Can the Stock Market Close Higher For a Record 10th Year in a Row?

Stock-Markets / Stock Markets 2018 Jul 11, 2018 - 10:51 AM GMTBy: Troy_Bombardia

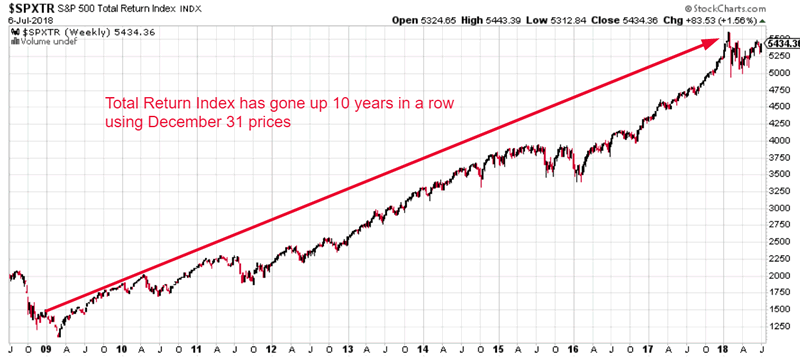

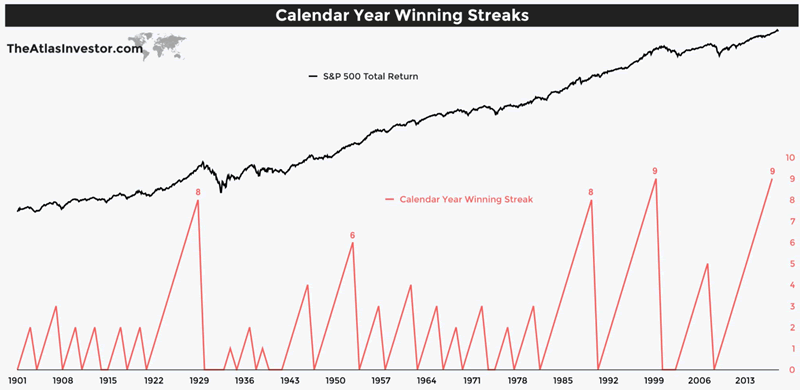

The S&P 500 Total Return Index is slightly different than the S&P 500 Index in that it includes the dividend yield that companies throw off. Hence, the S&P 500’s Total Return Index tends to go up a little more than the S&P 500 each year.

The S&P 500 Total Return Index is slightly different than the S&P 500 Index in that it includes the dividend yield that companies throw off. Hence, the S&P 500’s Total Return Index tends to go up a little more than the S&P 500 each year.

As of the end of 2017, the S&P 500 Total Return Index has gone up 9 years in a row (2009 – 2017, inclusive). If the Total Return Index closes higher at the end of this year, it will set a new record for 10 years higher in a row.

Will this happen? Will the Total Return Index close higher 10 years in a row? Or will the streak break because the TIME cycle is “too stretched”? (The Total Return Index is up more than 4% year-to-date).

What the bears believe

The bears believe in TIME cycles. E.g. if a market goes up for “too long”, it must go down.

Since the S&P has gone up 9 years in a row already, the bears believe that the stock market “must” go down this year.

