Individual Savings Accounts (ISAs) becoming more complex - Not such an easy ISA

Personal_Finance / Savings Accounts Mar 21, 2007 - 12:26 AM GMTBy: Sarah_Jones

Rachel Thrussell, Head of savings at moneyfacts.co.uk – the money search engine, comments:

“As the end of another tax year approaches, banks and building societies have been stepping up their efforts in an attempt to capture their slice of the huge ISA market.

“When the Mini Cash ISA was first introduced in 1999 as an easy tax efficient way to save, the majority of ISAs were straightforward, either instant access or notice and occasionally with an introductory bonus.

“But an overriding theme has developed this year with providers becoming more creative with their product design, attaching more complex terms and conditions in order to offer a higher return.

Packaged ISAs

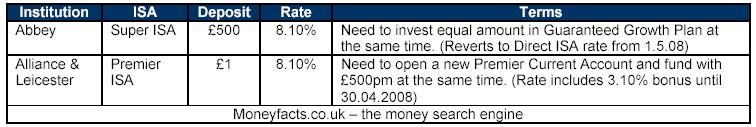

“The packaged ISA is a new concept, offering what appears to be by far the most attractive interest rates, but requiring an additional account to be opened. In the case of the Abbey this is a Guaranteed Growth plan, while Alliance & Leicester asks that a Premier Current Account be opened. Smile, also offers a preferential ISA interest rate to current account holders.

“The rates on these packaged ISAs are also inflated by limited rate incentives. In the case of Abbey, after 1.5.08 this account reverts to the Direct ISA rate, currently paying between 5.5% and 5.75%, which also includes a 0.5% bonus to 1.5.08, while the Alliance & Leicester rate includes a 3.10% bonus until 30.4.08.

“If you are happy to open the required current account or take more risk with an equity based investment, then these current rates are unrivalled in the short term.

“With such large reductions in the interest after the first 12 months, it will certainly be worth checking out the competitiveness of the deal come next April. Also make sure your other accounts don’t suffer in the process – the Alliance & Leicester Premier Current Account for example offers between 0.10% and 1.49% credit interest.

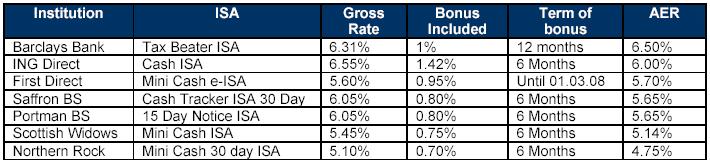

Bonuses

“Many of today’s best ISA rates include a bonus, so it is important not only to check out the size of the bonus but also its length. Take the Barclays ISA for example; although this ISA includes a bonus of 1%, at least it is available for a full 12 months, making the AER currently an unrivalled 6.5%.

“As many ISAs are freely portable, your relationship with one provider does not have to be lifelong. So why not take advantage of the best rate for this year, and then decide on a new provider next April?

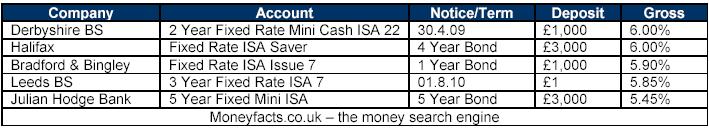

Fixed rate

“This year in particular, ISAs rates weaken the long-held belief that, on average, notice accounts traditionally yield higher returns. As the table below illustrates, similar rates are available for fixed and variable rate ISAs, which shows that ISA providers are being cautious of future fluctuations in money market rates.

“ISAs are a great way to save, are tax free and can provide great returns. Make sure you search for the best account, taking into account any restriction, bonuses and notice terms. ISAs rates will start to bloom over the next few weeks, with many new ISAs sprouting up too. But if past years are anything to go by, they won’t stay around for long and the offers may be withdrawn at short notice or alternatively rates will drift lower over time.”

Posted by Sarah Jones - For Rachel Thrussell of MoneyFacts.co.uk

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.