Stock Market Something Wicked This Way Comes, Crash?

Stock-Markets / Stock Market Crash Dec 23, 2016 - 12:10 AM GMTBy: James_Quinn

I stopped trying to predict markets back in 2008 when the Federal Reserve, Treasury Department, Wall Street bankers, and their propaganda peddling media mouthpieces colluded to rig the markets to benefit the elite establishment players while screwing average Americans. I haven’t owned any stocks to speak of since 2006. I missed the the final blow-off, the 50% crash, and the subsequent engineered new bubble. But that doesn’t stop me from assessing our true economic situation, market valuations, and historical comparisons in order to prove the irrationality and idiocy of the current narrative.

I stopped trying to predict markets back in 2008 when the Federal Reserve, Treasury Department, Wall Street bankers, and their propaganda peddling media mouthpieces colluded to rig the markets to benefit the elite establishment players while screwing average Americans. I haven’t owned any stocks to speak of since 2006. I missed the the final blow-off, the 50% crash, and the subsequent engineered new bubble. But that doesn’t stop me from assessing our true economic situation, market valuations, and historical comparisons in order to prove the irrationality and idiocy of the current narrative.

The proof of this market being rigged and not based upon valuations, corporate earnings, discounted cash flows, or anything related to free market capitalism, was the reaction to Trump’s upset victory. The narrative was status quo Hillary was good for markets and Trump’s anti-establishment rhetoric would unnerve the markets. When the Dow futures plummeted by 800 points on election night, left wingers like Krugman cackled and predicted imminent collapse. The collapse lasted about 30 minutes, as the Dow recovered all 800 points and has subsequently advanced another 1,500 points since election day. Krugman’s predictive abilities proven stellar once again.

It’s almost as if the Deep State oligarchs and their Wall Street co-conspirators are declaring to the world they are still running this show. Despite deteriorating economic conditions, skyrocketing debt, stagnant wages, and bubbles in the stock, bond, and real estate markets, the narrative being spun is a glorious future of tax cuts, less regulations, jobs coming back to America, and GDP growth so high, it will easily pay for all the tax cuts and spending increases. You would think those high frequency trading machines, programmed by Ivy League MBA geniuses, would be smart enough to determine when markets are extremely overvalued as fundamentals are deteriorating.

Something is not making sense. During the debates Trump declared on more than one occasion the stock market was in a bubble. It is now 2,000 points higher and he is proclaiming its advancement as an endorsement of his plan to drastically cut taxes, spend trillions, and Make America Great Again. The financial media, which despised Trump six weeks ago, is now peddling an economic recovery, soaring future corporate profits, and a stock market poised to blast through 20,000 to higher and higher all-time highs. I think that would be swell, but let’s examine a few facts before putting our life savings in Twitter and Fakebook stock.

As proof that Wall Street despises Main Street, when oil prices rise this is seen as a huge positive by the criminal bankers, as they see oil as an investment to be manipulated for profits. Falling oil and gas prices benefit everyday Americans trying to balance their monthly budgets. The drop in gas prices from $3.70 per gallon in mid 2014 to $1.70 per gallon in early 2016 helped average Americans save enough to partially offset soaring Obamacare costs, rising rents and stagnant wages. But Wall Street and their corporate media talking heads have cheered the 33% increase in gasoline and the 85% increase in oil since February. Just as with TARP, what is good for Wall Street is not good for Main Street.

The Fed narrative of no inflation, supported by the sliced, diced, manipulated, massaged, hedonically and seasonally adjusted drivel produced by the government drones at the BLS, has benefited from the almost two year decline in gas and oil prices. That is now reversing itself, as gasoline prices have risen at an annualized rate of 20% over the last three months. It is poised to rise by 30% to 40% year over year in the next few months. Even the Deep State government bureaucrats are having trouble disguising raging inflation in expenses affecting average Americans on a daily basis.

