We Are Putting Off the Inevitable

Economics / Recession 2017 Dec 02, 2016 - 03:37 PM GMTBy: John_Mauldin

Only two presidents in history did not see a recession, and they were inaugurated after single-term presidents. In every single instance at the end of a two-term presidency, there’s been a recession. This means there is a 100% chance of recession for the new president.

Only two presidents in history did not see a recession, and they were inaugurated after single-term presidents. In every single instance at the end of a two-term presidency, there’s been a recession. This means there is a 100% chance of recession for the new president.

My friend Raoul Pal, in his latest Global Macro Investor, talks about the potential for a recession in 2017:

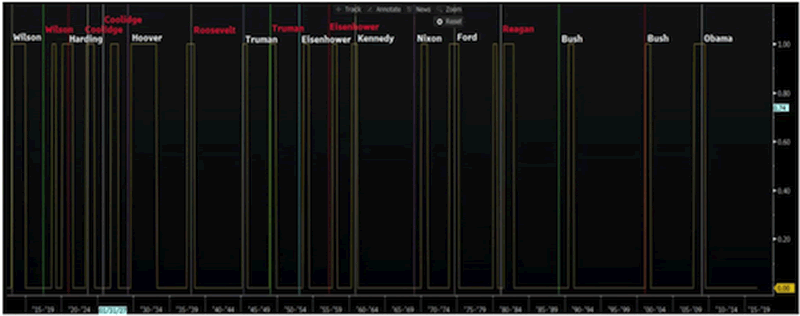

The following chart shows every recession since 1910 (in yellow) with the new president after a two-term election marked in white and the new presidents after a single-term presidency in red. Wilson and Eisenhower appear as both. Only Coolidge saw more than a year (sixteen months) from his second-term election and the onset of the subsequent recession at the end of WWI…

Every single US recession bar one (with explainable circumstances) occurred around an election. Only two presidents in history did not see a recession, and they were inaugurated after single-term presidents.

You can see the whole piece here. There are a few caveats and some slight curve fitting, but his general observation of recessions after a two-term presidency pretty much holds as far as I can see.

One objection is that there are not enough data points to make it a really accurate predictor. There is nothing that I can think of economically about a two-term presidency that requires a recession to follow it.

If the economy were now growing at 3% to 4%, if unemployment were truly under 4%, and if we had the deficit under control, I wouldn’t be worried at all. But Raoul has pointed out those prior recessions.

For now, the country is growing rather slowly, at very close to stall speed. Corporate profits are coming under pressure. The post-election US dollar is rising seemingly relentlessly. This is damaging US corporation profits, not to mention emerging markets. And interest rates are climbing all over the world.

And then there’s Europe, which could potentially deliver a massive shock to the global economy in the not-too-distant future…

What happens if there is a recession soon?

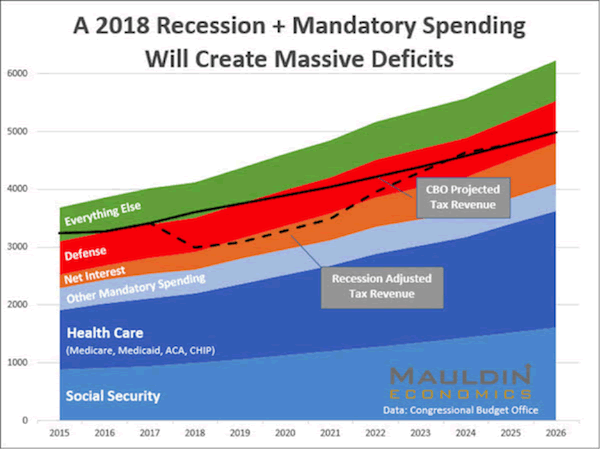

Patrick Watson had our team at Mauldin Economics create the following chart. It shows what would happen to the federal budget if there were a recession in 2018. If the recession were to move up to 2017 or if it were to hold off till 2019, the result would be much the same.

Revenues go down. Expenses go up. Taxes would pay only for required spending like health care, welfare, and Social Security—plus interest costs. Money for defense spending and everything else would have to be borrowed. The on-budget deficit would rise close to $1.3 trillion.

Add in the off-budget debt that always seems to increase, and you could quickly grow total US debt to $30 trillion before the end of Trump’s first term.

Clearly, that doesn’t take into account any of the measures the new administration will put in place. This is just using Congressional Budget Office (CBO) data for our current trends.

By the way, the chart also shows that we can expect trillion-dollar budget deficits as far as the eye can see.

I should point out that federal income tax revenues are basically flat, though the jobs numbers are up. That means a lot of people are getting lower-paying jobs. The underlying economy is weaker than it appears.

