Hi-Ho Silver!

Commodities / Gold and Silver 2018 Mar 26, 2018 - 03:04 PM GMTBy: Peter_Degraaf

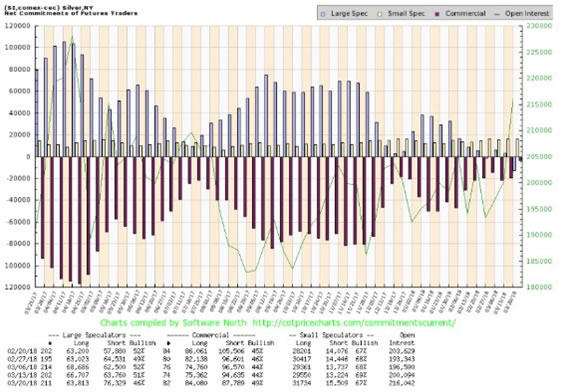

If the latest COT report for silver gets any more bullish than the one released on March 23rd, commercial traders will have to go ‘net long!’ As it is, they reduced their ‘net short’ position to the lowest number in many years, down to just 4,000 contracts – barely 2% of the total open interest! This is bullish action! As recently as January 16th the number of ‘net short’ positions was 50,000, and the percentage of open interest was 26%. (Charts are courtesy Goldchartsrus.com unless specified).

If the latest COT report for silver gets any more bullish than the one released on March 23rd, commercial traders will have to go ‘net long!’ As it is, they reduced their ‘net short’ position to the lowest number in many years, down to just 4,000 contracts – barely 2% of the total open interest! This is bullish action! As recently as January 16th the number of ‘net short’ positions was 50,000, and the percentage of open interest was 26%. (Charts are courtesy Goldchartsrus.com unless specified).

This chart courtesy COT@softwarenorth.com, tells us is that commercial silver traders, such as bullion banks and silver miners, think the silver price has hit bottom, and is likely rise from here.

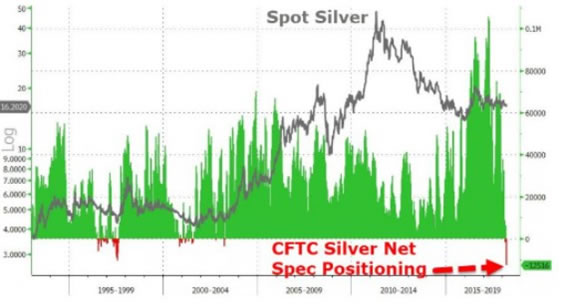

This chart courtesy Zerohedge.com shows silver speculators at the largest short position in at least 28 years. From a contrarian perspective this is very bullish.

This chart courtesy Goldswitzerland.com shows a bullish wedge formation is forming. An upside breakout will attract many buyers.

This chart courtesy Google.com shows ‘silver searches’ are beginning to rise up from a double bottom.

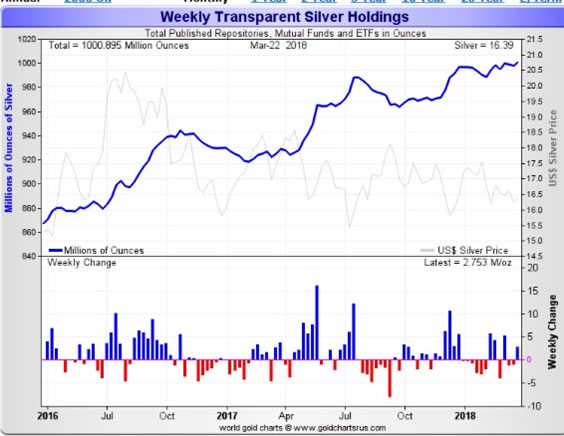

This chart shows the amount of silver bullion that is backing various trusts and ETFs, has been rising steadily for more than two years.

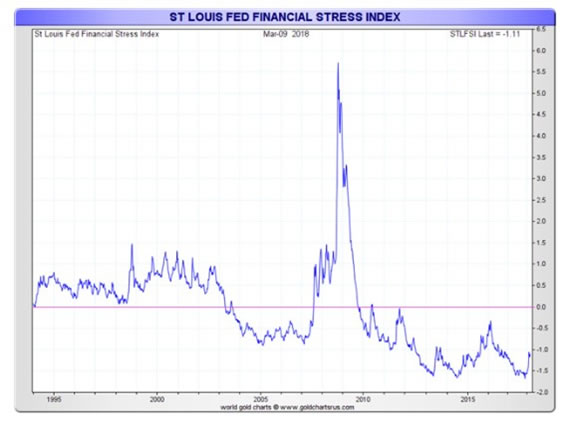

This chart shows the FED’s Financial Stress Index is rising up from a triple bottom. During times of financial turmoil, investors tend to seek the safety provided by gold and silver.