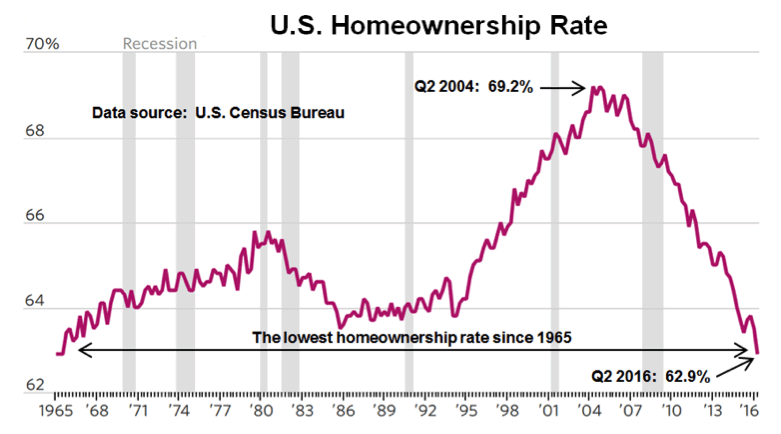

Yellen and her fellow Ivy League academic puppets continue to flog the 2% inflation mantra, as if these theorists have any clue what the “ideal” rate of inflation should be. Even the manipulated core CPI has been running above 2% for all of 2016. Have you heard any captured media pundit report that CPI has been running at an annualized rate of 3.6% over the last three months? The Fed engineered housing bubble 2.0 has even driven the man made owners equivalent rent calculation up to a 3.5% annual rate. The Fed’s latest bubble blowing adventure has also driven the home ownership rate to a 50 year low. So much for Bush’s ownership society dream.

Rental society seems more likely, especially for student debt burdened millennials working their Obama jobs at Shake Shack. The Fed induced housing bubble, designed to sure up insolvent Wall Street bank balance sheets, has priced out millions of Americans and driven rents sky high, especially in metropolitan areas like NYC, SF, DC, and Chicago. The BLS’ manipulated data shows an annual increase of 3.9%, while in desirable areas, rents are rising by double digits.

The truly hysterical drivel spewed by the BLS drones is that medical care costs are only rising at a 4% annual rate and only account for 8.4% of a family’s annual costs. The gyrations and hedonistic seasonal adjustments they must make to somehow configure 20% to 50% increases in premiums, doubling of co-pays, and $6,000 deductibles into a 4% annual increase must be a wonder to behold as they plug their fake variables into their excel spreadsheets. Anyone living in the real world, outside of the Imperial Capital, knows their annual living expenses are rising by at least 5% to 10%.

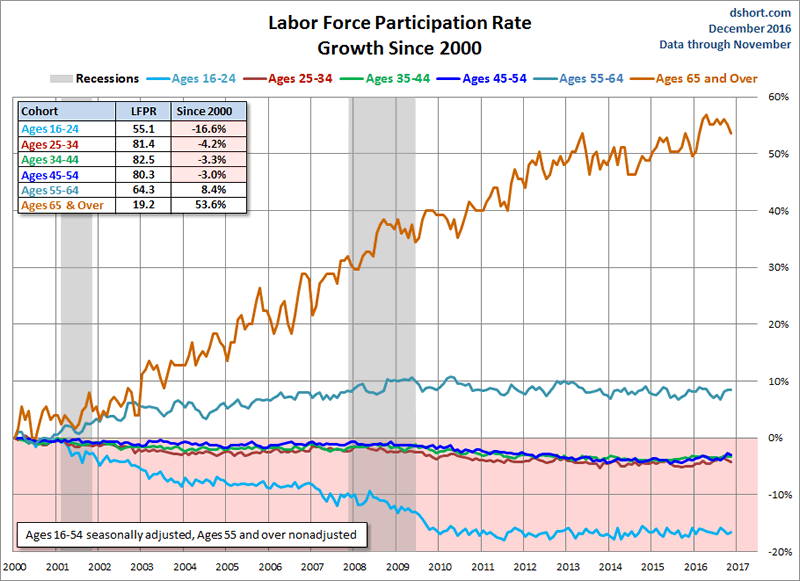

As Obama takes his victory tour, taking credit for the stupendous jobs recovery, the deplorables in middle America know their real wages have barely budged during the entire Obama recovery. If the unemployment rate was really 4.6%, would real wages be growing at less than 1%? NO. They would be growing at 3% and the Fed Funds rate would be at 3%, not .50%. With the labor participation rate at a thirty year low of 62.7%, a record number of Boomers having to work to survive, and 124 million full time employees supporting 102 million non-working Americans, you might have the real reason Trump won the election.

The false narrative propagated by the captured mainstream media propagandists has been the labor force participation rate falling is strictly due to Boomers retiring. Despite data proving the median Boomer household has less than $20,000 saved for retirement, the talking heads and brainless bimbos on CNBC and other corporate media outlets continue to purposely mislead the public with misinformation about Boomers retiring to live lives of luxury and endless vacations.

Meanwhile, the only demographic showing dramatic increases in labor participation are the old fogies who forgot to save. How do the pundit propagandists explain the decline in participation by 25 to 54 year olds in their prime working years? Are they busy finding themselves? Did they hit the lottery?

