Unlike the U.S. Government, the Gold Market Never Closes

Commodities / Gold and Silver 2018 Jan 23, 2018 - 03:57 PM GMTBy: Arkadiusz_Sieron

The U.S. government partially closed at midnight on Friday. But the UK deals with a much more serious crisis. Potentially also for gold.

The U.S. government partially closed at midnight on Friday. But the UK deals with a much more serious crisis. Potentially also for gold.

So it happened again. The most powerful country in the world didn’t manage to renew another short-term government funding extension. It’s quite embarrassing, but we all should already get used to it. Since 1976, there have been almost 20 previous occurrences. But the world never collapsed. Why should it, given the character of the government? In the worst case it is a parasitic, mafia-style organization, while in the best scenario it is an inefficient bureaucratic Moloch with the dynamism of a sloth.

And this time the apocalypse didn’t occur as well. You see, political embarrassment is not equal to an economic headwind. After all, much of the government continues to function. We hope that nature and culture lovers will not be offended, but the world will cope with the temporary closure of museums and national parks. Surely, a reduction in hours worked by government employees may shave a portion of the Q1 GDP, but the impact shouldn’t be substantial. Gold traders must sense it, as the price of the yellow metal rose amid a softer greenback and worries caused by the government shutdown, but the increase was moderate, as one can see in the chart below. It suggests that the economic impact of the government shutdown is likely to be limited and temporary – gold investors shouldn’t take positions based only on that factor.

Chart 1. Gold prices over the three last days.

Will the Next Crisis Come from the UK?

While the world’s attention is focused on the U.S. (or on the Germany, as the Social Democratic Party voted for the entering formal talks with Angela Merkel to create a coalition and form a new government), the UK’s economic outlook is rather gloomy. According to some insolvency specialists, almost half a million UK businesses started 2018 in significant financial distress due to the plunge in the value of the pound after the Brexit vote, weaker consumer spending, growing business uncertainty, rising inflation and interest rates. The number of UK firms in financial problems soared 36 percent from 2016 to 2017.

A great example of distress may be Carillion, a construction firm employing almost 20,000 people in the UK, which collapsed last week under a mountain of unsustainable debts. With £2bn of debts, the bankruptcy of the company is one of the most spectacular corporate failures of recent years. The situation is grave – although the government refused to bail out the company, it set up a special national task force to tackle the crisis and prevent further bankruptcies in the industry. As Carillon owed money to about 30,000 small firms, analysts are afraid of the domino effect.

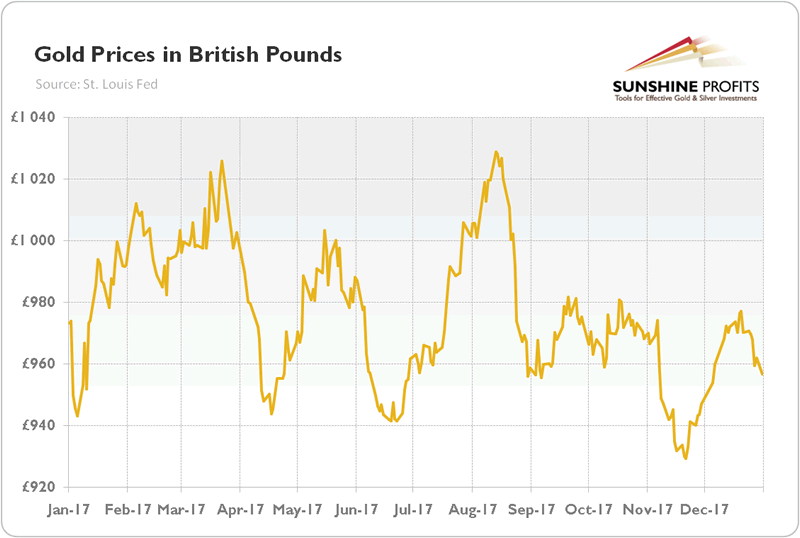

However, the chart below, which shows the price of gold in British pounds, doesn’t show a surge in the safe-haven demand for gold. The Carillion crisis is thus believed by gold traders to remain limited.

Chart 2: Gold prices over the last twelve months (London P.M. Fix, in £).

Conclusions

At Friday’s midnight the U.S. government run out of funds and had to shut down. It triggered some worries, adding downward pressure on the greenback and supporting the yellow metal slightly. However, we believe that the government shutdown will be temporary, so its economic impact will be limited. The effect on the U.S. dollar and gold may actually reverse if the Congress renews government funding.

While the U.S. government shutdown attracted press attention, the Carillion crisis remains unknown for the general public outside the UK. It’s a bit surprising, as there is a serious risk of contagion to the subcontractors and their banks. However, the price of gold expressed in British pounds has remained unruffled so far (or it has actually fallen). But we will monitor the situation, as nobody knows for sure how it will unfold. Even if nothing happens, the Carillion crisis may show what might happen in the U.S. or other countries when inflation will finally hit and the interest rates rise.

This week may be very interesting for the gold market, with some volatility, as both the Bank of Japan and the European Central Bank hold their monetary policy meetings. Stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.