UK House Prices BrExit Crash NOT Likely Despite London Property Market Weakness

Housing-Market / UK Housing Jul 03, 2016 - 04:42 PM GMTBy: Nadeem_Walayat

The establishment REMAIN camp peddled the same story for the UK housing market all year, one of a collapse, crash or worse! As operation fear each month ramped up the threats of that which awaited a post Brexit Britain. The house prices crash fear mongering even emanated direct from George Osborne himself who warned: “If we leave the European Union there will be an immediate economic shock that will hit financial markets... That affects the value of people’s homes and the Treasury analysis shows that there would be a hit to the value of people’s homes by at least 10 per cent and up to 18 per cent."

The establishment REMAIN camp peddled the same story for the UK housing market all year, one of a collapse, crash or worse! As operation fear each month ramped up the threats of that which awaited a post Brexit Britain. The house prices crash fear mongering even emanated direct from George Osborne himself who warned: “If we leave the European Union there will be an immediate economic shock that will hit financial markets... That affects the value of people’s homes and the Treasury analysis shows that there would be a hit to the value of people’s homes by at least 10 per cent and up to 18 per cent."

And Apparently in a world where zero interest rates are moving to negative rates the UK would be the odd one out to actually increase interest rates as George Osborne added And at the same time first time buyers are hit because mortgage rates go up, and mortgages become more difficult to get.”

David Cameron and George Osborne then continued with their contradictory statements of a plunging sterling and rising inflation but falling house prices inflation.

"If we leave the EU the fall in the value of sterling would be an average 12%."

"Let's be clear what that means: a weaker currency means more expensive imports; that means more expensive food and it drives higher business costs; and we all know where that ends up: higher prices in the shops." - David Cameron

Firstly, as I have repeatedly pointed out that a fall in exchange rate is what virtually every central bank is trying to engineer by means of zero and negative interest rates! It's called the CURRENCY WARS, central banks trying to IMPORT inflation and EXPORT deflation as I covered in this video in response to earlier government propaganda -

In a world starved of yield with many bond holders in Japan and Germany actually PAYING interest to lend money to the government (bonds), rising UK interest rates would act as a huge financial hoover, sucking in foreign investment into UK bonds which ironically would result in a FALL in UK interest rates i.e. demand exceeding supply.

Though of course now post brexit interest rates have done the OPPOSITE to the fear mongering and so are house prices likely to RISE rather than crashing by 18%! For the fundamental fact that UK house prices in dollars are now 12% CHEAPER! A BrExit discount for potential foreign buyers who primarily will be wondering whether UK house prices will get cheaper in currency terms or should they act to seize the moment and pick up a bargain now. So in my opinion foreign demand will be STRONGER for UK property going forward and the only delay is in investors waiting and watching for sterling to stabilise which it seems to be doing so in the £/$ range of 1.30 to 1.38, and the longer sterling holds this range or trends higher then the greater will be foreign interest in buying UK property, especially if the doom merchants headlines for a house price falls fail to materialise.

Whilst post-brexit nothing much has really changed in the doom commentary as the mainstream press remains focused on stories for imminent falls in UK house prices as the following illustrates:

Property market on the ropes following Brexit vote

Mirror.co.uk-28 Jun 2016

Annual house price growth will rapidly slow down towards the low single digits across the UK's major towns and cities as the EU referendum ...

A Post-Brexit House Price Crash Is the Real Danger for the U.K.

TheStreet.com-30 Jun 2016

Unlike in the U.S. and in European countries like Spain or Ireland, the U.K. did not see a real house price crash following the financial crisis of ...

The Brexit effect on UK property will be more devastating than ...

Business Insider-10 Jun 2016

While Chancellor George Osborne already warned in May that a Brexit would make house prices crash by 10% to 18%, Mark Burrows and his ...

Zoopla's EU warning claiming house prices could drop by 20%

Daily Mail-18 Jun 2016

The company, which allows owners to monitor the estimated value of their property, said the current average house price of just over £297,000 ...

London house prices are heading for a 20% fall

MoneyWeek-23 Jun 2016

In other words, unless you believe that property prices will keep ... of MoneyWeek, house prices elsewhere in the UK are expensive by historic standards. ... A muted or crashing London market certainly will make most people ...

And many of those proposing a drop in UK house prices or worse are the same who have been wrongly calling for its imminent demise for years!

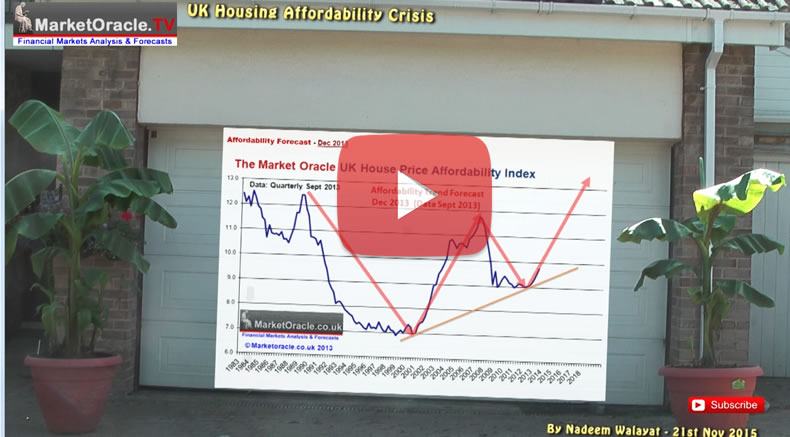

What the academics and mainstream press commentators persistently fail to comprehend is TREND, or more precisely the TREND in AFFORDABILITY. The trend over the past 40 years has been for the proportion of household earnings spent on housing costs to rise from 20% 40 years ago to an average of 35% for Dec 2013, which is trending towards 50% by 2030. This is the big story that the academics have missed as over time, decades in fact people are gradually becoming conditioned to spend more and more of their earnings on housing costs as being the norm which the government subsidises through benefits such as tax credits and housing benefit.