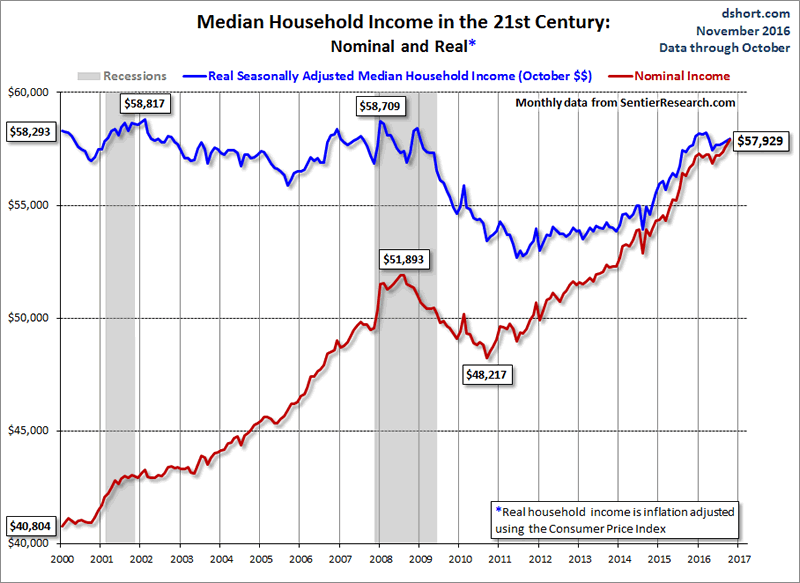

No matter how long Obama’s nose grows trying to convince the ignorant masses he has presided over the best economy in decades, inconvenient facts keep getting in the way. When real median household income is lower than it was in 2000, and not materially higher than it was in 1989, you might have economic stagnation. When you take into consideration the systematic under-reporting of inflation over this time frame, the real numbers are far worse than those portrayed in the chart.

Obama hoots about all the jobs added during his reign of error, but fails to mention that 94% of all jobs added since 2004 were either temporary or independent contractor jobs. Low wage, part-time, no benefits, Obama jobs don’t pay the bills. That’s why a record number of Americans have to work multiple jobs to survive.

The narrative about an improving economy, thriving jobs market, and glorious future is bullshit. I know it. You know it. And your establishment puppeteers know it. But only “fake news” sites would dare reveal these inconvenient truths. The willfully ignorant public doesn’t want to know the truth, because that would require critical thinking and making tough choices.

If the unemployment rate is really 4.6% and GDP is really growing, why are retail sales in the dumper, even with auto makers giving their cars away at 0% interest for six years if you can sign an X on a loan document? At the same time, the establishment reports soaring consumer confidence, while consumers don’t act confident at all. Do you believe these propaganda surveys or your own eyes.

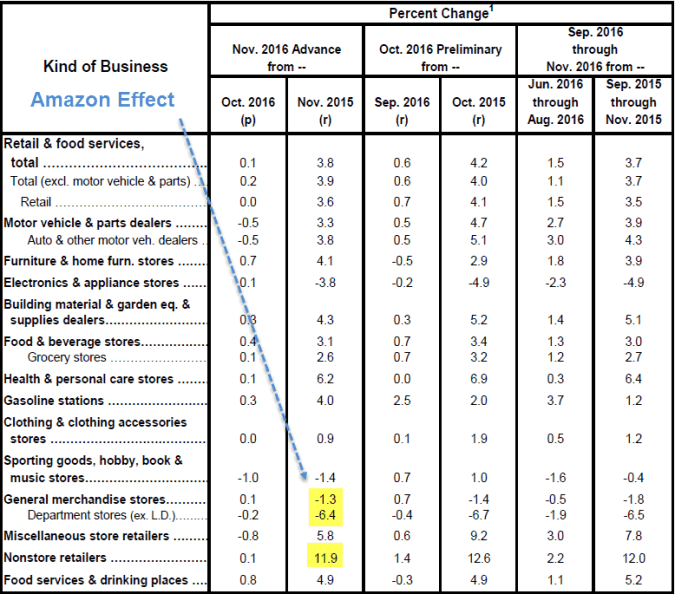

This Christmas (we’re allowed to use that word again now that Trump is on his way) shopping season is going to be atrocious. Retail sales over the last three months have grown at a pitiful 1.5%. If you adjust that for a true inflation rate of 5% or so, real retail sales are in decline. The bricks and mortar retailers are dying, as Amazon and other on-line outlets eat their lunch. The store closing announcements in February should be robust. More ghost malls coming to a neighborhood near you.

