Deutche Bank Stock Price Crash - The EU Has Problems Far Beyond the Brexit

Stock-Markets / European Stock Markets Jul 26, 2016 - 01:39 PM GMTBy: Harry_Dent

The Dow dropped nearly 1,000 points (5%) and the London FTSE dropped 10% after the Brexit vote surprised the markets on June 23. After two days though, markets were marching back up again.

The Dow dropped nearly 1,000 points (5%) and the London FTSE dropped 10% after the Brexit vote surprised the markets on June 23. After two days though, markets were marching back up again.

That’s just like markets on “crack!” They react to political events, but totally miss the fundamentals.

Yes, Brexit is important. Years from now it will be recognized as the beginning of the end for the great Eurozone experiment.

It isn’t just about the renegotiations on trade agreements with Britain and initial slowing of GDP. It’s also about the threat that more countries will choose to exit the economic bloc. The euro and Eurozone have 40%-plus unfavorable ratings in polls in France, the Netherlands and Italy. That many areas within countries will break free of their overlord.

And then this rush for nationalism will spread across the globe like wildfire.

But here’s the 800-pound elephant in the room (I talked about this in detail in the February issue of The Leading Edge). The one Wall Street seems blind to at the moment…

Italy is the next Greece!

It’s bad – non-performing bank loans have risen to 18%.

At 10%, most banks are technically bankrupt. That’s the percentage of capital and pledged deposits they have against bad loans. Our pledged deposits, not theirs.

At 18%, they’re no longer “technically” bankrupt. They ARE bankrupt!

Greece still has bad or non-performing bank loans of 34%, Ireland 19% and Portugal 12%. And we haven’t seen the next serious financial crisis yet.

Yet nothing has been done to seriously restructure debt in southern Europe. The EU just bailed out Greece to stop the dominoes from hitting other countries. They’re pumping in heavy doses of QE to keep the banks and economy temporarily liquid and solvent.

But the problems are growing even worse. The blood is getting harder to hide…

Just look at Deutsche Bank. It had its largest loss in history in the fourth quarter of 2015: $7 billion, without any help from the next financial crisis!

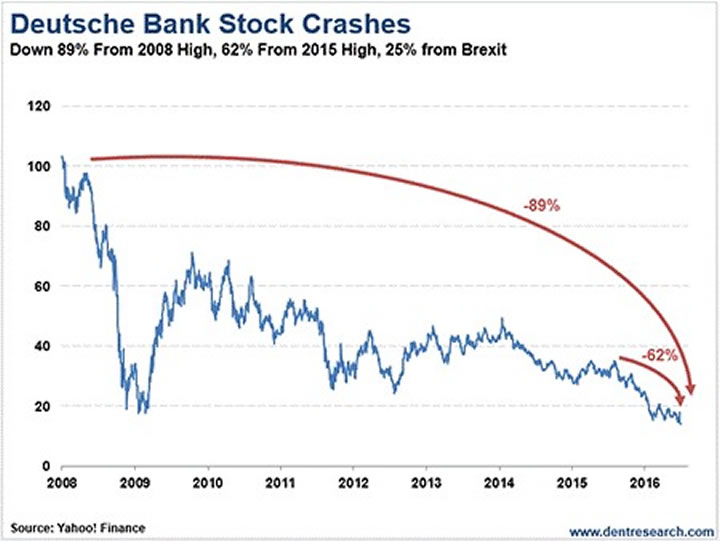

Its stock is now down 89% from its early 2008 high, and 62% from its 2015 high.

It’s the largest bank in Germany. Why is Wall Street ignoring this!?

UniCredit is the largest bank in Italy. Its stock is down 94% since the 2008 high, and 71% since its 2015 high.

Banca Carige, another major Italian bank, is down over 99% from its high in 2008.

HSBC in the UK lost 15% since Brexit, while the Royal Bank of Scotland dropped 40% and Barclays bled 41%.

Investors in these stocks are suffering tortures no investor should ever endure. And there’s more pain to come.

Depositors in these banks are willingly settling their heads into the guillotine!

But here is the worst part…

To raise capital after the 2008 global financial crisis, Deutsche Bank issued CoCo bonds. They didn’t want to dilute their shareholders or their senior bond holders, so they issued a new B.S. bond that ranked just below senior level. But – and this is a pretty significant “but” – the 6% coupon only gets paid if the bank has sufficient cash flow… and any missed payments don’t have to be made up. If they continue to miss payments, the bonds get converted to stock. And there’s nothing the bond holder can do about it!

These should have been called Coo-Coo, not Co-Co, bonds!

The yields have now spiked above 12% and the bonds have been devalued substantially already…

And again, we haven’t even seen the next real financial crisis yet.

If Deutsche Bank is in this much trouble, you know many other major banks are.

Before the Brexit vote, most of these guys were trading at well below book value, while the broad markets trade at 2-times-plus book value. Italy’s Banca Carige is trading at just 3% of book value. Citibank is at 54%, Spain’s Banco Santander is at 58%, Deutsche Bank is at 59%, Credit Suisse is at 63%, and HSBC is trading at 69% of book value. Since then, they’ve gotten worse.

And the bank with the highest exposure to the most leveraged and toxic of all assets – credit default swaps (largely mortgage derivatives) – is Deutsche Bank! It holds 10% of this $550 trillion nuclear bomb. Not billion. Not million. Trillion!

At 10%, that means Deutsche Bank has $54.7 trillion credit default swamps on its books. JPMorgan isn’t far behind, with $51.9 trillion. Citibank has $51.2 trillion, Goldman Sachs has $43.6 trillion and the Bank of America has $27.8 trillion.

Markets should be much more worried about the coming default in Italy.

They should be much more worried about the largest banks in the world failing… and they will fail.

Yet they seem more concerned about political factors like Brexit, or when Janet Yellen will raise the fed funds rate 0.25%.

Investors are going to get their asses handed to them.

Mark my words: a major collapse is bearing down on us. Don’t be among the blind investors flattened when it arrives!

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.