The US Consumer-Driven Economy Has Hit a Brick Wall

Economics / US Economy Jun 16, 2016 - 12:10 PM GMTBy: John_Mauldin

Tony Sagami writes: Get a load of this headline from a German newspaper, which translates into “Extreme Low Interest: Who Saves Is the Fool.”

Tony Sagami writes: Get a load of this headline from a German newspaper, which translates into “Extreme Low Interest: Who Saves Is the Fool.”

This insulting headline means only one thing: central bankers have started waging a war against savers.

Former President of the Federal Reserve Bank of Dallas, Richard Fisher, offered this sage (sarcasm alert) advice last week:

“I would be prepared when they move—and I hope they move sometime in June—there’ll be a settling in of the market place. There will be a correction. Suck it up. Deal with it. That’s reality.”

Example #2: ECB President Mario Draghi said that negative rates are “not the problem, but a symptom of an underlying problem” caused by a “global excess of savings.”

“If central banks did not do this, investing would be unattractive,” added Draghi.

In other words, shut up and buy some stocks!

What those central bankers want you to do is either (1) spend money to increase demand, or (2) buy stocks to increase capital.

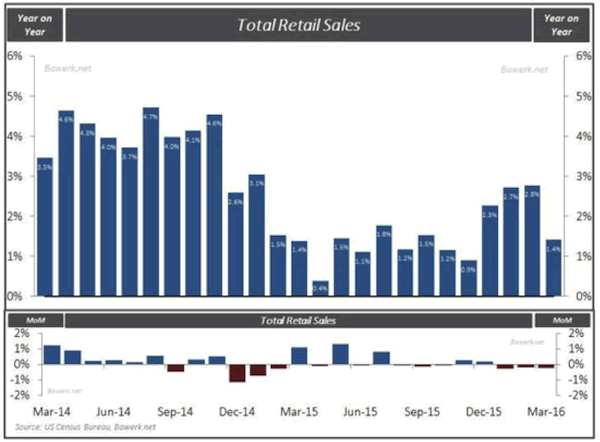

Well, it sure looks like American consumers are not doing the former.

Consumer spending is falling

Experts say that the US economy is consumer driven. It’s true; consumer spending makes up 70% of our GDP. The latest data shows, however, that retail sales fell over the entire first quarter.

But who knows consumers better than people who sell to them? One of them is Sally Smith, the CEO of Buffalo Wild Wings, which just reported an awful quarter:

“The macro environment for casual dining has had a rough quarter and a rough couple of quarters. I just don’t think there is a robust consumer out there.”

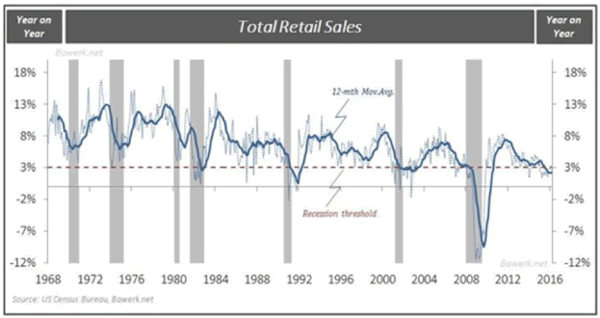

If Smith and the Census Bureau are right, our economy is headed for a recession. EVERY time the yearly growth rate of retail sales has fallen below 3%, the US economy has gone into recession.

Worse yet, the SEC is planning a change that will add more fuel to the fire.

A regulatory change that could knock off the stock market

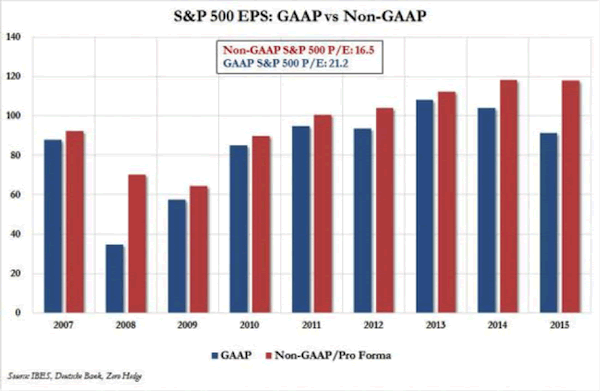

The Securities and Exchange Commission has finally decided to put an end to the accounting hanky-panky that artificially inflates profits.

The SEC is going to examine companies’ “homegrown earnings measures” and target firms that “inflate their sales results and employ customized metrics that stray too far from accounting rules.”

It looks like the SEC is waking up to the misleading picture that pro forma earnings—compared to generally accepted accounting principles, or GAAP—generate.

Now, the commission is launching a campaign to crack down on made-to-order earnings. To see the impact of such a crackdown, all you have to do is take a look at the growing difference between GAAP profits and pro forma profits.

By the way, I suggest you reread my March 8, 2016 column about corporate America’s accounting razzle-dazzle.

Yes, my bear market radar is on high alert, and the new SEC scrutiny could be just the thing that knocks the bull market off its feet.

Subscribe to Tony’s Actionable Investment Advice

Markets rise or fall each day, but when reporting the reasons, the financial media rarely provides investors with a complete picture. Tony Sagami shows you the real story behind the week’s market news in his free weekly newsletter, Connecting the Dots.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.