Carnage of the Middle Class

Politics / Social Issues Feb 06, 2017 - 03:08 PM GMTBy: Michael_Pento

In President Donald J. Trump's inaugural address he promised, "This American carnage stops right here and stops right now." And immediately liberals and the MSM took umbrage to his use of the word carnage, which means the slaughter of a large number of people, claiming it was just too dark a description for America. Maybe so. However, in a recent Bloomberg commentary, Justin Fox cites some sobering statistics that support Trump's statement.

In President Donald J. Trump's inaugural address he promised, "This American carnage stops right here and stops right now." And immediately liberals and the MSM took umbrage to his use of the word carnage, which means the slaughter of a large number of people, claiming it was just too dark a description for America. Maybe so. However, in a recent Bloomberg commentary, Justin Fox cites some sobering statistics that support Trump's statement.

While the overall murder rate for the nation should end up increasing about 8% year-over-year, the surge within U.S. cities is absolutely staggering. Chicago suffered a 59% increase in homicides during 2016. Murders were up 56% in Memphis, 61% in San Antonio, 44% in Louisville, 36% in Phoenix and 31% in Las Vegas.

There were also 44,193 suicides in the U.S. in 2015, with the percent increase in suicides rising the most for females aged 10–14, and for males aged 45–64. The suicide rate has risen 24% over the past 15 years and is the highest recorded rate in 28 years.

But it isn't just violent crime that has exploded recently in the U.S.: an incredible 52,404 Americans died from drug overdoses in 2015. More than double the amount experienced in 2002.

These morbid truths reveal the crux of this election. While Washington and the media elites were busy gloating about a falling unemployment rate, the overlooked carnage lay in plain sight. But it wasn't just the disturbing rise of unnatural deaths. If liberal elites ever bothered to land in flyover country they would have easily found another type of carnage…the evisceration of the middle-class.

There are two reasons for this decline. The first is a result of the Federal Reserve's money printing that forced $3.8 trillion into the canyons of Wall Street, leaving just crumbs for the people on Main Street to feed upon. The Federal Reserve's money flowed mostly into stocks, bonds and real estate, creating asset bubbles and inflation for the rich to enjoy. While the middle class--who don't own nearly as many assets and spend much more of their disposable income on energy, food and shelter—became even poorer.

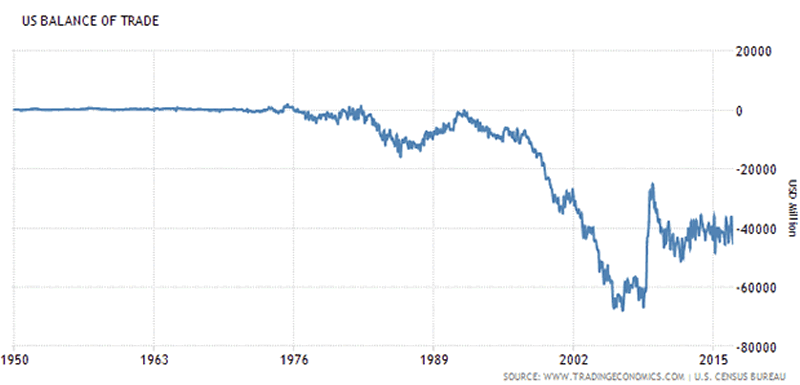

The second is America's huge and persistent current account and trade deficits. The current account deficit was $500 billion, and the trade deficit was $762 billion for 2015. The sad truth is that we haven't had a trade surplus since Nixon closed the gold window back in 1971.

Unlike what most pundits like to argue, the money that is lost through our current account deficit and returns to us as a capital account surplus, is not merely an innocuous transaction. The so called capital account surplus is really just the transfer to foreign ownership of U.S. equities, real estate and bonds; driving them into unsustainable bubbles and making the rich even richer.

But that's not the worst of it. That deficit is the result of high-paying manufacturing jobs leaving this country and turning the middle-class factory worker into a minimum wage Wall Mart greeter.

In 1970, more than a quarter of U.S. employees worked in the manufacturing sector. By 2010, only one in 10 did. Therein lies the nucleus of the trade deficit and the demise of the middle class.

But the middle class rout is not solely a result of companies moving plants overseas--often a company doesn't have to move locations to get cheap labor. In October of 2015, Disney, the self-proclaimed happiest place on earth, didn't make 250 of their U.S. employees very happy when they replaced them with immigrants on temporary visas. This transaction was facilitated by an outsourcing firm based in India.

And Disney is not the alone; similar "outsourcings" have happened across the country. Businesses have been misusing temporary worker permits, known as H-1B visas, to place immigrants willing to work for less money in technology jobs based in the United States.

These visas are intended for foreigners with advanced science or computer skills to fill specific positions only when a similar skilled American worker cannot be found. But legal loopholes have allowed companies to circumvent the requirement to recruit American workers first and that guarantee capable American workers will not be displaced.

American blue and white collar workers have good reason to fear that globalization will result in the slow extinction of the middle class; setting the United States on a dystopic course where a small group of wealthy elite reign over a large class of workers without benefits, pensions, job security or a living wage.

This is the unrecognized pain that sat below the frequently-touted government data points on employment and GDP. And it is the carnage of the middle class that has abetted the dissolution of the American family, which in turn as led to the surge in homicides, suicides and drug overdoses in the United States.

Washington and media elites have failed to listen to the forgotten man for decades. Normalizing interest rates and enforcing fair trade agreements are absolutely mandatory for a middle class renaissance to take place. Even though the transition will be incredibly painful, it appears there is finally someone in the White House who will begin to address these issues. The hope and prayer is that he will have the courage to see it through.

Michael Pento produces the weekly podcast “The Mid-week Reality Check”, is the President and Founder of Pento Portfolio Strategies and Author of the book “The Coming Bond Market Collapse.”

Respectfully,

Michael Pento

President

Pento Portfolio Strategies

www.pentoport.com

mpento@pentoport.com

(O) 732-203-1333

(M) 732- 213-1295

Michael Pento is the President and Founder of Pento Portfolio Strategies (PPS). PPS is a Registered Investment Advisory Firm that provides money management services and research for individual and institutional clients.

Michael is a well-established specialist in markets and economics and a regular guest on CNBC, CNN, Bloomberg, FOX Business News and other international media outlets. His market analysis can also be read in most major financial publications, including the Wall Street Journal. He also acts as a Financial Columnist for Forbes, Contributor to thestreet.com and is a blogger at the Huffington Post.Prior to starting PPS, Michael served as a senior economist and vice president of the managed products division of Euro Pacific Capital. There, he also led an external sales division that marketed their managed products to outside broker-dealers and registered investment advisors.

Additionally, Michael has worked at an investment advisory firm where he helped create ETFs and UITs that were sold throughout Wall Street. Earlier in his career he spent two years on the floor of the New York Stock Exchange. He has carried series 7, 63, 65, 55 and Life and Health Insurance www.earthoflight.caLicenses. Michael Pento graduated from Rowan University in 1991.

© 2017 Copyright Michael Pento - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.