Is it even possible to balance the budget?

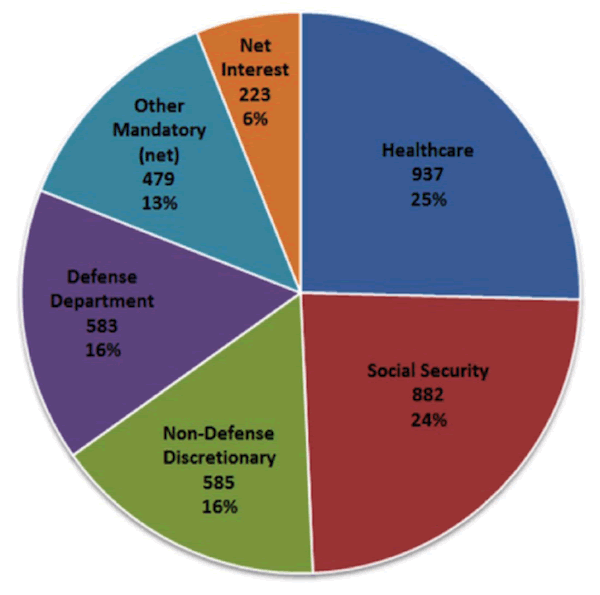

We should of course cut out waste and fraud. But that won’t balance the budget. Take the following pie chart for example. Even if you cut out every single non-defense discretionary item, the budget still would not have been balanced last year.

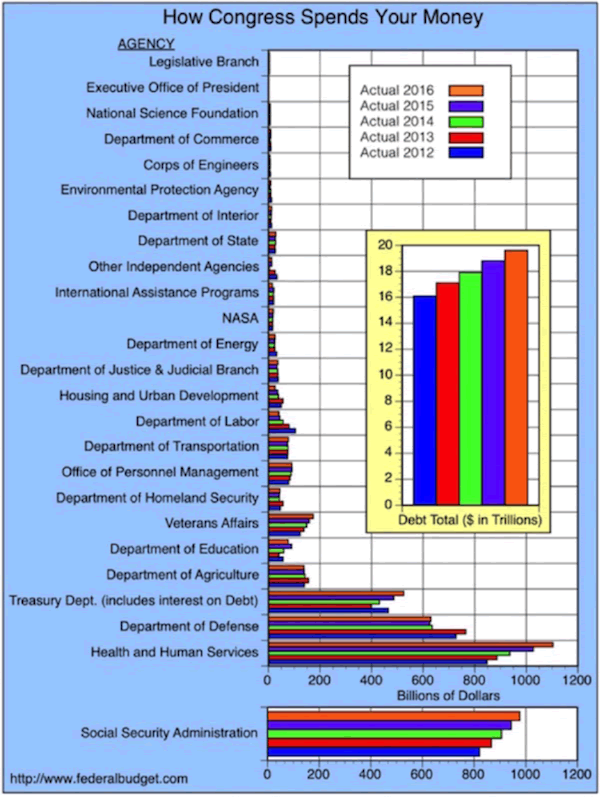

For some detail, take a look at this bar graph. It shows the growth of spending in the various branches and departments of government. Which areas are you going to cut to make any meaningful difference?

For the purposes of my argument, I am going to assume that the Republican Congress and administration somehow wrestle with the Affordable Care Act and bring actual individual healthcare costs down.

But the reality of the “Baby Boomer Bulge” is that no matter what we do, overall costs are still going to rise again within a few years. Rationing health care is not a viable political option. As baby boomers retire in droves, not only will they need more health care, they will also need more Social Security.

There are things we can do to get the whole healthcare process under control and to improve the general health of the country. But that’s not going to have a significant effect in the next two or three years.

So, what choice do we have?

So bluntly, if you cut income and corporate taxes (which is something I think we should do) without any offsetting revenue increases, you’re going to make the deficit and debt problems worse.

The national debt could rise by 50%. Cutting taxes makes people happy. And simply adding to the debt merely puts off the hard choices. And it makes them a lot harder still when we hit the wall.

The simple reality is that this is where we find ourselves today. We are left with distasteful choices. When you’re left with nothing but difficult choices and bad choices, and you avoid the difficult ones, then you end up with only bad choices (cf. Greece).

FREE Report: How the Fed Is Leading Us to Monetary Hell

Contrary to common belief, it’s not greedy Wall Street brokers that are wrecking the US economy—but academic policymakers like the ones employed by the Federal Reserve. And they all have the best intentions… Read financial-bestseller author John Mauldin’s riveting special report, How the High Priests of Economics Are Leading Us to Monetary Hell. Click here to get your free copy now. John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.