Stock Market Clear and Present Danger!

Stock-Markets / Stock Markets 2016 Sep 24, 2016 - 06:58 AM GMTBy: Chris_Vermeulen

The cycle since 2009 has been different from other market cycles, throughout history, in only one significant manner. That having been said, it is the Global Central Banks that have intentionally pushed interest rates to zero and below. This encouraged investors to speculate in the equity markets which have now become ‘dangerously overvalued, overbought, as well as ‘over bullish’ extremes according to all measures. In my opinion, this has “deferred” and not eliminated the disruptive unwinding of this “speculative” episode.

The cycle since 2009 has been different from other market cycles, throughout history, in only one significant manner. That having been said, it is the Global Central Banks that have intentionally pushed interest rates to zero and below. This encouraged investors to speculate in the equity markets which have now become ‘dangerously overvalued, overbought, as well as ‘over bullish’ extremes according to all measures. In my opinion, this has “deferred” and not eliminated the disruptive unwinding of this “speculative” episode.

They have encouraged a “historic expansion” of public and private debt burdens with equity market overvaluations that rivals only those of the 1929 and 2000 extremes on reliable valuation measures. These brazen experimental policies, of Central Banks, have amplified the sensitivity of the global financial markets to “economic disruptions” and “distortions of value” in relation to investor risk aversion.

It is very clear that a zero interest rate policy has encouraged yield-seeking speculation by investors. As I have previously discussed, in many of my past articles, I detailed that monetary easing “in and of itself” does not “support” the financial markets. ‘Easy money’ merely stimulates speculation while investors are already inclined to embrace even more risk. The actions of the FEDs’ aggressive and persistent ‘easing’ will fail to prevent this “market collapse”.

Any financial professional who has any understanding of how securities are priced, should know that elevating the price that investors pay for financial securities does not increase “aggregate wealth”. A financial security (stocks) are nothing but a claim to some future set of cash flows. The actual “wealth” is embroiled in those future cash flows and the value-added production that generates them. Every security that is issued MUST be held by someone until that security is retired. Therefore, elevating the current price which investors pay for a given set of future cash flows simply brings forward investment returns that would have otherwise been earned later on. The FED is leaving “poorly-compensated” risk, on the table, for the future!

The total debt of the United States has reached gigantic proportions well beyond 2008 – CLICK HERE

The crisis ended precisely when, in the second week of March of 2009, the Financial Accounting Standards Board (FASB) responded to Congressional pressure and changed rule FAS157 so as to remove the requirement for banks and other financial institutions to mark their assets to market value. The mere stroke of a pen has eliminated any chance of widespread defaults by making balance sheets look financially stronger. The new balance sheets may be great, in the short-term, but ultimately have become weapons of “mass destruction”.

The Race to Debase Continues…

As of September 2nd, 2016, the BLSBS “disappoints” with a print of just 151,000 “jobs”. This will eliminate the possibility of a FED FUNDS increase, however, do not be surprised if some FED officials emerge to tell you otherwise, as we are already experiencing some counter-intuitive moves within several of the “markets”.

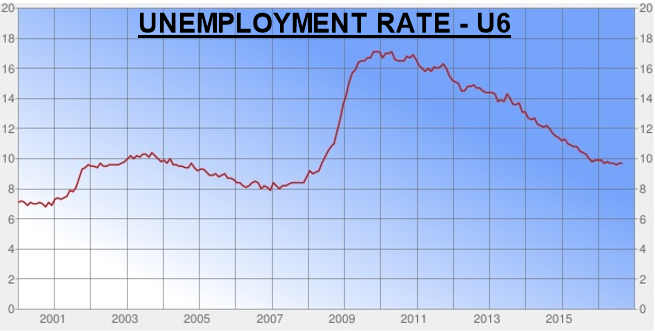

The true unemployment rate is ACTUALLY U-6! Consequently, the U-6 rate more accurately reflects a natural, non-technical understanding of what it means to be unemployed. Including discouraged workers, underemployed workers and other people who exist on the margins of the labor market, the U-6 rate provides a broad spectrum of the “underutilization” of labor within the country. In this sense, the U-6 rate is the TRUE unemployment rate which is close to 10%.

U-6 Unemployment Rate

Concluding Thoughts:

In short, this incredible bull market is stocks which we have embraced since 2009 is quickly nearing its end. The FED’s mass easy money policies, stock buyback programs, accounting rule changes have simply masked/covered up most of the financial mess people, business and global economies are in.

Eventually all these tactics to cover-up and kick the financial-can down the road will start to fail. One they start failing things will get really ugly fast for the entire economy for those not knowing how to avoid and profit from market weakness.

If you would like to learn more about how to take advantage and profit from tough times, follow me at www.TheGoldAndOilGuy.com

Chris Vermeulen

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.