For Gold, It's All About the Dollar

Commodities / Gold and Silver 2018 Sep 12, 2018 - 10:56 AM GMTBy: The_Gold_Report

Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, discuss the factors that they believe could cause a powerful rally in gold.

Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, discuss the factors that they believe could cause a powerful rally in gold.

Positioning, sentiment and market structure favor a powerful rally in gold. The COTs released by the CME on September 7, 2018, show the gross speculative short position grew 1.3% to 213,259 contracts, just shy of the all-time record set two weeks ago. On a net basis, speculators are short 13,500 contracts, the largest short position since December, 2001. The commercial net short position collapsed into negative territory for the first time since December, 2001 at -6,525 contracts. In other words, commercials are now net LONG, a very rare occurrence historically seen only at major turning points.

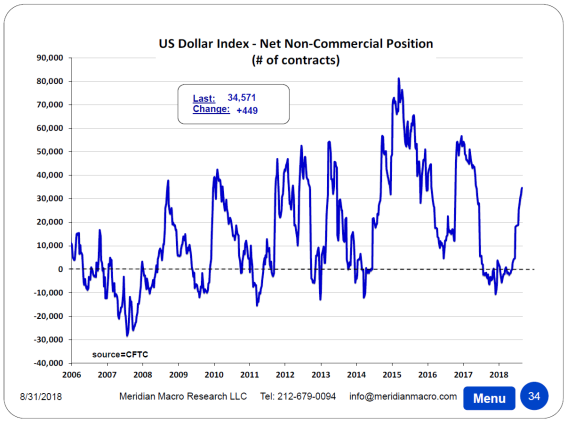

Nonetheless, gold continues to look weak, largely the result of a stronger dollar and market expectations of further dollar strength, which is putting pressure on gold, commodities and emerging markets currencies. Not surprisingly, speculators have been crowding into the dollar.

There are four main reasons why the dollar looks to go higher despite U.S. political uncertainty, growing deficit spending and a worsening trade balance. Each of those reasons may prove to be short-lived.

First, U.S. dollar-denominated debt offers higher interest rates than the debt of other developed economies, especially euro debt, which has attracted funds into the dollar. The key comparison here is the yield on the German 10-year note compared to its U.S. counterpart.

Over the past year, the yield gap has widened in favor of the dollar until June when the trend has stalled, reflecting a 50% cut in bond purchases by the European Central Bank and an expectation that ECB buying will come to an end this December. If true, EU debt will fall (yields will rise) as the biggest and least price-sensitive purchaser stops bidding. We expect the yield gap will likely close.

The second main support for the dollar is the market's perception of the U.S.-China trade war. In a nutshell, the market sees China and the Chinese economy as the losers while Trump and the U.S. economy are perceived to be winners before any serious damage is done to the U.S. economy and corporate earnings. Every time Trump implements a new set of trade sanctions, the dollar rises while the yuan, commodities and gold fall. This pro-dollar trade will unwind when markets begin to conclude there is no easy, early victory. We think this may be imminent. America's largest companies are now warning that Trump's trade policies are beginning to cut into their business prospects and many are reporting serious upward pressures in pricing due to the tariffs and their disruption to established supply lines.

Third, the U.S. has had the best performing stock market on the planet for the past two years, which has attracted global capital to the dollar. U.S. corporate earnings are up strongly, in part because of the magic of share buy-backs but also because of the pro-business policies of the Trump Administration. Regulations have been reduced and taxes have been cut. We think the tax cut has produced a "sugar high" but its effect is already wearing off. Meanwhile, mid-term elections are fast approaching and there is a real possibility that Republicans will lose control of the House to increasingly "progressive" Democrats, effectively ending the Trump effect. U.S. political uncertainty, growing deficit spending and a worsening trade balance may then begin to matter, all to the detriment of the dollar.

Fourth, in our view, the dollar still depends primarily upon one thing…the perception of Fed policy. The Fed is tightening, steadily raising short-term rates and selling assets into the market for dollars it then extinguishes. The latter initiative will shortly reach its objective of removing $50 billion per month, a level the Fed has said it will maintain for years to come.

The key question for the dollar is whether the Fed stays the course. The market assumes it will. We are less certain. We believe that Fed tightening will break the stock market and cause a reversal in Fed policy, which will have a dramatic impact on the dollar and gold.

Even now, while the stock market remains strong, the Fed is laying down markers that support the end of tightening. First, Fed Chairman Powell says he is not concerned about imminent inflation. The latest Fed statement noted that "market-based measures of inflation compensation have increased in recent months but remain low; survey-based measures of longer-term inflation expectations are little changed, on balance." Second, the Fed has stated that it is watching to see if there is a negative economic impact from Trump's trade policy and the stronger dollar. Third, the yield curve is only one 25 basis point increase away from inverting, a fact noted in the latest Fed minutes where some governors expressed concern that an inverted curve has reliably signalled oncoming recessions in the past.

But especially, watch the Emerging Market currency implosions that now threaten more than 20 countries ranging from Turkey, Argentina and South Africa to Poland and Brazil. This growing crisis is directly attributable to Fed tightening thanks to the fact that Emerging Markets have incurred more than US$3.7 trillion in dollar-denominated debt. None of these economies may be big enough to matter in a global context but their impact on the global banking system may be another matter.

Gold is sold out and should begin to rally. The obstacle is the dollar, but perhaps not for much longer.

This article is the collaboration of Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, and reflects the thinking that has helped make them successful gold investors. Rudi is the current Chairman and CEO of Seabridge and Jim is one of its largest shareholders. Disclaimer: The authors are not registered or accredited as investment advisors. Information contained herein has been obtained from sources believed reliable but is not necessarily complete and accuracy is not guaranteed. Any securities mentioned on this site are not to be construed as investment or trading recommendations specifically for you. You must consult your own advisor for investment or trading advice. This article is for informational purposes only.

Disclosures: 1) Statements and opinions expressed are the opinions of Rudi Fronk and Jim Anthony and not of Streetwise Reports or its officers. The authors are wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation. The authors were not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the authors to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 2) Rudi Fronk and Jim Anthony: we, or members of our immediate household or family, own shares of the following companies mentioned in this article: Seabridge Gold. We personally are, or members of our immediate household or family are, paid by the following companies mentioned in this article: Seabridge Gold. 3) Seabridge Gold is a billboard sponsor of Streetwise Reports. Click here for important disclosures about sponsor fees. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts provided by the authors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.