Affordability Forecast - Dec 2013

The reason why I expected affordability to trend ever higher again has its roots in the exponential inflation mega-trend as workers relentlessly face a loss of purchasing power of earnings and savings due to reasons such as the Inflation of the size of the population that is MOSTLY as a result of continuing out of control IMMIGRATION, as evidenced by the baby boom now underway mostly amongst migrant families of the past 15 years that acts to relentlessly put pressure on housing availability where annual construction (new builds) are not able to keep pace with even half of the new demand generated each year. Therefore workers have no choice but to commit an ever larger proportion of their earnings towards housing costs, the effect of which is that housing bear market affordability troughs are being ratcheted ever higher, which has left many academics confused as they remain fixated on their theoretical models that imply house prices must fall so as to return to affordability levels of past troughs as the real world trend passes them and their models by.

The updated affordability graph (Dec 2015) shows the underlying relentless trend of affordability being once more ratcheted higher that looks set to breach the 2007 bull market peak during 2016 i.e. house prices this year will be even more unaffordable then they were right at the very peak of the last housing bull market mania!

More on the housing affordability crisis in the following video -

UK House Prices 5 Year Forecast

In terms of the prospects for UK house prices, it is now 2 1/2 years since excerpted analysis and the concluding 5 year trend forecast from the then forthcoming UK Housing Market ebook was published:

30 Dec 2013 - UK House Prices Forecast 2014 to 2018, The Debt Fuelled Election Boom

UK House Prices Forecast 2014 to 2018 - Conclusion

This forecast is based on the non seasonally adjusted Halifax House prices index that I have been tracking for over 25 years. The current house prices index for November 2013 is 174,671, with the starting point for the house prices forecast being my interim forecast as of July 2013 and its existing trend forecast into Mid 2014 of 187,000. Therefore this house prices forecast seeks to extend the existing forecast from Mid 2014 into the end of 2018 i.e. for 5 full years forward.

My concluding UK house prices forecast is for the Halifax NSA house prices index to target a trend to an average price of £270,600 by the end of 2018 which represents a 55% price rise on the most recent Halifax house prices data £174,671, that will make the the great bear market of 2008-2009 appear as a mere blip on the charts as the following forecast trend trajectory chart illustrates:

The most recent UK average house prices data (£216,017) is showing just a 3.2% deviation against the forecast trend trajectory, which if it continued to persist then in terms of the long-term trend forecast for a 55% rise in average UK house prices by the end of 2018 would then translate into a 7% reduction in the forecast outcome to approx a 48% rise by the end of 2018.

UK House Prices Momentum

UK house prices momentum gong into the EU referendum had significantly slowed from + 11.1% for March 2016 to +8.7% for May 2016. I expect momentum to continue to slow over the next few months, probably bottoming out at above 5% before rising again towards +10% by the end of thus year. Thus UK house prices will continue to defy the highly vocal perma-wrong crowd who have been proclaiming that a house prices crash is imminent for the past for 4 years! Who I am sure will be jumping up and down like demented rabbits as they assume the slowdown in momentum is anything other than just that a slowdown in the rate of the annual increase in house prices, which I still expect to remain strongly positive i.e. at above +5% and end 2016 trending back towards 10%.

Whilst London will see a more severe slowdown in momentum than the rest of the UK and actual year on year falls in some over priced locations and property types (flats), as per my in-depth analysis of December 2015 that had expected London to take a hit but overall UK average house prices to continue trending higher for 2016, a trend that should become apparent over the coming months.

The bottom line is that UK house prices are going to continue to get ever more expensive where those who are waiting for a crash to more affordable levels will continue to regret not buying as the only way housing can even start to become more affordable is if the UK literally triples the number of new builds each year from approx 140,000 per year to 400,000, something that is just not going to happen as it would literally mean the government undertaking to build a new major city EVERY YEAR! Instead it has been over 40 years since the last new town let alone city was built.

Therefore the UK housing crisis is not just one of the inability of the housing market to cope with current demand, but as the earlier housing affordability trend graph illustrates that the crisis is going to get much WORSE with each passing year, which ultimately means an social EXPLOSION of some kind, maybe not a revolution but it's not going to look pretty! And where BREXIT is just the first rebellion of the people against the establishment that want to import cheap labour that the tax payer picks up the bill for in terms of in work benefits and the people of Britain pay the price for in terms of the slow motion collapse of society as literally each service after service FREEZES! Hence why the housing crisis cam ONLY be addressed AFTER Britain has LEFT the European Union, which still remains several years away.

For what happened on BrExit night see my selection of highlights from 8 hours of BBC coverage of EU Referendum night.

And also see how all hell broke lose once the polls closed Friday as the markets, bookmakers and pollsters ALL got the EU Referendum very badly wrong, as YouGov's 10pm poll convinced all, even Nigel Farage that REMAIN had won triggering a further sharp rally in the FTSE futures and sterling that was sustained until the actual results started to be announced shortly after midnight. Which I covered in this comprehensive video of exactly what happened in the markets during a very volatile trading session.

Ensure you are subscribed to my always free newsletter for in-depth analysis of the many future consequences of BrExit.

By Nadeem Walayat

Copyright © 2005-2016 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.