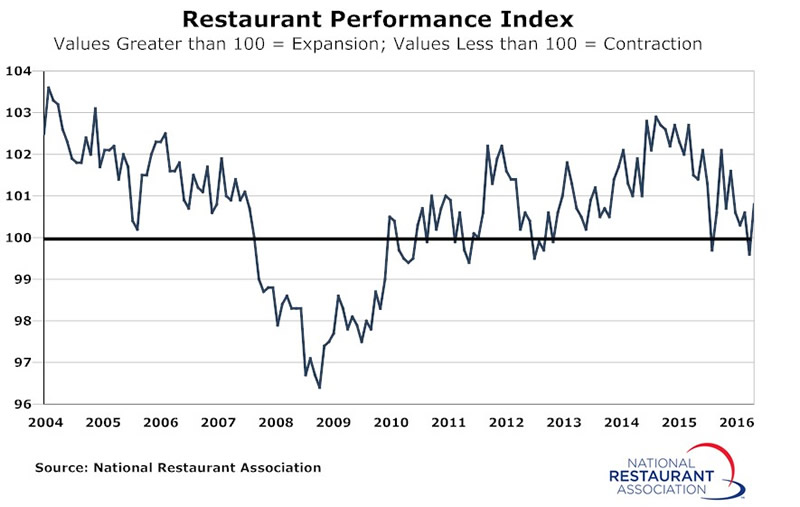

One of the strongest areas of spending during the Obama recovery has been restaurants and bars, as the obese masses have gorged themselves while drowning their low wage sorrows in craft beers. But now, average Americans are so tapped out they can’t even afford the unlimited breadsticks at Olive Garden or the all you can eat crab legs at Red Lobster anymore.

Restaurant sales have been in a downward trend for two years and have recently gone negative year over year. Where are all the new Obama jobs for heavily indebted college graduates going to come from if there are less retail clerks, waitresses and bartenders needed in this booming economy?

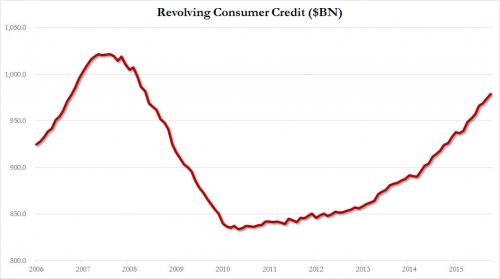

A critical thinking individual may be wondering how retail spending could even be positive if real household income is still below 2008 levels. You can thank the Fed, your $800 billion TARP contribution to Wall Street bankers, and millions of delusional borrowers lured back into spending money they don’t have for things they don’t need.

Credit card debt is now approaching $1 trillion again for the first time since 2008. At least the Wall Street banks have repaid the favor of TARP and 0% borrowing rates from the Fed, by only charging 14% on credit card balances and racking up billions in late fees if the bill is paid one day late. They are true patriots.

The real reason for the 25% increase in credit card debt since 2010 is because a huge number of households are surviving on their credit cards. You now can pay your electric, gas, water, sewer, phone, real estate taxes, and Federal taxes with a credit card. Of course, there is a 3% to 5% “processing fee” for your friendly Wall Street banker. Again, what a great bunch of guys. This desperate way of life can go on for quite some time, but will end abruptly when the next financial crisis hits. Wall Street bankers will cut credit lines and millions will go bankrupt and lose their homes again.

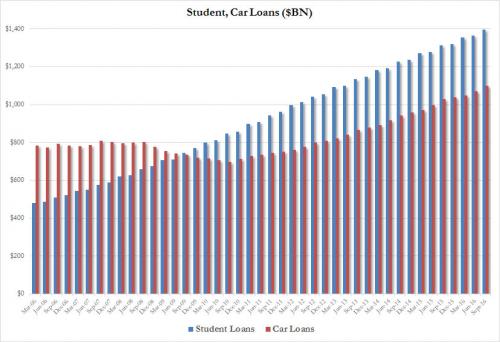

This faux economic recovery has been financed by subprime student and auto loans. Both loan bubbles are the result of the Obama administration’s disregard for credit risk or desire for having the loans repaid. The $1.4 trillion of student loan debt on the shoulders of taxpayers is a disaster in process. Over 25% of this debt is effectively in default. The taxpayer bailout will exceed $500 billion.