Why the bears are wrong

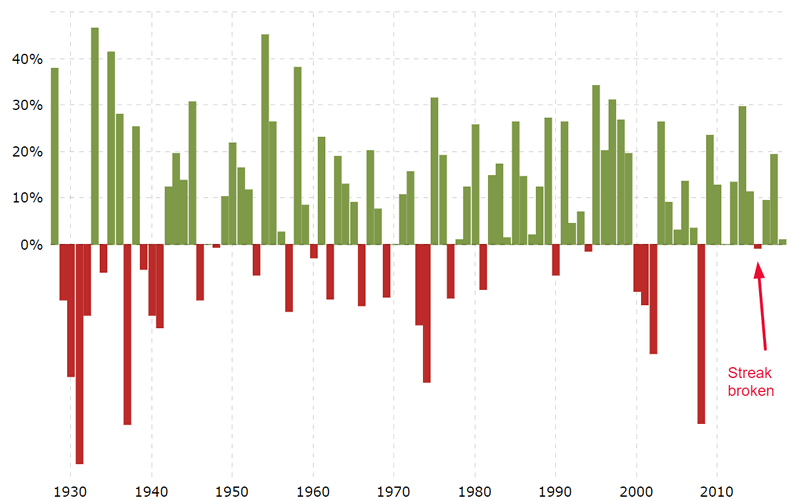

For starters, this streak has already been broken.

If you just look at the S&P 500 Index (not the Total Return Index), the S&P was flat in 2011 and closed negative in 2015. The S&P 500 Index has not gone up 9 years in a row.

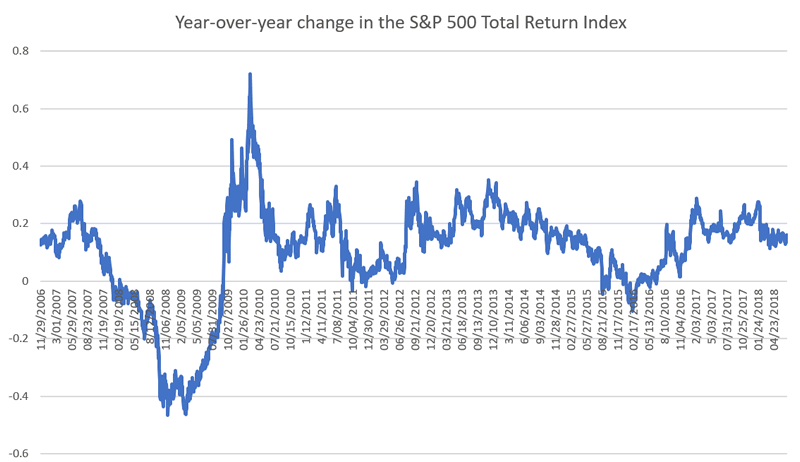

But here’s the more important point. Saying that the Total Return Index has “gone up 10 years in a row” is misleading because this statement only uses yearly closing prices (i.e. right before December 31 of each year). There’s nothing magical about December 31 – it’s just a trading day, and there are 252 of them every trading year.

The reason why the Total Return Index has not “closed negative” is because none of the “big corrections” in the current bull market (e.g. 2010, 2011, 2015-2016″) happened occurred near the end of the calendar year.

If instead of using January 1 – December 31 as your “year” you used any 12 month period as your “year”, you’ll see that the stock market has “gone down over the past year” in 2011, 2012, 2015, and 2016.

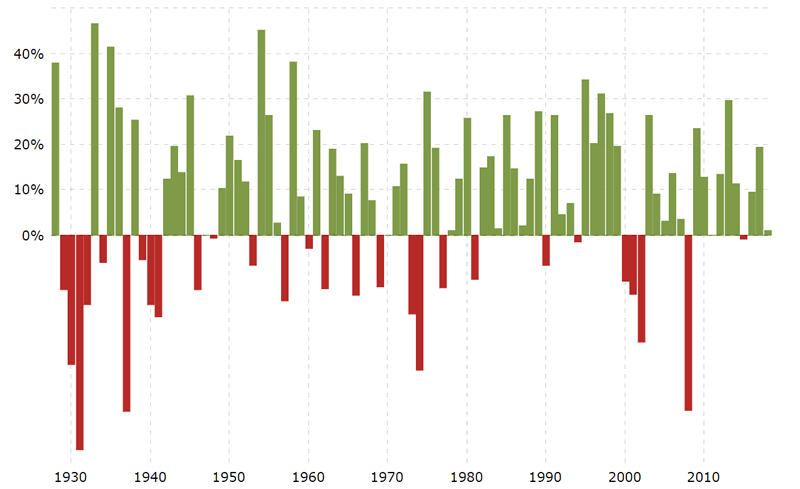

Bull markets and economic expansion don’t die of old age

Here’s the most important point that bears fail to realize. Bull markets and economic expansions don’t die of old age. Let’s look at the S&P 500’s annual returns chart again.

