What Investors Need To Know About U.S. Money Market Funds?

Stock-Markets / Financial Markets 2017 Feb 24, 2017 - 10:36 AM GMTBy: Chris_Vermeulen

Why Low Risk Does Not Equate To Risk Free!

Why Low Risk Does Not Equate To Risk Free!

Charles Schwab has informed its’ clients that “at least 80% of the fund’s net assets will be invested solely in U.S. government securities…”. Schwab automatically assumes that all clients affected by this change will accept: “if you are in agreement with this change in your cash feature, no response is required from you. They consider a non-response from its’ clients to be notice. “Those who disagree have the “option” of either sweeping their cash into the corporate bank exposing them to greater risk. They add “you also have the right to close your brokerage account(s) without penalty at any time.”

Who will be the most recent owners of the rest of the current and future new debt? The answer is: YOU. U.S. Mutual funds, U.S. pension funds and American investors. Why? Because our insolvent government needs Americans to finance it before the entire house of cards come crashing down! One’s ability to take your savings out of banks and store it in cash is coming to an end. U.S. Institutions are holding up to 99.5% of assets in cash, U.S. government securities, and repurchase agreements that are collateralized solely by the U.S. Government’s good faith.

“Debt-As-Legal-Tender”

This will make it much more difficult for one to be able to access any/all of your personal cash which was always considered to be accessible liquid risk free funds. What will American citizens do when they realize they were conned into “toxic investments” and decide to just pull their cash out of the banks and store it themselves? If you do take possession of your savings in cash, how secure do you feel when the government comes knocking on your door asking about your stockpile of cash? Schwab and others are taking preemptive action now to move your money into U.S. debt.

The top complaints and reviews about Schwab refusing to honor its’ clients’ money:( https://www.consumeraffairs.com/finance/schwab.html). Fidelity is also causing the same problems for its’ clients, as well: (https://www.consumeraffairs.com/finance/fidelity.html).

This is just a new vehicle in which the U.S. Federal Government is taking control of your cash and converting it into “toxic assets” to be spread out amongst us all. Why? The answer is to cover our enslavement of $19.9 trillion debt which is growing with each passing second. The Current outstanding public debt of the United States is: $19,926,581,166,878.36 as of Monday, February 20th, 2017. That equates to everyone, in the United States, currently owing $65,586 which represents their share of the U.S. public debt.

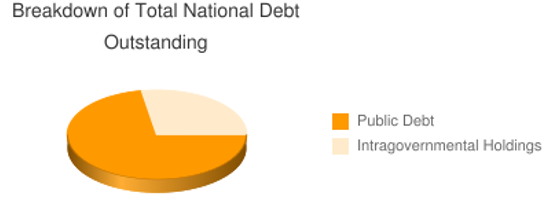

Public Debt: $14,403,392,566,439.40

Intragovernmental Holdings: $5,523,188,600,438.96

Total U.S. National Debt: $19,926,581,166,878.36

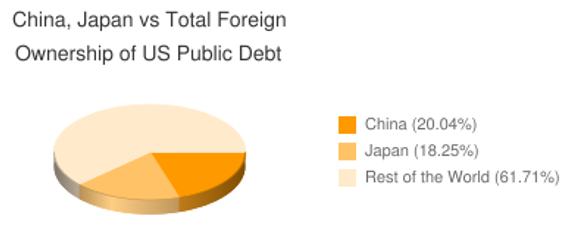

Who owns the public debt?

Foreign governments own the most U.S. debt.

This has been done under the auspices of the S.E.C. (Securities Exchange Commission): (http://www.investopedia.com/terms/s/sec.asp). They implemented the “New Money Fund Reform Rules”:

(https://www.sec.gov/News/PressRelease/Detail/PressRelease/1370542347679). The rules require fund providers to institute liquidity fees and suspension gates as a means of preventing a run on the fund. The requirements include asset level triggers for imposing a liquidity fee of 1% or 2%. If weekly liquid assets fall below 10% of total assets, it triggers a 1% fee. Below 30%, the fee is increased to 2%. Funds may also suspend redemptions for up to 10 business days in a 90-day period. These are the official rule changes; there are several factors investors should know about the reform and how it will affect them during its’ implementation.