While the government still controlled Ally Financial (aka GMAC, aka Ditech) they started doling out subprime auto loans like candy, forcing the other lenders to follow suit. Now, every Tom, Dick and Laquisha in America is driving a new vehicle and auto loan delinquencies are skyrocketing. The record number of leases are now coming due. The six and seven year auto loans are leaving millions underwater on their loans when they try to trade in for a new car. This is all coming to a head, just as it did in 2008.

So, any unbiased assessment of our economic situation clearly paints a pretty bleak picture. Unwarranted confidence and false narratives spun by media pundits does not put bread on the table or pay your health insurance premiums. This brings us to the irrationality of financial markets and the implications when reality pops the delusional bubbles keeping hope alive.

The Fed finally raised rates by .25% last week, about three years too late. The bond market is now leading Yellen. She’s a follower at this point. The bond market knows real inflation is here and Trump’s articulated plans would lead to more inflation. That’s why the 10 year Treasury has risen from 1.3% in July to almost 2.6% today. For the math challenged, that’s a double in six months.

The implications of this increase are yuuge. The 1% surge in mortgage rates has effectively ended the refinancing business and will put a stake in the heart of an already faltering housing market. There is nothing like all-time high prices combined with rapidly rising interest rates to pop housing bubble 2.0.

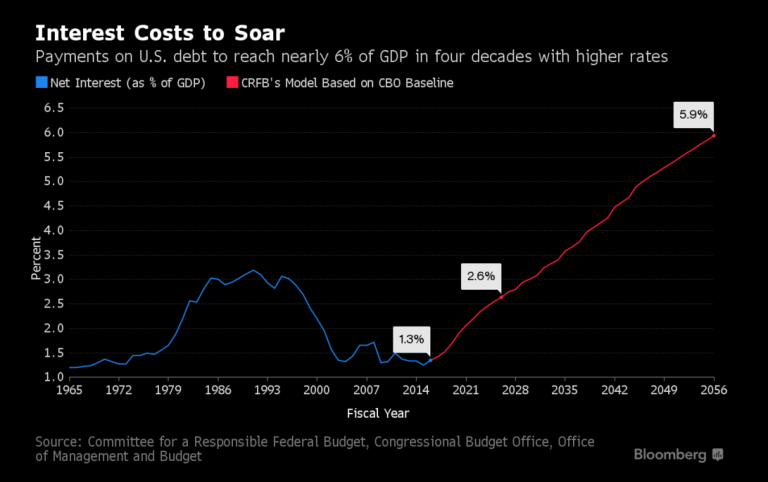

Obama and the Federal government have lucked out while doubling the national debt in the last eight years. By financing the debt with short term bonds, the interest on the national debt of $432 billion is virtually the same as it was in 2007 before the debt orgy really got underway. A 1% rise in rates across the curve will result in a 50% increase in interest expense and $230 billion instantly added to the annual deficit. If interest rates rose back to 2008 levels, the annual interest would double to $900 billion. And this is before taking into account Trump’s tax cuts and spending increases. There is no way out when your debt is $20 trillion and you add $4 billion per day.

Trump’s plan to Make America Great Again is to bring manufacturing jobs back to America. The USD is now the strongest it’s been since 2002. Why would a manufacturer utilizing low wages in the Far East and benefiting from the strong dollar by selling their products into the US, decide to pay US level wage rates and have to compete in world markets with the anchor of a record high USD around their necks?

In case the brilliant stock analysts on Wall Street hadn’t noticed, the international conglomerates, which make up most of the S&P 500, will have to translate their international profits back into the US with the dollar at fourteen year highs. Corporate earnings, which have been artificially boosted by record low interest rates, a weak dollar and stock buybacks, will continue their downward trend as rates rise, the dollar soars and buybacks dissipate. A perfect formula for record highs. Right?

This brings us back to the stock market. There isn’t a doubt in my mind the Wall Street shysters and their HFT supercomputers will achieve their goal of Dow 20,000 in the next few days. It’s a given. This is all part of the marketing plan. CNBC will have party balloons and streamers. Jim Cramer and Steve Liesman will breathlessly expound upon our glorious future and make up a believable rationale for the Trump rally – lower corporate and individual tax rates, along with ramped up government spending is just the ticket.

