The Worst Urban Crisis in History Could be Upon Us

Stock-Markets / China May 24, 2016 - 10:36 PM GMTBy: Harry_Dent

Like our resident market P.I. John Del Vecchio, Kyle Bass is one of those hedge fund managers who profited in the last crash when he bought credit default swaps to short the housing market.

Like our resident market P.I. John Del Vecchio, Kyle Bass is one of those hedge fund managers who profited in the last crash when he bought credit default swaps to short the housing market.

He’s also one of the few financiers in the market today who says there’s a reasonable chance the U.S. will fall into a recession over the coming months. But he’s really on the money when it comes to China.

Mr. Bass estimates that China’s bad debt exposure is at least five times that of the subprime crisis in the U.S.

Think that’s enough to trigger the next global financial crisis and depression?

You bet it is!

Two things are happening now in China that most people aren’t fully aware of. The country’s on track to create $4 trillion in new debt this year alone, or nearly 40% of its GDP, building houses for no one, while rural migrants are declining for the first time in 30 years.

In other words, the very people it’s overbuilding all these condos and infrastructure for are leaving!

After decades of rapid urbanization, no one saw that coming.

In the first quarter of 2016, China added $1 trillion in new debt, which puts it on track to reach that $4 trillion figure. One trillion is about the same the U.S. did in QE in 2013. It’s the same the ECB did in 2014.

China’s done it in a single frickin’ quarter with an economy 60% our size!

Even if you take the highest level of QE that the U.S., Europe and Japan added in a single year, the most that would add up to is $3.3 trillion.

So at $4 trillion, China is set to rack up more debt in one year than these other major countries did at their peaks, combined.

And it’s mostly by creating money out of thin air.

Countries can do this in a couple of ways. They can expand their bank loans against 10% reserve deposits – basically issuing $10 million when they’ve only got $1 million in the bank – or they can use QE. It’s the difference between 90% money creation with the fractional reserve loans, or 100% for QE. It’s all crack to me!

The developed world has moved more and more to QE to keep the gravy train rolling. It hasn’t worked because we’d already reached saturated debt levels in the great boom into 2007 – what David Stockman who spoke at our last two Irrational Economic Summits calls “peak debt.”

China isn’t doing QE per se, but they’re issuing tons of government-backed loans to corporations at affordable rates, so they can build infrastructure they’ll never use with money they don’t actually have.

It’s like our monetary gods said, “thou shalt be money!”

They think they can keep wishing money into existence without ever having to pay the consequences.

When has a drug addict ever gotten over their addiction without a relapse?

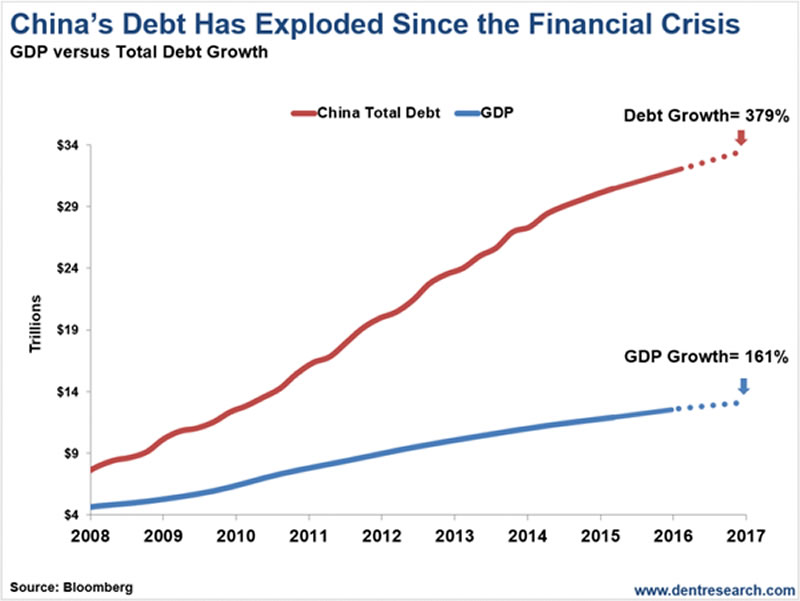

The chart below shows China has expanded their debt growth at 2.35 times their GDP growth since 2008.

China has expanded their total debt 4.8 times just since 2008 and 16.4 times since 2000. This is totally nuts. Debt growth is 379% while GDP growth is just 161% over that period.

Any economist who thinks China can have a soft landing after this is a blooming idiot!

At this rate China is looking at a debt-to-GDP ratio of 292% by year-end, or almost 3:1. Meanwhile, other large emerging countries typically run between 100% and 150%.

If this isn’t a train wreck coming, I don’t know what is.

The assumption is that China needs to keep expanding their infrastructure as more and more people move from the rice paddies to the cities. But like I said, the opposite is now happening!

Urbanization has come to a halt, with urban migrants declining by six million, from 253 million to 247 million in 2015. Why? Crazy real estate prices for one. Massive smog and traffic for another.

And the kicker – slowing jobs and wages. No thanks!

And what do you think a global depression will do to Chinese urbanization growth and job opportunities?

Simple – the greatest urban disaster in history.

If you think demographics will make the situation better now that China has abandoned their one-child policy, not so fast. Demographics make the situation worse as China’s age 15-64 workforce peaked in 2011. Since then, it’s declined by 30 million, from 941 million to 911 million (-3.2%).

Such rates of decline will accelerate after 2025, just when China finally works off the excess building of the past two decades.

Japan was never the same after 1989 due to predictable and rapid aging – and overinvestment and bubbles driven by a top-down government.

China’s drunken excess makes Japan look like a teetotaler.

So I’m with Kyle Bass on this one. China is going to fall like an elephant, making India the next big thing in the emerging world, dominating demographic growth in the next global boom after 2022.

The most affluent Chinese see it. They’re moving their money out of the country, buying real estate and businesses all over the world.

The handwriting’s on the wall. You just have to see it. It’s there.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.