American Men Are Giving Up on Jobs

Economics / Unemployment Mar 10, 2017 - 05:59 PM GMTBy: John_Mauldin

I’ve written about this before, but there are 10 million American males between the age of 24 and 64 who have literally dropped out of the workforce. It means that they have given up on finding a job or are simply not looking.

I’ve written about this before, but there are 10 million American males between the age of 24 and 64 who have literally dropped out of the workforce. It means that they have given up on finding a job or are simply not looking.

But, focusing on just one subset among those who are 24–64, we see that white working-class males’ labor force participation rate has dropped to 59%.

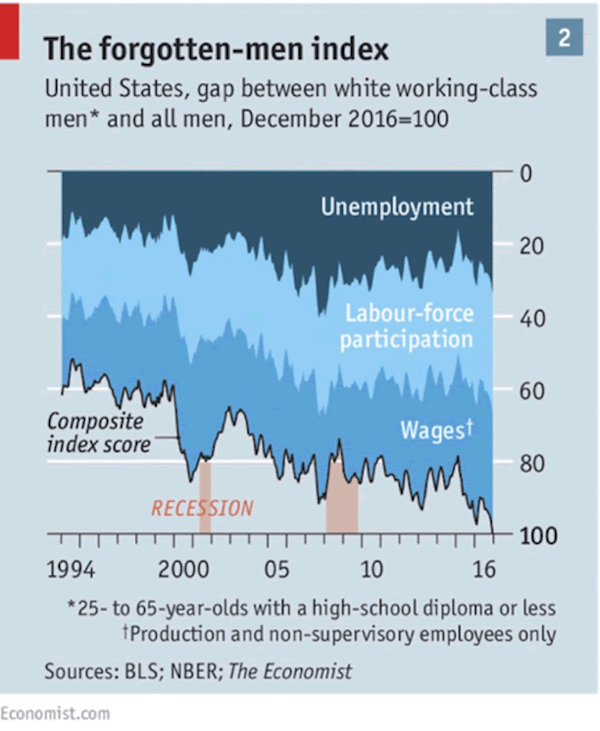

The Economist has created something called a Forgotten Men Index, which shows the gap between white working-class men in particular and all men in general.

I bring this data up because white working-class men have become the focus of much current political discussion. The participation numbers are similar or worse for other racial categories except for Asians.

Among the 10 million men not in the workforce—men who are not even looking for a job—57% of the Caucasian population between 21 and 55 collect disability benefits, which means they can get Medicaid benefits and cheap narcotics.

Opioid addiction has become rampant in 50-something men.

This Isn’t New

For the first time in the last 250 years of history, we are watching the probable longevity rates within a demographic segment of the population fall. That specific demographic is working men in their 50s, and the main causes of early death in this cohort are alcohol, drug abuse, and suicide.

Shrinking workforce participation is not a recent trend; I’ve written about it plenty. It has been happening since the ’60s, through every administration and every tax reform. It seems that with every major technological advance, a certain portion of the working population doesn’t find a way forward to take advantage of the next set of opportunities.

Let me pull a few random quotes from Nicholas Eberstadt’s powerful book Men Without Work. These are just a few of the almost 40 pages that I copied and made notes on from his 200-page book. I could literally write a whole letter just focusing on what I think are important quotes.

The work rate has improved since 2014, but it would be unwise to exaggerate that turnaround. As of early 2016, our adult work rate was still at its lowest level in three decades. If our nation’s work rate today were back to its start-of-the-century highs, approximately 10 million more Americans would currently have paying jobs.

Here, then, is the underlying contradiction of economic life in America’s second Gilded Age: A period of what might at best be described as indifferent economic growth has somehow produced markedly more wealth for its wealth-holders and markedly less work for its workers. This paradox may help explain a number of otherwise perplexing features of our time, such as the steep drop in popular satisfaction with the direction of the country, the increasing attraction of extremist voices in electoral politics, and why overwhelming majorities continue to tell public opinion pollsters, year after year, that our ever-richer America is still stuck in a recession….

All of these assessments draw upon data on labor market dynamics: job openings, new hires, “quit ratios,” unemployment filings and the like. And all those data are informative—as far as they go. But they miss also something, a big something: the deterioration of work rates for American men…

Between 1948 and 2015, the work rate for U.S. men twenty and older fell from 85.8 percent to 68.2 percent. Thus the proportion of American men twenty and older without paid work more than doubled, from 14 percent to almost 32 percent. Granted, the work rate for adult men in 2015 was over a percentage point higher than 2010 (its all-time low). But purportedly “near full employment” conditions notwithstanding, the work rate for the twenty-plus male was more than a fifth lower in 2015 than in 1948.

It’s Happening All Across the Board

Recent data over the last number of years have begun to show that it is not just the American male who is struggling. The participation rate of female workers is beginning to decline as well.

The trend in the workplace has not been our friend. And any reasonable analysis suggests that in the future, the rate at which jobs are being lost to new technologies is only going to double and triple.

This is one of the central problems facing society today, not just in the US but all across the developed world.

Do you think the trends will be any different in Europe, England, Japan, or China? Those countries will all have their own ways of dealing with this problem, of course, but as I’ve shared before, technology is going to put a strain on the number of jobs available to people without specific technical expertise.

Get a Bird’s-Eye View of the Economy with John Mauldin’s Thoughts from the Frontline

This wildly popular newsletter by celebrated economic commentator, John Mauldin, is a must-read for informed investors who want to go beyond the mainstream media hype and find out about the trends and traps to watch out for. Join hundreds of thousands of fans worldwide, as John uncovers macroeconomic truths in Thoughts from the Frontline. Get it free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.