The move for money market fund reform grew out of the 2007–2008 ‘financial crisis’. The Reserve Primary Fund recently settled its’ claims:( “ADDITIONAL INFORMATION REGARDING YIELD PLUS FUND-IN LIQUIDATION (Formerly known as Reserve Yield Plus Fund) DATE OF FINAL DISTRIBUTION WEDNESDAY, JUNE 15, 2016” ): (Reserve Primary Fund). The fund had assets totaling $62 billion. The class action suit brought against them resulted in a mere $10 million settlement: http://www.usatoday.com/story/money/markets/2013/09/08/money-fund-broke-buck-deal-managers/2782931/). The 2008 financial crisis precipitated by The Reserve Primary Fund (Reserve Primary Fund) when it was forced to reduce its’ net asset value (NAV) of its’ money market fund below $1, due to huge losses, which were generated by failed short-term loans issued by Lehman Brothers. It was the first time a major money market fund had to break the $1 NAV which caused panic among institutional investors, who consequently began mass redemptions. The fund lost two-thirds of its’ assets within 24 hours and eventually had to suspend operations and commence liquidation. This event prompted significant redemptions by institutional money market fund investors, putting the funds under severe financial stress. The Reserve Primary Fund, which invested in Lehman Brothers debt, “broke the buck”: (http://www.investopedia.com/articles/mutualfund/08/money-market-break-buck.asp).

The S.E.C. Chairwoman. Mary Jo White, said “Today’s reforms fundamentally change the way that money market funds operate. They will reduce the risk of runs in money market funds and provide important new tools that will help further protect investors and the financial system. Together, this strong reform package will make our markets more resilient and enhance transparency and fairness of these products for America’s investors.” This is what the SEC wants Americans to believe and buy into it!

The official final amendments to money market rules, which were made in 2014, for protecting shareholders from the impacts that a flood of redemptions could have on money market funds is how the S.E.C. is rationalizing this dilemma. The amendments are also intended to give fund managers enough time to respond to requests in a more thoughtful, prudent manner and in a much slower period.

- Fidelity is converting its’ largest prime fund into a U.S. government fund. Federated is taking steps to shorten the maturities of its’ prime funds to make it easier to maintain a $1 NAV. Vanguard is assuring its’ investors that its’ prime funds have more than enough liquidity to avoid triggering a liquidity fee or redemption suspension.

The Bank of America Corp. sold its’ money market business to BlackRock, Inc. to avoid these types of future problems.

- Restricts who can invest in retail money market funds.

- Continues to seek a stable $1 net asset value (NAV) for retail and government funds, but requires institutional funds to have floating NAVs like other mutual funds.

- Allows certain funds to impose liquidity fees and temporarily suspend withdrawals (known as gates) in certain circumstances.

Gold Is Money!

Global negative interest rates have shifted the worlds’ appetite to buying gold and silver, once again. Gold and silver can sit outside the system and remain completely private. It cannot be tracked by the government or banks. Gold and silver have been the world’s greatest wealth protectors for over 5,000 years. It has shielded its’ citizens from government and banking collapses during the worst crises in history. Physical gold and silver cannot be instantly seized with the stroke of a keyboard. This is why I believe we should invest in gold and silver, before we have potentially nothing left to protect. Its two things to me: a store of untraced wealth, and an insurance policy in case something really bad happens. I like feeling financially protected and this is one way I do this.

Timing Is Everything!

The next BIG TRADE is setting up. You should take advantage of my hard work and expertise to make you short term profitable trades. Protect your financial future by getting my market and trade alert reports every week. Your portfolio should involve a proven strategy which I provide.

We have just entered a new commodity trade (UGAZ) Feb 21 as its forming a bottoming pattern. We have locked in 10% in 36 hours and hold the remaining for much larger gains. Do you want to be in the next trade of the Next Hot Stock setup? My subscribers banked a 112% in a swing trade with NUGT (Dec 16 – Feb 8th). All the trades are based on my Momentum Reversal Method (MRM) trading system.

Another trade this month was ERX, in which we took a nice profit of 7.7% in less than 24 hours after entry. All risks are well contained.

Follow my lead and start making money every month with www.ActiveTradingPartners.com

John Winston

Co-Author: Chris Vermeulen

www.ActiveTradingPartners.com

Chris Vermeulen

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.