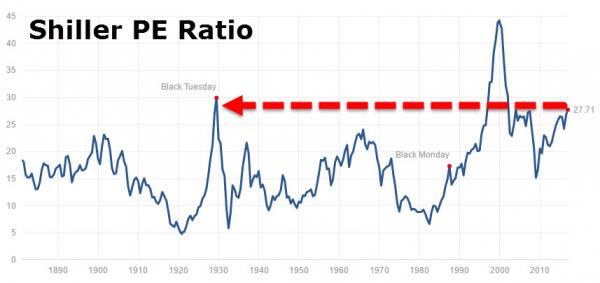

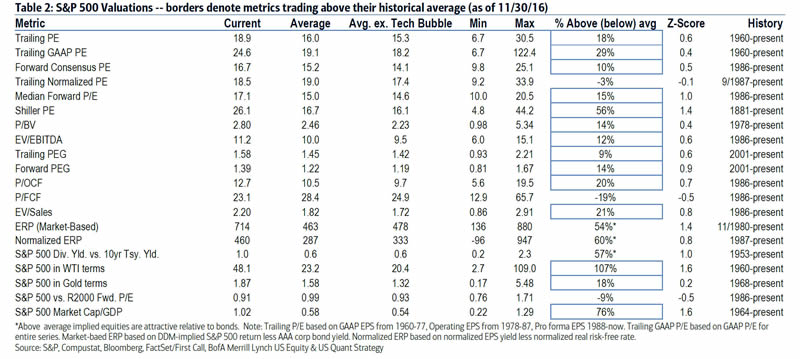

What they will not tell you about is the extreme overvaluation of stocks based upon just about every historical measure used for the last century. The well regarded, non-adjusted, historically accurate predictor of market crashes, Shiller PE Ratio has only been this high in 1929, 2000, and 2007. We all know what happened next. With earnings headed lower and stock prices at all-time highs, this will surely end well. Unless, of course, it’s different this time. Maybe we have a new Trump paradigm.

The pundits who dismiss the Shiller PE ratio as antiquated will also dismiss the other dozen or so metrics showing the stock market extremely overvalued. Wall Street, their media mouthpieces, and establishment hacks have a job to do – and that is to lure millions of useful idiots into the market just before they pull the rug out. Two brutal lessons in the last sixteen years wasn’t enough. Lemming investors need to be hit up the side of their heads with a baseball bat for the third time. Maybe they’ll learn this time. But, I doubt it.

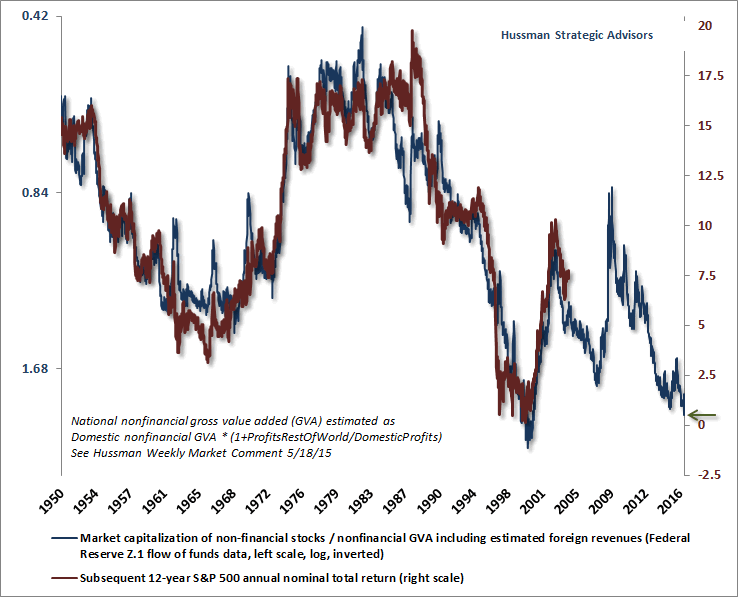

No matter how you cut it, stocks are currently valued to deliver nominal returns of 0% (negative real returns) over the next twelve years, with the high likelihood of a 30% to 50% crash in the foreseeable future. That isn’t an opinion. It is based upon historically accurate valuation methods that have been used for decades. In the short term anything is possible. Maybe even valuations on par with the dot-com bubble are possible. Of course, the NASDAQ fell 80% shortly thereafter, so we’ve got that going for us.

As I’ve said previously, I have no dog in this hunt. I don’t trust these rigged markets or the Wall Street shysters rigging them. Once the magical 20,000 is achieved and Trump takes office in January, all bets are off. The establishment is pretending to play nice with Trump, but there is nothing like a 20% crash over a two week period to show him who’s really the boss. I’m not predicting anything, but it sure looks like something wicked this way comes.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2016 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.