War, Peace and Recession 2018

Politics / GeoPolitics Jan 04, 2018 - 08:35 AM GMTBy: EconMatters

December and January are usually two busy months for researchers as they release prediction/forecast of the New Year. We are going to briefly discuss two such forecasts here.

December and January are usually two busy months for researchers as they release prediction/forecast of the New Year. We are going to briefly discuss two such forecasts here.

Top 5 World War III Crises

The first one is a geopolitical forecast, 5 Places World War III Could Start in 2018, published last month. Now let’s take a quick look at the top five crises that could lead to the greatest conflict in 2018:

- North Korea: North Korea is probably the worst foreign-policy and war potential facing the world today. The country has repeatedly conducted missile and nuclear tests over the last decade, and North Korea is showing no inclination to relent under US pressure. The neighboring China is said to secretly support North Korea, while president Trump claims he has a bigger nuke button than Kim Jong-un. The escalating tension means likely war conflict between US (South Korea, possibly Japan) vs. North Korea (and China) destabilizing East Asia.

- Taiwan: With only 99 miles from each other across the Taiwan Strait, China and Taiwan have been blood-feuding for more than 70 years. China on many occasions openly insists on reunification of the two without ruling out the use of force. Partly in response to the increasing Chinese bombers, fighters and military vessels crossing over to the Strait, Taiwan announced it would raise military budget by 2% a year to about $10.7 billion in 2018, while the US seeks to “strengthen US-Taiwan military alliance”. Potential war conflict: Taiwan (and US, possibly Japan) vs. China and could seriously impact the entire Southeast Asia, and US interests.

- Ukraine: Although there’s supposed to be a cease fire in Easter Ukraine, the country is experiencing increasing violence between Kiev and Moscow-supported local militias and possible collapse of the government altogether. Russia's Putin is not shy about taking advantage of the situation with military incursion into Ukraine. Potential war conflict: Europe (and US) vs. Russia

- NATO South: NATO has 29 sovereign countries from Europe and North America in the field of security and defense. However, Turkey, although a member of NATO, has been estranged from the EU and the United State by cozying up to Russia. Turkey is an immensely important country and could affect conflicts in in Syria, Iraq, Iran, the Balkans and the Caucasus, NATO’s Southern Flank.

- The Gulf: The Middle East region has long been a hot bed for geopolitical conflicts, and is now laced with Saudi’s renewed resolve in building a diplomatic and military coalition against Iran, and Russia reasserting its position in the region. War has broken out in the Gulf before without dragging the rest of the world into it, but fuse is growing shorter every day.

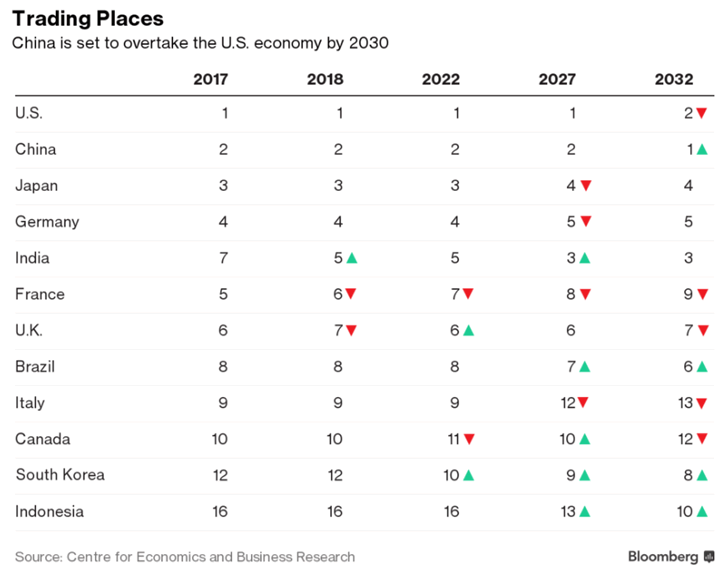

Another one was also published last month when Centre for Economics and Business Research in London came out with a forecast that China would overtake US Economy by 2032.

For three decades, the rise of China has been a fundamental growth force in the global economy. China overtook Japan as the 2nd largest economy in the world early 2011. Since then, there are many predictions of when China would surpass US to become the world’s largest economy. Measured by Purchasing Power Parity, IMF already declares China has become the world's largest economy in 2014. Then in 2016, Conference Board estimates that by 2018 China’s contribution to global GDP will surpass that of the US.

As you can see, the timing of the Big China (2014, 2016 and now 2032) got pushed back further and further. This is mostly due to China’s many growing pains, fairly similar to what the US is facing, including high-debt-financed growth (government, companies as well as individuals), real estate market bubbles, infrastructure and the aging demographics.

A Perfect Storm

The juxtaposition of the aforementioned predictions indicates that China has a minimum of two high octane crises close by (North Korea and Taiwan) which could thwart the overtaking of US by 2032. On the other hand, the US could be even worse than China since as the current world leader, the US would have been deeply involved with all five war crises.

Many experts believe the war crisis could be averted via skillful foreign policy and diplomacy leading to new world balance. Unfortunately it does not look like the US could fulfill that role as diplomacy and foreign policy are not the strong suit of the new Trump Administration.

In addition, effective foreign policy and diplomacy is a two-way street from all parties involved. Right now, the world is in a precarious stage where the similar behavior pattern of prominent leaders including Trump, Putin, Xi Jinping, Kim Jong-un, and even Rodrigo Duterte (Philippines president) is forming a perfect storm pointing to increasing chaos, tension and world war III probability.

Both the Second Fiddle?

From that perspective, world war crises seem more imminent which could lead to global recession (although the recession will eventually come from world's central banks incessant QEs even without WW III). With both the US and China marred by war(s) consuming all resources, the question should be when both countries will play the role of second fiddle instead of which one to retain the title of world’s largest economy and super power.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2016 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.