Should You Sell Your Stocks Before Tuesday’s Big Elections?

Stock-Markets / Stock Markets 2018 Nov 03, 2018 - 03:24 PM GMTBy: Stephen_McBride

Are you prepared for Tuesday?

Are you prepared for Tuesday?

It’s going to be a crucial day for the stock market.

As you likely know from the lawn signs dotting American neighborhoods, midterm elections take place this Tuesday.

If the polls are correct, President Trump and Republicans are in big trouble…

According to statistical analysis firm FiveThirtyEight, there’s an 85% chance Democrats will seize control of the House of Representatives from Republicans.

This is causing bigtime anxiety for investors who’ve enjoyed the 28% stock market rally since Trump took office.

No matter what you think of Trump, his reign as president has been great for stocks. But as the election has drawn closer, the market has fallen apart.

Yesterday the S&P 500 closed out October for a 7% monthly drop—nearly its worst month since the financial crisis!

I’m going to tell you exactly how to be invested ahead of Tuesday’s big elections.

But before I continue, a warning…

Few topics stir emotion in America like politics. Many perfectly reasonable people lose the ability to think straight when they hear the name “Trump.”

Politics and investing do not mix. Superinvestor Warren Buffet often says “If you mix politics and investing, you’re making a big mistake.”

So let’s steer clear of opinion and emotion. Instead, I want to focus solely on the facts that are relevant to you as an investor.

As you’ll see, you don’t need to waste even one second worrying about which party will win on Tuesday.

My team went back and studied every midterm election since the Second World War.

I was surprised by what we found.

It turns out there’s a shockingly easy way to predict whether stocks will rise or fall after a midterm election. And it has nothing to do with predicting in advance which party will win.

Here’s what we found…

Since 1946, there have been 18 midterm elections.

US stocks have climbed higher in the next 12 months after every single one.

Every single one.

That’s 18 for 18!

I’ll repeat it because this is so important:

For each of the past 18 midterms, stocks have ALWAYS climbed higher a year later.

Always.

We’ve had every possible political combination in the past 72 years. Republican president with Democratic Congress. Democratic president with Republican Congress. Republican president and Congress. Democratic president and Congress.

The market climbed higher every time.

And stocks don’t just grind higher after a midterm election. They often surge…

Since 1946, stocks have jumped an average of 17% in the year after a midterm.

And if you measure from the yearly midterm lows, the results are even better. From their lows, stocks jumped an average of 32% over the next 12 months.

For perspective, that’s more than double the average performance for stocks in all years.

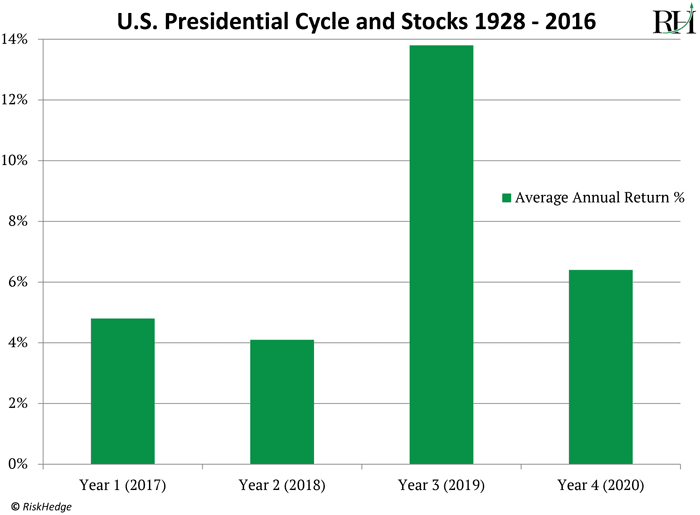

We’re also entering the third year of a presidential term, which is historically the strongest year for stocks.

Take a look at this chart. You can see that the performance of stocks in the third year of a presidential term beats all other years by a long shot:

The facts are clear… but why do markets behave this way with such remarkable consistency?

Glance up at the chart above once more and you’ll notice the second year of the presidential cycle is typically the worst for stocks.

That’s the year we’re in right now—the year when midterms occur.

There’s one last important point you should know. Leading up to midterms, US stocks typically perform poorly. From January to October in midterm years, they drop an average of roughly 1%.

In all other years stocks rise roughly 7% in that timeframe.

Think of midterm elections like a thick fog covering markets. They obscure what the political situation will look like in the near future.

Unable to see what’s coming, investors get nervous and act cautiously. Just as they would slow down while driving a car through a thick fog.

Once the election concludes and the fog clears, investors regain confidence and the market gets back on track.

2018 is following this script to a T. For all the market’s gyrations in the past few weeks, the S&P is roughly flat year to date. If we stay on script, we should expect the market to surge in November after the uncertainty of the elections is behind us.

Knowing all this, now is your chance to take advantage of the market’s pre-election jitters.

If you’ve been reading the RiskHedge Report, you know I practice “disruption investing.” I identify and invest in companies that are disrupting industries and inventing the future. Often, these stocks can hand us big gains of 3x, 4x, 5x our money or more.

This stock market pullback is our chance to get in on great disruptive businesses at much cheaper prices than we could a few weeks ago.

Today I want to highlight your opportunity to buy Google (GOOG) at a great price. I’ve called Google one of the “ultimate disruptors,” because it’s like an octopus with tentacles in many disruptive sectors.

As you surely know, Google has an effective monopoly on the internet search market. For every 100 searches performed, 92 of them flow through Google. And this year it’ll earn over $100 billion from selling internet ads on its search pages.

But this is only scratching the surface. Google also owns YouTube, which my research shows could be a $150 billion company on its own.

It also owns Waymo, the world’s leading self-driving car company. As I explained recently, it will launch a fully driverless ride-sharing service in Arizona later this year.

Underneath it all, Google is super-profitable. In the latest quarter it increased its net profit margin to 27.2%. Meaning for every $100 in sales, it can reinvest $27 into growing its disruptive businesses.

A few weeks ago, I recommended you wait to buy Google until it pulled back to near $1,050/share. Today we have our chance. As I type it’s trading for about $1,070/share – close enough for me to pull the trigger.

I’m buying Google here and I plan to hold for at least two years.

That’s all for today. What do you think… Are you worried about the stock market pullback? Or do you see it as an opportunity? Write me at stephen@riskhedge.com.

Stephen McBride

Chief Analyst, RiskHedge

By Stephen McBride

© 2018 Copyright Stephen McBride - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.