Modern Delusions, Japan Thinks It Can Balance Its Budget

Economics / Japan Economy Jan 28, 2017 - 06:58 PM GMTBy: John_Rubino

A recurring problem for most developed-world governments is explaining why last year’s plan didn’t work while convincing voters that this year’s new and improved plan will do the trick. This is especially tough when the new plan is pretty much the same as the old one and therefore just as likely to fail.

A recurring problem for most developed-world governments is explaining why last year’s plan didn’t work while convincing voters that this year’s new and improved plan will do the trick. This is especially tough when the new plan is pretty much the same as the old one and therefore just as likely to fail.

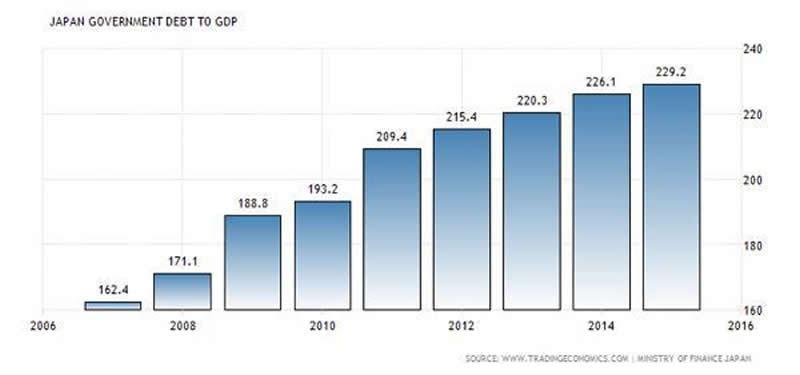

Let’s take Japan as our first object lesson. Its government is the world’s most deeply indebted relative to GDP. Its population is the world’s oldest, with the number of retirees on public assistance soaring. Yet for some reason its leaders keep promising to balance the budget, only to be forced to push the date further into the future with each new report.

Japan’s budget surplus goal elusive with worsening fiscal health

(Mainichi) — Japan foresees a bigger-than-expected primary deficit of 8.3 trillion yen ($73 billion) in fiscal 2020, highlighting the daunting challenge of achieving a surplus that year, the latest estimates by the Cabinet Office showed Wednesday.The figure is a sharp revision from its previous forecast of a 5.5 trillion yen deficit in July. The government expects tax revenues to be smaller than initially projected in the face of slowing income growth and sluggish consumer spending.

In Wednesday’ meeting, Abe called for the swift enactment of a record-high budget plan worth 97.45 trillion yen for fiscal 2017 starting in April due to ballooning social security costs.

Abe has touted growth in tax revenue in recent years as one of the achievements of his “Abenomics” policy mix. But the yen’s advance in the run-up to the election in November of U.S. President Donald Trump has cast a shadow on Japanese companies’ earnings and the outlook for tax revenue.

Japan’s fiscal health is the worst among major developed countries. Its graying society is expected to boost social security costs further, raising the bar for drastically reducing total spending.

The latest projections were based on the scenario that the Japanese economy will grow 3 percent or higher in nominal terms and 2 percent or higher in real terms. In the July to September quarter last year, the world’s third-largest economy expanded an annualized real 1.3 percent.

This dance has been repeating for as long as most Japan watchers can remember, and the choreography never changes. Back in the 1990s the country responded to bursting financial bubbles with massive increases in public borrowing and spending, propping up the banks and builders but taking on inordinate amounts of debt to do so. Each subsequent budget has offered more of the same, with ever-higher debt and ever-lower interest rates.

Meanwhile the Japanese people, like most rich societies where women have a choice in the matter, have lost their taste for reproduction. More workers are retiring than are being replaced, which increases the cost of public pensions relative to the tax base and accelerates the slide towards insolvency.

Nothing mysterious here – and nothing unique. The entire developed world is in the same general fix. But admitting impotence in the face of overwhelmingly bad numbers isn’t a political option. So leaders consult their economists, who pull out the same old Keynesian models recommending the same old solutions: Borrow and spend more money while lowering interest rates and the economy will grow out of its limitations.

Japan’s mistakes began earlier than those of Europe or the US, so they’re more obvious. But the trends are the same everywhere and the policy responses, as a result, are eerily similar. Europe’s demographics and growth are almost as dismal as Japan’s, so the European Central Bank buys up all the government debt in the system and pushes interest rates below zero. When that doesn’t produce the promised boom it starts buying corporate bonds. When this experiment fails Europe will — based on the think tank chatter — ban cash, start buying equities and force rates even lower.

The US, meanwhile, elects a president who promises a massive infrastructure build-out financed with new borrowing – in other words, what Japan has been doing for the past couple of decades, straight from the Keynesian playbook. And few in the mainstream point out the similarities because, well, at least we’re doing something and that’s better than nothing, right?

Actually, no. Nothing is better than something, if the something is what created the problem.

The Austrian school of economics alone seems to get all this. But it’s easy to understand why politicians shy away from the idea that once societal leverage reaches a certain point there really is nothing to be done but let it burn. As von Mises famously put it:

There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.

And as another Austrian School writer notes,

Ultimately, it is not deficits per se but total government spending that distorts the economy and starves the private sector of resources. But deficits are insidious because they give the illusion of freebies in the near term, and the reckoning comes with a vengeance down the road.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.