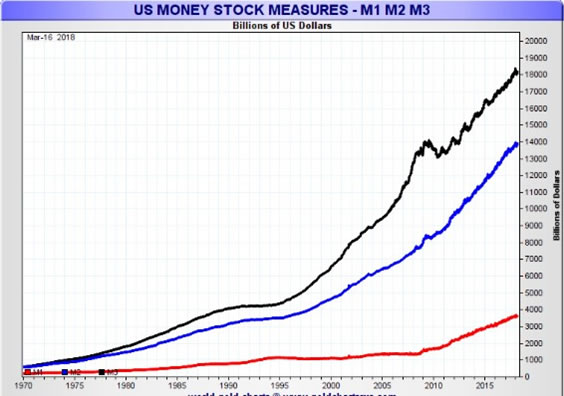

This chart shows US money supply just keeps on rising. Newly printed money causes price inflation, providing energy for gold and silver to rise in price.

This chart shows the seasonal tendency for the gold price to consolidate after a dip in March, followed by a steady rise into October. (Disregard the red line which is dominated by a four year bear market).

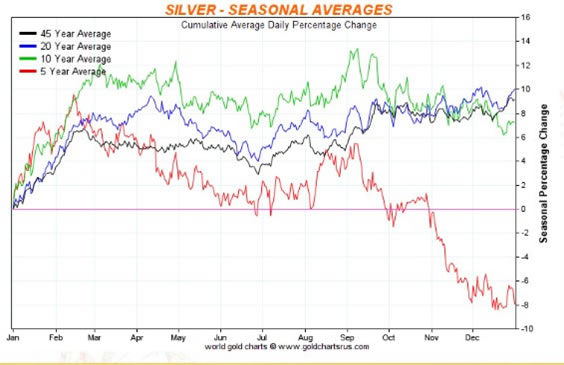

This chart shows the seasonal tendency for silver to provide buying opportunities during the spring season. These opportunities may not last long, if the latest COT report is any indication. (Disregard the red line as it is dominated by a 5 year bear market).

Featured is the daily bar chart for silver, courtesy Stockcharts.com. The silver price has been slowly rising since December. The RSI at the top and CCI at the bottom, are showing positive support for this uptrend. A breakout at the blue arrow sets up a target at the green arrow.

This chart courtesy Stockcharts.com features UUP, the US dollar index ETF. The price has been declining and a drop below the brown arrow is likely to mark the start of a rapid decline. Since gold and silver are priced in US dollars, a lower dollar raises the price of precious metals.

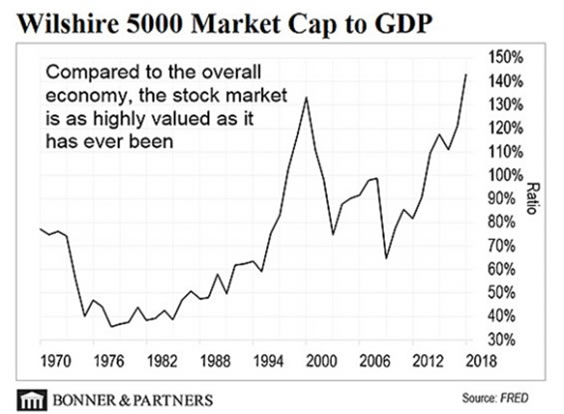

This chart courtesy sources listed shows the US stock market to be overbought, even with the current pullback. As money begins to leave the stock market, some of it will trickle into the precious metals sector. That is what happened in 2001-2002 after the stock market decline.

Peter Degraaf is NOT responsible for your trading decisions. Please do your own due diligence.

By Peter Degraaf

Peter Degraaf is an on-line stock trader with over 50 years of investing experience. He issues a weekend report on the markets for his many subscribers. For a sample issue send him an E-mail at itiswell@cogeco.net , or visit his website at www.pdegraaf.com where you will find many long-term charts, as well as an interesting collection of Worthwhile Quotes that make for fascinating reading.

© 2018 Copyright Peter Degraaf - All Rights Reserved

DISCLAIMER:Please do your own due diligence. Investing involves taking risks. I am not responsible for your investment decisions.

Peter Degraaf Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.