Basic Income in The Time of Crisis

Politics / Social Issues Jul 23, 2016 - 03:15 PM GMTBy: Raul_I_Meijer

Basic income is a topic I’ve been thinking about for a while, and while I won’t get anywhere near a comprehensive overview -there are too many uncertainties and untested ideas-, I’m going to try to paint a first chapter in a work of progress. Or, a thought experiment, for me and others.

Basic income is a topic I’ve been thinking about for a while, and while I won’t get anywhere near a comprehensive overview -there are too many uncertainties and untested ideas-, I’m going to try to paint a first chapter in a work of progress. Or, a thought experiment, for me and others.

Of course I’ve read a lot of and about other people’s ideas on the topic, and I’m sure there are many more out there that I haven’t seen yet, but I’m afraid to say that about all of those I did read tend to fall into the same ‘trap’. That is, they project their ideas, which are widely varying, onto -or close to- the economy (economies) and society (societies) as they are today.

Their basic income examples and ideas and theories (as well as criticisms of them) are all built around a perception of the economy as it is, or better still as it once was. And that is probably a bad idea. Because the economy of the future will not be like it is today, or was yesterday, and neither will societies.

And that is not because of the role automation and/or robots will play, a topic that features prominently in many basic income writings; those things are but a minor distraction. What will change our world much more profoundly will be the inevitable demise of the economic system as we know it.

And it’s against that backdrop that the issue of basic income must be viewed. If only because it then becomes something entirely different.

I started thinking a while back that it would not be robots or inequality that would be the foundation of and driving force behind basic income, but the ruin of our pension systems. Of course one has to be careful with general statements on this, because there are so many different systems and approaches when it comes to pensions and other old-age ‘provisions’ and/or ‘benefits’.

What all have in common today, though, is that they’re woefully underfunded and sliding down further fast due to ultralow interest rates and other ‘policies’, as well as to ageing societies. It seems almost incredulous that until a few years ago most pensions funds were required by law to invest only in AAA-rated assets.

While they may not all suffer from the same afflictions, all these systems, from Social Security to private pension funds, do suffer from the same symptoms. Painting the picture with a broad stroke, it’s safe to say they’re all in essence Ponzi schemes.

While many of the ‘Social Security variety’ depend on the trust in a government to pay out something for which nothing -or very little- has been set aside, those of the variety in which money IS actually paid in are inflicted by the twin impairments of too little return on what is paid in to maintain the fund, and too few newcomers to pay for what ‘oldtimers’ never paid but do want to take out.

A third ‘impairment’ will occur when younger workers figure out they’re paying into something they will never see any benefits of, and refuse to fork over any longer.

Low interest rates and ageing populations are wreaking havoc on -especially- European and Japanese pensions even as we speak, and a brief look at future trendlines makes abundantly clear where things are going.

Pondering all that, it seems obvious that at some point a government with at least a bit of vision would come to the conclusion that a basic income to replace all the faltering old-age provisions schemes -and many others- might make a lot of sense. If only because, once you think about it, ‘free’ money only for older people does not make sense, neither politically nor economically.

But let’s take a step back; that last bit still doesn’t take sufficiently into account that our economies are about to undergo radical changes because they are collapsing. What I find interesting is that this collapse actually seems to play into the hands of a basic income. For several reasons, as a matter of fact.

I am convinced that a basic income in an economy that’s part of a centralized, even globalized, system, makes no sense. You can’t really have a basic income in a society that imports most of what it uses, but that still is the model of most of our societies. We import much of what’s essential, and export non-essential things.

That is a problem that will more or less solve itself, though we better pay attention and be prepared, or else. We may not know exactly when or how the economic collapse will occur, but that’s not the most important thing. What is, is that centralization can only happen in a growing economy. As soon as growth halts -or even reverses-, economies will of necessity decentralize. Unless perhaps they’re under a dictatorship, but even then.

Setting up a basic income system in a society that, for example, imports its clothes and furniture -and sometimes even food- from China, is a doomed proposition. The number one requirement for a successful basic income is that the money issued stays inside the society it’s being issued in. If not, it would merely speed up bankruptcy.

The money must be spent locally, on local products, as much as possible, because then it will be worth much more to the local economy. This will also go far towards fighting deflation, because the velocity of money will increase. To ensure that as much as possible is spent inside a community/society, the manufacturing base will need to be (re-)built.

Which must happen anyway as the global economy sinks, and the sooner, the better. The worldwide transport lines we know today will not exist for much longer, and it will take time to adapt one’s economy to that.

On the bright side, this decentralization, or relocalization, or ‘protectionism’ if you will, will (re-)create a lot of jobs. Not ones that will pay as much as what we see now, but that’s not necessarily such a bad thing. And besides, it’s not as if we have some kind of free choice. Reality will dictate the terms. We must produce our own essentials once again: food, clothing, housing, furniture etc.

Still on the bright side, the new jobs will make basic income much less costly for a society. Because you can top off what people make on top on whatever the basic income is, and you can do so at a level that everyone can agree to.

That’s my first take of basic income in a crisis, a crisis I see as set in stone. Which changes the whole issue of a basic income. Plenty people will see this as socialism or something in that vein, I see it as perhaps the only way to make sure you have a functioning society on the way down. With none of the alternatives looking particularly appealing.

When discussing the details of such a program, what would probably be good, if only for the sake of justice, is to combine it with Steve Keen’s notion of a Modern Debt Jubilee, in which debt gets cancelled but those with most debt are obliged to pay -part of it- down, while those who are debt-free get ‘rewarded’ for that status.

