Commodities Are the Best Bargain Now—Here’s What to Buy

Commodities / Investing 2016 Aug 26, 2016 - 06:03 PM GMTBy: John_Mauldin

TONY SAGAMI writes: What kind of investor are you? Are you the buy-high-sell-higher (trend continuation) type? Or are you a bargain hunter who likes beaten-down (trend reversal) opportunities?

TONY SAGAMI writes: What kind of investor are you? Are you the buy-high-sell-higher (trend continuation) type? Or are you a bargain hunter who likes beaten-down (trend reversal) opportunities?

The former type of investor is now in heaven. With the stock market at new highs, there are many stocks on fire.

But if you’re looking for bargains, the pickings are pretty slim.

Don’t worry. There are still many places to invest your money. I'm talking about hard assets, aka commodities.

Why invest in commodities now?

Hard assets go well beyond real estate and gold. They include all types of natural resources like oil, wheat, copper, timber, coffee, zinc, and pork bellies.

Investors often overlook natural resources. But this asset class has been beaten down and should be at the top of every bargain hunter’s list.

You should consider commodities for two reasons:

- Commodities don’t usually move in sync with the stock market, so they will help diversify your investment mix and reduce risk. Since 2000, there has been only a 35% correlation between commodities and the stock market.

- If you buy at the right time, you can make a mountain of money in commodities.

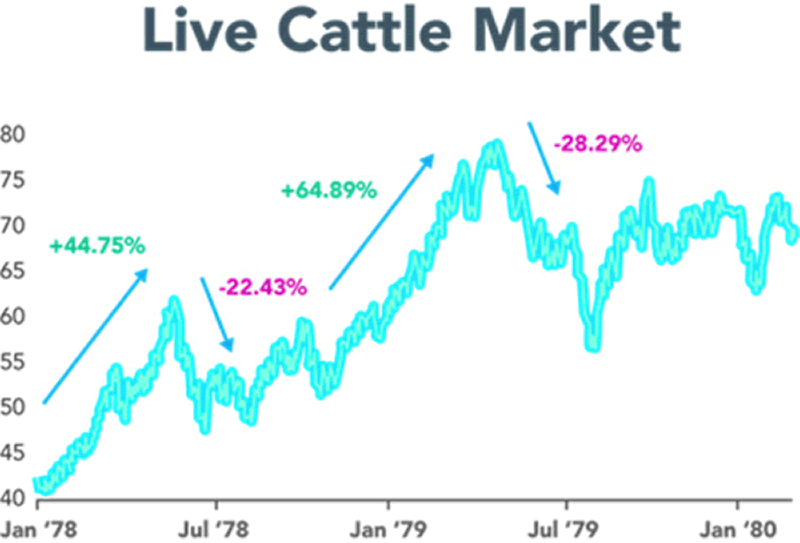

Take a look at Hilary Clinton. In the 1970s, she opened a commodity trading account with a company called Refco and seeded it with $1,000. Mrs. Clinton turned that $1,000 into over $100,000 in just 10 months. That’s a whopping 9,000% return.

The Wall Street Journal stated, “Over 10 months, buying and selling futures contracts in a variety of commodities, especially cattle, Mrs. Clinton after various ups and downs had made nearly $100,000, and in July 1979 got out of the market.”

Hillary should have kept trading. At that pace, she would have made $700 million in three years and a couple trillion in 10 years.

My point is that investing in commodities can be very rewarding. And given the low prices that many natural resources are trading at right now, you should think about adding them to your portfolio.

The best way to invest in commodities

There are many ways to invest in commodities (including futures like Mrs. Clinton). But, the best way for most investors is via exchange-traded funds.

Name |

Ticker |

Commodity |

PowerShares DB Commodity Index Tracking Fund |

DBC |

All |

United States Oil Fund |

USO |

Energy |

iPath Bloomberg Commodity Index Total Return ETN |

DJP |

All |

iShares S&P GSCI Commodity-Indexed Trust ETF |

GSG |

All |

PowerShares DB Agriculture Fund |

DBA |

Food |

United States Commodity Index Fund |

USCI |

All |

United States Natural Gas Fund |

UNG |

Energy |

iPath Bloomberg Grains Subindex Total Return ETN |

JJG |

Food |

iPath Bloomberg Sugar Subindex Total Return ETN |

SGG |

Food |

The Teucrium Wheat Fund |

WEAT |

Food |

iPath Bloomberg Copper Subindex Total Return ETN |

JJC |

Metals |

iPath Bloomberg Cocoa Subindex Total Return ETN |

NIB |

Food |

The Teucrium Soybean Fund |

SOYB |

Food |

iPath Bloomberg Livestock Subindex Total ReturnSM ETN |

COW |

Food |

iPath Bloomberg Nickel Subindex Total Return ETN |

JJN |

Metals |

The Teucrium Sugar Fund |

CANE |

Food |

iPath Bloomberg Industrial Metals Subindex Total Return ETN |

JJM |

Metals |

United States Diesel Heating Oil Fund |

UHN |

Energy |

United States Copper Index Fund |

CPER |

Metals |

iPath Bloomberg Aluminum Subindex Total Return ETN |

JJU |

Metals |

iPath Pure Beta Cotton ETN |

CTNN |

Food |

iPath Pure Beta Nickel ETN |

NINI |

Metals |

iPath Pure Beta Grains ETN |

WEET |

Food |

PowerShares DB Oil Fund |

DBO |

Energy |

PowerShares DB Base Metals Fund |

DBB |

Metals |

iPath Bloomberg Coffee Subindex Total Return ETN |

JO |

Food |

PowerShares DB Energy Fund |

DBE |

Energy |

The Teucrium Corn Fund |

CORN |

Food |

Two ETFs that track a broad basket of commodities are the PowerShares DB Commodity Index Tracking Fund (DBC) and the iShares S&P GSCI Commodity-Indexed Trust (GSG).

If you prefer a more concentrated strategy, you won’t have any problems finding ETFs for specific niches—from coffee to copper, to corn.

As always, timing is everything, so any bargain hunter worth his salt should be watching natural resources and commodities. This is especially true if you think that ZIRP, NIRP, and QE will result in the wild return of inflation.

Subscribe to Tony’s Actionable Investment Advice

Markets rise or fall each day, but when reporting the reasons, the financial media rarely provides investors with a complete picture. Tony Sagami shows you the real story behind the week’s market news in his free weekly newsletter, Connecting the Dots.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.