Where the U.S. Dollar Will Go Next

Currencies / US Dollar Jun 29, 2018 - 01:41 PM GMTBy: Troy_Bombardia

For a long time I said that “Money Flow” determines a currency pair’s direction. But I’ve never been able to quantify that concept using an indicator. I’ve tried various things over the years: inflation differentials, interest rate differentials, etc. All of these were commonly accepted theories but were disproven in the light of historical data.

For a long time I said that “Money Flow” determines a currency pair’s direction. But I’ve never been able to quantify that concept using an indicator. I’ve tried various things over the years: inflation differentials, interest rate differentials, etc. All of these were commonly accepted theories but were disproven in the light of historical data.

From Ed Yardeni’s book “Predicting the Markets”, we can now quantify the idea behind Money Flow:

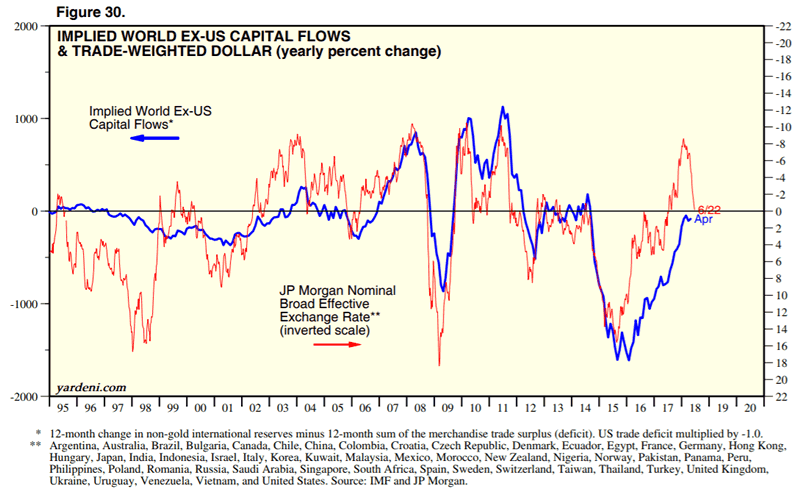

On a 12 month basis, the United States has been running widening trade deficits for decades. The trade deficit of the U.S. must equal the trade surplus of the rest of the world. So the 12 month change of non-gold international reserves held by all central banks (excluding the Federal Reserve) minus the trade surplus of the rest of the world should be a proxy for capital inflows (and outflows) to the rest of the world from the U.S.

*FYI, I highly recommend Yardeni’s book. It’s definitely the best book out there for macro traders and investors.

This is Ed Yardeni’s way of calculating international capital flows. And it works. It has a very strong correlation with the 12 month percent change in the U.S. Dollar. This suggests that the U.S. Dollar is more sensitive to capital flows than trade flows (capital flows tend to be more volatile, trade flows tend to be more persistent and slow moving).

Ed uses a trade-weighted U.S. Dollar Index, which is better than the USD Index.

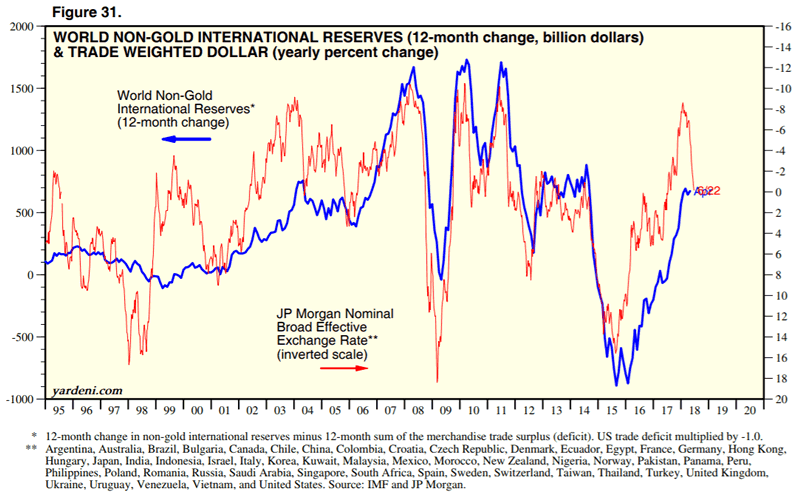

Since the trade-weighted dollar is more sensitive to capital flows than trade flows, the USD also has a very strong correlation to the 12 month change in capital flows (both absolute, and in percentage)

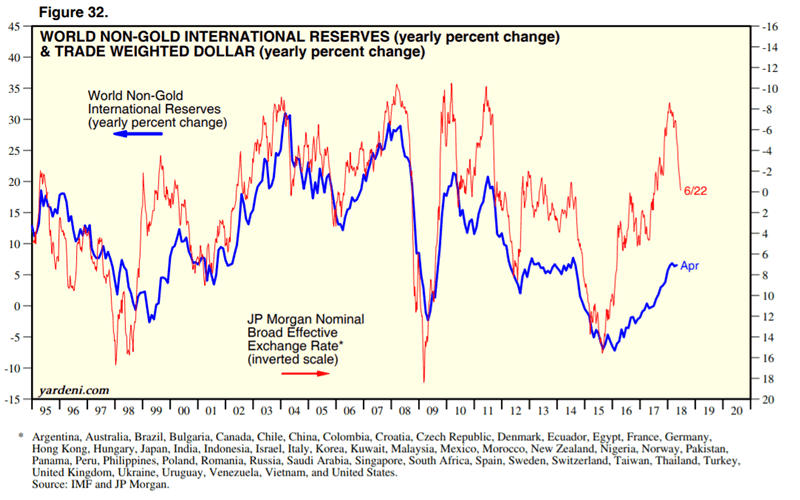

An even better measure is overlapping the 12 month PERCENTAGE of non-gold international reserves vs. the 12 month change in the U.S. Dollar (inverted).

Conclusion

As you can see, the 12 month PERCENTAGE of non-gold international reserves and the 12 month change in the U.S. Dollar (inverted) tend to move in the same direction.

This means that money flowing to the rest of the world is bearish for the U.S. Dollar, and money flowing to the U.S. is bullish for the U.S. Dollar.

You can see that the data on non-gold international reserves lags by 2 months. Hence, the 12 month percentage change in non-gold international reserves is not always a leading indicator for the 12 month change in the U.S. Dollar.

However, these 2 data series do move together in the medium and long term. This means that:

- Non-gold international reserves cannot be used to pick turning points in the U.S. Dollar’s trend. However,

- Non-gold international reserves can be used to confirm the U.S. Dollar’s current trend (i.e. a trend following indicator).

Right now

Non-gold international reserves are starting to flatten. This suggests that the U.S. Dollar will start to flatten and will most likely swing sideways in a wide range.

A big USD bull market or bear market is unlikely right now because the 12 month percentage change in non-gold international reserves is flattening.

With that being said, the elephant in the room are Trump’s tariffs. If Trump’s tariffs cause world trade to decline significantly, then that is a medium-long term bullish factor for the U.S. Dollar because it’ll cause non-gold international reserves to decline.

At the moment, Trump’s tariffs have not had a significant impact on world trade.

Click here to see other trading models.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.