What I have always found difficult to envision is how a jubilee would work in modern days. The ones ‘of old’ would typically involve a local ruler and/or landlord to whom subjects owed debts of some sort, which the ruler could declare null and void while still being the ruler- and the richest man around.

Today debts are global, with much of them having been securitized and sold on to large -financial- institutions who may even be anonymous and have shareholders in dozens of different countries. How do you get them to agree to large-scale debt cancellation or reform? I’m not saying it can’t be done, but it’s not the same thing.

The hardest part of what I laid out above may well be to get people who feel they are owed benefits, pensions or otherwise, to accept that these will be incorporated into a new basic income system. Not many understand to what extent pensions systems are Ponzi’s, and even those who do to an extent may still refuse to give up their slice of the pie.

It should be fairly easy, though, to explain what their slice will look like once the systems collapse, or even simply once nobody pays in anymore. And because younger people have no reason to pay for something they know they will never see the benefits of, and moreover all this can be phased in/out over a certain period of time, it may well unfold faster and easier than one might think at first sight.

Lastly, some numbers. Greg Ip wrote for the Wall Street Journal last week: Revival of Universal Basic Income Proposal Ignores Needs of Labor Force. Obviously, in my example, i.e. in an economy that’s going down the drain, the term ‘needs of the labor force’ takes on a whole different role and meaning. In his piece, Ip says:

To send every American adult $10,000 a year would cost $2.4 trillion, or 13% of GDP.

And I think that is a misleading way of phrasing things. Because the money doesn’t disappear, so it doesn’t ‘cost’ that; and that’s not only true in my theoretical example. Most of the ‘basic income money’ would circulate inside the economy, and much comes back to the issuing state through various taxes. Crux is don’t let it leave the economy it’s issued in.

Mind you, I don’t see a basic income trial happen in the US, because it’s far too big a country. The EU is too large too. You’d need smaller units. And as I said, a shrinking economy would of necessity make units smaller. In Europe, these units already exist. In countries the size of Finland, Switzerland, Scotland, Wales, perhaps Greece, a basic income trial may well be viable.

That is, provided they shrug off the strangleholds that bind them to centralized systems. But that they will wind up doing regardless. What’s more important is that such a trial is meticulously planned, and not with some pie in the sky idea of where the world economy is headed.

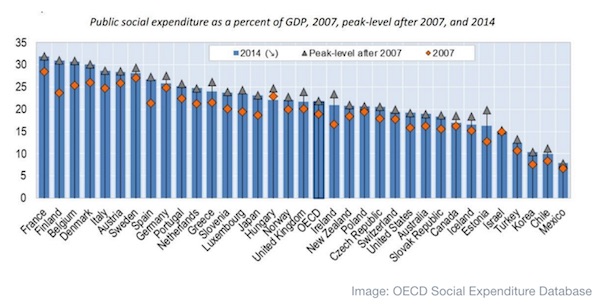

Greg Ip suggests that a $10,000 basic income for all US adults is not realistic, because it would ‘cost’ 13% of GDP. But this graph from the World Economic Forum World Economic Forum on social expenditures as calculated by the OECD, puts things in a different light:

In 2014, US social expenditures were at about 20% of GDP, which is 50% more than Ip’s example. And that is the main point behind the basic income question, even if you don’t subscribe to the collapsing economy ‘thesis’: what would happen if you replace all -or almost all- social benefit schemes in a particular society with a basic income? How much money would you save, or how much extra would it cost?

Ip seems to contend that a basic income would be prohibitively expensive. But, even if the OECD numbers fail to include certain items, there’s a lot of leeway between the 13% of GDP a US basic income would cost, and the 20% of GDP America now pays in benefits. About $1.2 trillion in leeway. So the cost picture at the very least is not all that obvious.

By the way, it’s kind of funny that I’ve seen nobody address the perhaps most ironic thing: even if the state would save a lot of money moving to the much simpler basic income from a myriad of other programs, that would make a whole lot of civil servants unemployed all at once. Can’t help wondering why no-one brings that up.

But the US is not the best example, for various reasons. It’s countries that have the right size to hold a trial in, or at least what we can perceive as the right size. Finland, Belgium, Denmark all spend close to 30% of GDP on social expenditures. Portugal, Greece, Slovenia, Luxembourg are at 25%. If a basic income can be had for 13% of GDP, these countries stand to save a fortune…

Unfortunately, you can’t be in the EU and start a basic income trial. And that’s a shame. Because it’s going to be very hard to get this right, and it’ll take some serious time and effort. So much so that not starting today is a risk in itself.

But as long as people keep having faith in the economists, politicians, bankers and reporters who drill the ‘recovery is right around the corner’ meme into them 24/7, and any alternative to that meme just scares the heebees out of them, I’m afraid there’ll be no basic income trial. Yes, there are a few ideas, but they’re all based on the wrong -growth- assumptions, so they’re sure to fail.

Caveat: No, I haven’t gone through all different social benefits plans of all countries I’ve mentioned, so I don’t know what part of GDP each spends at present, or how much they could save or lose. Someone will have to write ‘the book’ on this.

For my thought experiment here I found it sufficient to go with the basic principles, and throw in a few numbers. And the most elementary difference between me and other voices is not there anyway: that is in my putting the basic income issue against the backdrop of economic collapse, and nobody else really doing that whom I’ve read.

Yes, the title is Marquez, of course, THE time of cholera

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)© 2016 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.