Trading View: Is It Time To Take Profits From This Stock Market?

Stock-Markets / Stock Market 2017 Dec 20, 2017 - 02:55 PM GMT I have been teaching investment and trading technique since 1995 and in all those years never have I sensed such anxiety in students, colleagues and readers. For the last 6 months, almost on a daily basis, I have been asked the same question: is now the time to get out of this market and go to cash?

I have been teaching investment and trading technique since 1995 and in all those years never have I sensed such anxiety in students, colleagues and readers. For the last 6 months, almost on a daily basis, I have been asked the same question: is now the time to get out of this market and go to cash?

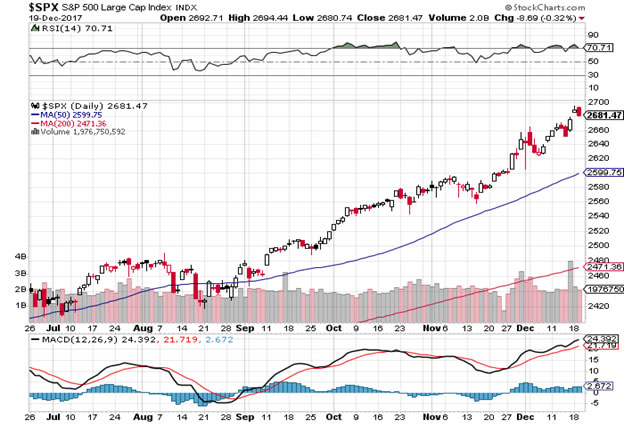

As always with trading and investment decisions one should never become emotional and a good understanding of technical analysis helps one see the wood from the tree and remain grounded. At the outset let me make it clear that from a technical point of view there is no obvious material weakness in this market, even though is very very over-bought. As we speak there have been recent “breakouts” to new highs on the Dow Industrials, the Dow Transports, the S & P 500 and the NASDAQ 100. One major index that I like was showing some weakness, the Russell 2000 small cap, but last week once it reached its 50 Daily Moving Average (DMA) it bounced right back up in concert with all the other indices.

However, one student who has over one million Euro in a pension fund, was beginning to get very anxious. She had got in very early on this bull market and following Dow Theory she had stuck with the trend and was getting very worried about her profit pile. (Remember the large-cap US market is up over 230% since this rally commenced in March 2009). In this instance I was happy to support her decision to take 25% of her portfolio off the table and place it in cash. This “war-chest” she wants to use to take advantage of any significant correction or new recession.

Speaking of recession in my opinion one could occur at any time, given that in historical terms this bull market is “getting on in years”. What could be the catalyst for such an event one might ask? Well take your pick: a successful Trump impeachment, should control of Congress be lost to Democrats next November; a sudden Middle East crisis, prompted by Trump’s unilateral recognition of Jerusalem as Israel’s capital; unexpected interest rate rises due to unanticipated growth in inflation levels; a sudden withdrawal of the USA from the WTO (World Trade Organization) prompting a trade war with China; an unsuccessful “hard” Brexit process causing economic and banking instability throughout Europe, particularly in Italy and Spain; a collapse in the Bitcoin digital ponzi scheme, a valueless cypher now being actively traded by over 23 million persons on Coinbase alone (only one of numerous worldwide crypto currency exchanges).

That being said, for those investors/ traders who did not fully benefit from this exceptional bull “expansion” I would still recommend being invested in equities, given current momentum. The Trump tax reform plan has the potential to radically transform the profitability of mainstream American business and I do not think the full positive reality of this timely development has been totally priced into the market, but future index action will tell thus follow the market in candlestick price mode not tips, media gossip, intuition or emotion.

Chart: Dow Industrials: Daily.

Chart: Dow Transports: Daily.

Chart: S & P 500: Daily.

Chart: NASDAQ 100: Daily.

Chart: Russell 2000: Daily.

Charts: Courtesy of StockCharts.Com

Christopher Quiqley

B.Sc., M.M.I.I. Grad., M.A.

http://www.wealthbuilder.ie

Mr. Quigley was born in 1958 in Dublin, Ireland. He holds a Bachelor Degree in Accounting and Management from Trinity College Dublin and is a graduate of the Marketing Institute of Ireland. He commenced investing in the stock market in 1989 in Belmont, California where he lived for 6 years. He has developed the Wealthbuilder investment and trading course over the last two decades as a result of research, study and experience. This system marries fundamental analysis with technical analysis and focuses on momentum, value and pension strategies.

Since 2007 Mr. Quigley has written over 80 articles which have been published on popular web sites based in California, New York, London and Dublin.

Mr. Quigley is now lives in Dublin, Ireland and Tampa Bay, Florida.

© 2017 Copyright Christopher M. Quigley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Christopher M. Quigley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.