8 Reasons Your Investment Portfolio Needs Crisis Insurance

Commodities / Gold and Silver 2018 Mar 06, 2018 - 05:43 PM GMTBy: HAA

By Olivier Garret :

We’ve recently witnessed what I consider to be a turning point for the stock market.

By Olivier Garret :

We’ve recently witnessed what I consider to be a turning point for the stock market.

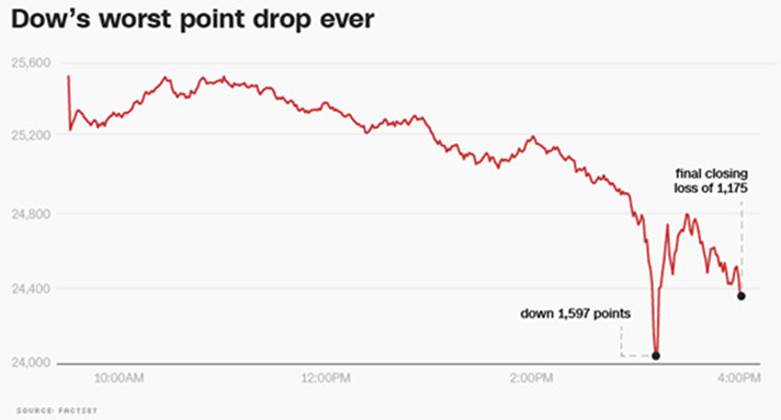

Just when many predicted another growth year for the markets, on Monday, February 5, the Dow plunged by 1,600 points—its greatest point drop in history.

Source: Money.CNN

The sudden decline shook investors’ bullishness to the core. Many belatedly remembered that markets do not always go up and that even the “New Economy” isn’t indestructible.

I have no doubt that the stock market bulls will find excellent excuses for this correction. Fundamentals are still strong for the economy and the markets. Maybe February 5 was just a fluke, and we can move confidently into the future!

I happen to think otherwise. I believe that what we experienced was only the foreshock before the “Big One” hits... and history is on my side.

History Repeats Itself

The vast majority of corrections and crashes follow initial warning signals.

Very often, market tops are followed by a few setbacks, followed by new highs, until the ultimate correction occurs.

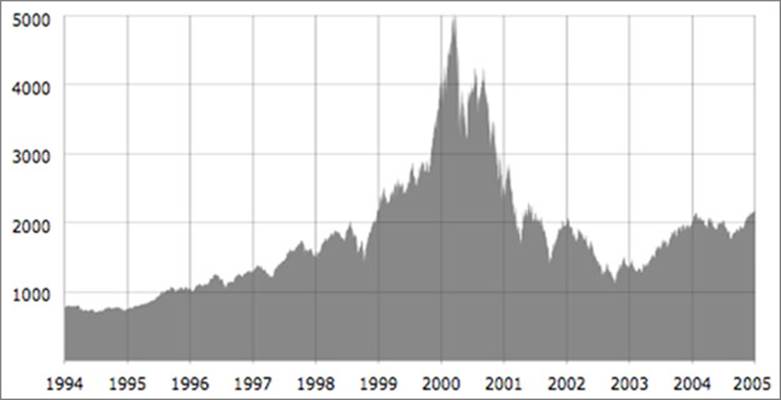

The 2000 dot-com collapse is a perfect example.

Source: Wikimedia

The initial correction started on March 11, 2000, but the index didn’t bottom until October 2002 after losing 78% of its pre-crash value.

Similarly, the Financial Crisis of 2008 and the collapse of Lehman Brothers were preceded by the 90% share price drop and subsequent bankruptcy of New Century Financial in March and April of 2007.

Source: StockCharts.com

The market actually peaked on October 9, 2007—a full six months after the initial shock. Then another five months later, Bear Stearns crumbled, followed by IndyMac in July 2008.

Bubbles rarely blow all at once.

The Question You Should Ask Yourself

The question investors should ask themselves is: Which part of the cycle are we in today? Are we closer to a top or to a bottom?

If we are closer to a top and we start seeing early signs of a correction, it’s important to adopt a defensive investment strategy before a more serious crash occurs.

The market may still reach new highs, but the risks are mounting. Personally, I’d rather sacrifice a bit of performance to protect the downside.

The reasons why we want downturn insurance in place now are:

- Stocks still have rich valuations today, especially the FAANGs. P/Es are high compared to historical averages.

- Over the last several years, corporations have used leverage for financial engineering rather than boosting productivity. US corporate debt levels are at an all-time high (above $6 trillion or about 31% of GDP). This excess leverage is fine when interest rates are low, but it can be deadly in a recession. In addition, stock repurchases don’t have the same impact on profits than capital investments.

- Interest rates are expected to increase as a result of the Fed’s tightening policies. Treasury issuances will likely increase over the next few years. Unfortunately, this may coincide with lower demand for US debt from both international and domestic buyers.

- Higher interest rates will put pressure on demand for consumer goods and real estate. These are two critical drivers of economic activity in the US.

- Many asset categories are currently in bubble territory and prone to downward adjustments: growth stocks, bonds, real estate in many markets, arts, collectibles, and luxury goods, and cryptocurrencies.

- Geopolitical risks are not insignificant (North Korea, Iran).

- Political gridlock in the US could lead to paralysis after the mid-term elections.

- Heightened risks of protectionism and trade wars.

There are some positive indicators that could prolong the current expansion—such as high employment rates and robust economic activity in all the developed economies.

The Trump administration’s tax reform could also boost the economy, although most of the benefits are likely to be delayed.

As far as I am concerned, starting in 2017, I have started adjusting my portfolio to get ready for a sizeable correction. I haven’t sold all my stocks and bonds, of course, but I have rebalanced the asset allocation considerably.

For example, I’ve sold overvalued positions and added a lot of cash to redeploy once the correction hits. And I have purchased a significant amount of gold during the last 12 months—both as insurance and because it is a non-correlated asset class that also happens to be quite inexpensive right now. In fact, the current gold price is a good entry point.

If you don’t know where to start, first learn the difference of gold ETFs vs. physical gold and how to open a gold IRA, which is one of the best ways to buy gold.

Then you’ll have to decide on what type of gold you want to purchase. I recommend sovereign coins such as Gold American Eagles, Canadian Maple Leafs or Gold Buffalos, which are some of the most liquid coins in the market.

In addition, I have made a few long-term leveraged bets on a market correction.

I recommend you do the same.

More From the Hard Assets Alliance Blog

© 2018 Copyright Hard Assets Alliance - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable,

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.