Stock Market Highs Make Strong Case for Precious Metal Buys

Stock-Markets / Stock Market 2017 Feb 01, 2017 - 12:47 PM GMTBy: MoneyMetals

Dow 20,000 was ushered in with great fanfare. Traders on the New York Stock Exchange sported "Dow 20,000" hats. Even President Donald Trump joined the celebration.

Dow 20,000 was ushered in with great fanfare. Traders on the New York Stock Exchange sported "Dow 20,000" hats. Even President Donald Trump joined the celebration.

Trump told ABC News he was "very honored" that the stock market gave his presidency a symbolic vote of confidence. "Now we have to go up, up, up. We don't want it to stay there," he said.

Everyone loves a bull market. Expecting stocks to go up forever, however, is a dangerous mindset to have as an investor. Recent history suggests that major milestones for the Dow should be viewed less as cause for celebration and more as warning signs.

What 1999 Can Teach Us About 2017

A case in point: Dow 10,000. On March 29, 1999, the Dow Jones Industrials closed above 10,000 for the first time ever.

The financial media, of course, cheered the milestone, feeding the public Wall Street propaganda rather than healthy skepticism.

Sure, the perma-bulls will always concede, there might be a pullback at some point. But books like Dow 36,000, released in 1999, bolstered the conventional wisdom that stocks were destined march higher over the next decade.

In fact, stocks went nowhere for 11 long years. The Dow suffered two crashes - one in 2002 and a bigger one in 2008.

In mid 2010, the blue chip average was right back where it was on March 29, 1999. The Dow crossed back above 10,000, as it had dozens of times before, to little fanfare.

It turned out to be the 10,000 cross that mattered. Finally, more than 11 years after the Dow first hit 10,000, stocks were in a new bull market. The Dow was on its way to 20,000.

Anyone thinking of buying stocks at today's lofty valuations would be well advised to take heed of what happened to investors who bought at Dow 10,000 in 1999 and held on through today.

Yes, they did double their money (before dividends) in nominal terms.

But in real terms, the Dow hasn't made any progress.

Investors would have been better off selling stocks when the Dow hit 10,000 and using the proceeds to purchase gold bullion.

Back in March 1999, silver sold for $5.20/oz and gold prices traded at a mere $285/oz. Gold values got as high as $1,900/oz in mid 2011 and today come in at $1,200/oz - still more than four times their 1999 levels.

That puts the Dow's nominal rise from 10,000 to 20,000 in perspective. The index has merely flat-lined, at best, in real terms since 1999. Going forward, it may not even manage to do that.

Trump Knows He Inherited a Bubble

The price/earnings ratio on the Dow is now arguably in bubble territory. Valuations have been artificially inflated in no small part by the Federal Reserve. Last September, candidate Donald Trump called the Fed-fueled market "a big, fat, ugly bubble."

President Donald Trump no longer sees it that way. Dow 36,000 here we come!

It will come eventually - even if only because of currency debasement. That doesn't necessarily mean the next 5,000 point move in the Dow will be to the upside.

History suggests that investors will have better odds of making real gains in stocks by waiting to buy at lower valuations. A bear market in equities could commence at any time, and a final bottom could be years away. In the meantime, stocking up on alternative assets including precious metals will give you other opportunities to make real gains regardless of where the Dow heads over the next few years.

Will Trumpflation Be to Metals What Stagflation Was in the 1970s?

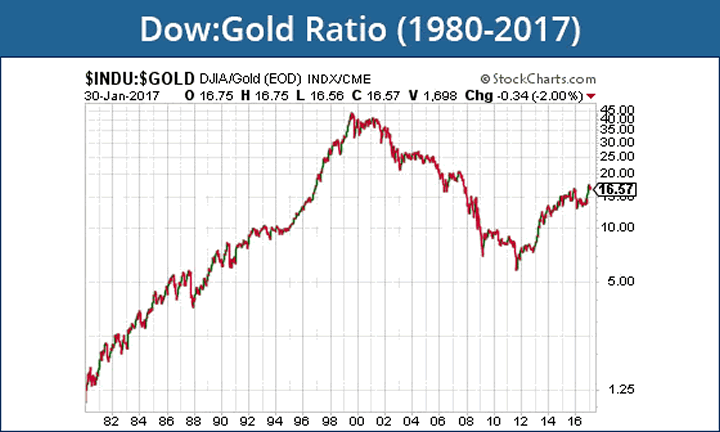

Gold and silver markets have posted some of their biggest up moves when the stock market has been down or flat. The stagflationary late 1970s weren't kind to stocks, but they gave rise to a spectacular bull market in precious metals. It culminated in January 1980 with the price of an ounce of gold briefly equaling the quote on the Dow Jones Industrials.

From 1980 - 2000, Dow to gold ratio moved from as low as 1:1 to as high as 43:1. From 2000 - 2011, it fell to as low 6:1. The Dow to gold ratio now stands at around 17:1. Should it ultimately revisit the 1:1 ratio, we'd be looking at a massive stock market crash, an explosive move higher in precious metals prices, or some combination of both.

Could gold prices one day meet the Dow at 20,000 or some other number? A return to the 1:1 ratio is an extreme scenario, to be sure. But it's not far-fetched at all to suppose that history might repeat itself.

Even if Dow to gold only got back to a 4:1 ratio, moving out of stocks and into precious metals at current levels would be the trade of a lifetime. It would imply a potential $5,000 gold price to a 20,000 Dow - a 317% return on gold versus a 0% return on stocks in this hypothetical scenario.

In any major bull market for precious metals, the more volatile metal - silver - can be expected to post the bigger returns. Silver, being both a precious metal and an industrial metal, may also be well suited to benefit from Donald Trump's pro-industrial policies. Silver is essential in many areas of manufacturing, especially electronic and high-tech products.

Silver is also one of the world's most enduring forms of money. Along with gold, silver stands as a "hard" alternative to depreciating fiat currencies and bubbly financial assets.

Stefan Gleason is President of Money Metals Exchange, the national precious metals company named 2015 "Dealer of the Year" in the United States by an independent global ratings group. A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC, and his writings have appeared in hundreds of publications such as the Wall Street Journal, Detroit News, Washington Times, and National Review.

© 2016 Stefan Gleason - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.