Maybe The US Economic Recovery Wasn’t Real After All

Economics / US Economy Apr 02, 2017 - 01:22 AM GMTBy: John_Rubino

For a while there it looked like the US and its main trading partners had finally achieved escape velocity. Growth was up, inflation was poking through the Fed’s 2% target, and most measures of consumer sentiment were bordering on euphoric.

For a while there it looked like the US and its main trading partners had finally achieved escape velocity. Growth was up, inflation was poking through the Fed’s 2% target, and most measures of consumer sentiment were bordering on euphoric.

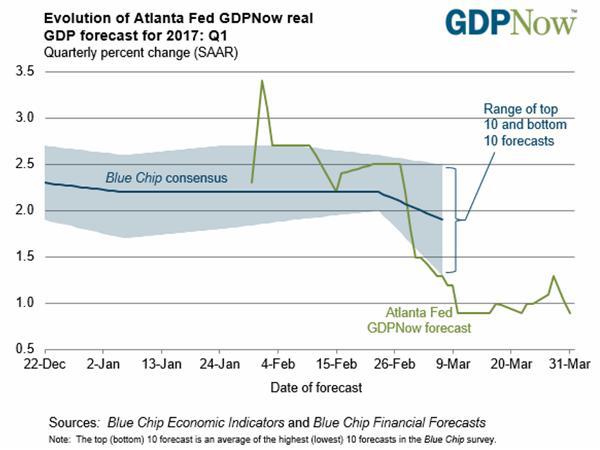

Then it all started to evaporate. Lackluster manufacturing and consumer spending reports sent the Atlanta Fed’s reading of Q1 GDP off a cliff to less than 1%:

And this morning the Wall Street Journal highlighted some recent changes in the yield curve that point towards further slowing:

Flatter Yield Curve in 2017 Shows Growth Concern Lingers

Long-term Treasury yields have declined modestly, while short-term yields have risen.A flattening of the Treasury yield curve in 2017 is a worrying sign for investors banking on resurgent U.S. inflation and growth.

Long-term Treasury yields, which are largely driven by the U.S. economic and inflation outlook, have declined modestly this year, following a sharp rise in the wake of the November election of Donald Trump as president. The 10-year U.S. Treasury yield has fallen to 2.396% from 2.446% at the end of 2016.

At the same time, short-term yields, which are more influenced by monetary policy, have risen in 2017 as Federal Reserve officials have made clear that they expect to continue raising the fed-funds rate through the rest of the year.

As a result, the yield premium on the 10-year note relative to the two-year note—known in the market as the 2-10 spread—slipped Wednesday to 1.107 percentage points, its lowest level since the election.The Journal goes on to note that the spreads between Treasuries and junk bonds are widening, which indicates growing fears of a slowdown-induced credit crunch. And that junk bond issuance is soaring, which implies a desire on the part of sub-investment-grade borrowers to raise cash while they can.

What’s happening? There are several possibilities:

1) There never really was a recovery. The post-election pop was, as the Journal asserts, just the human nervous system responding to a “new and improved” US government the way grocery store shoppers instinctively reach for boxes that promise a better version of an old stand-by. Now that the novelty has worn off, the markets are experiencing a “same corn flakes, different box” let-down. In which case 1% – 2% growth might be the ceiling, and debt/GDP will continue to soar world-wide. Make no mistake, this is an epic worst-case scenario.

2) Oil spiked in 2016, which led many to conclude that the global economy was growing because it was demanding more energy. But then crude gave back most of its gains, extinguishing the previous optimism and causing economic indicators like consumer spending to stall (because we’re all paying a bit less for gas lately). So risk-off: sell stocks and junk bonds, buy Treasuries. It’s no more complicated than that.

3) No one has the slightest idea what’s happening as insane levels of debt distort the models economists use to predict the future. From here on out, it’s unpleasant surprises all the way down.

Time will tell, but door number 3 is an increasingly safe bet.

By John Rubino

Copyright 2017 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.