If you look at the data carefully, you’ll notice that bull markets are lasting LONGER AND LONGER in terms of TIME. Anyone who becomes bearish just because “the bull market is getting long in the tooth” would have missed out on big gains.

Do you see any pattern in how long it takes for the stock market to fall?

No? That’s because there is no pattern. There is no rule saying that “if the stock market goes up X years, it must go down the next year”.

The stock market does not follow a TIME-driven cycle like the 4 seasons. The stock market follows the U.S. economy. If the U.S. economy continues to improve, then the stock market will continue to trend higher, regardless of how “old” the bull market is.

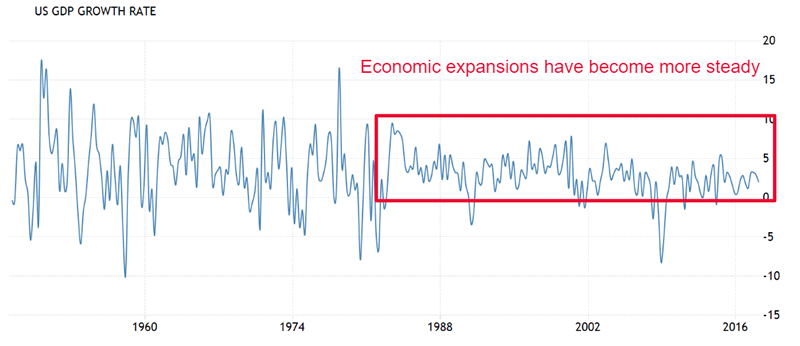

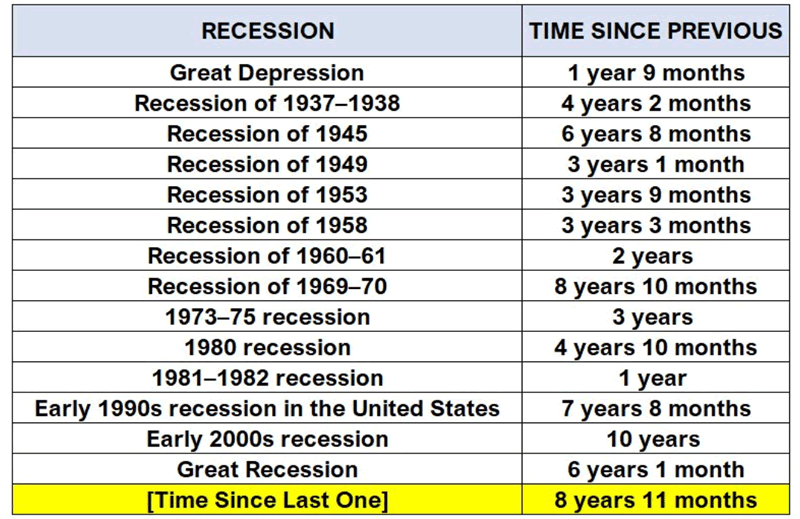

Here’s another interesting point. Since the 1980s, economic expansions have lasted longer and become more steady. Economic recessions before the 1970s were much more common than economic recessions after the 1970s. Before the 1960s, 10%+ GDP growth was common, but so was negative GDP growth. After the 1970s, 10%+ GDP growth has not occurred, and negative GDP growth has become rare.

As you can see, fluctuations in GDP growth are shrinking. With economic expansions lasting longer and longer, bull markets in stocks have also naturally lasted longer and longer.

“Analysts” who predict recessions based on “this economic expansion is too long the tooth” have failed miserably. Recessions were much more common pre-1970s and post-1970s.

Conclusion

The economy will not enter into a recession in 2018, and the S&P 500 Total Return Index will probably close higher for the 10th year in a row.

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.