ) staving off the Fed’s dreaded DEFLATION enemy.

If the Fed turns too hawkish however, Japan’s problem is solved as their Yen starts dropping but as the US Dollar in turn moves higher, commodity prices start moving lower and with that, the short-circuiting of the Fed’s efforts to gin up inflation here in the US.

All of these Central Bankers are trying to accomplish the same thing at the same time – namely, get out of the deflation trap and generate an inflation rate of 2% – but in order to achieve it, they all need a weaker currency which works to push up prices domestically. The problem is that someone’s weaker currency is someone else’s stronger currency. Inflation in one zone leads to deflationary pressures in the other.

What a nightmare. I sure wish the alarm clock would ring and we would see this bad dream come to an end but sadly I don’t hear any bells going off at the moment.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.