Gold Awaits the FOMC as Economic Data Send Mixed Signals

Commodities / Gold & Silver 2019 Jun 18, 2019 - 05:57 PM GMTBy: Arkadiusz_Sieron

Who wouldn’t know the Spaghetti Western The Good, the Bad and the Ugly? In today’s analysis, we have important pieces of economic data starring in the first two roles. Retail sales and industrial production rebounded in May, while the Empire State Index plummeted in June. How will these reports affect tomorrow’s FOMC decision and the gold market?

The Good

Friday brought us some good economic news. First of all, the U.S. retail sales rose 0.5 percent in May, according to the government. It means an acceleration from 0.3-percent increase in April. Moreover, the latter change was revised up from -0.2 percent, which means that reports of the death of the American retail sales were greatly exaggerated. Moreover, the retail sales excluding the automotive sector rose also 0.5 percent, which indicates broad-based gains.

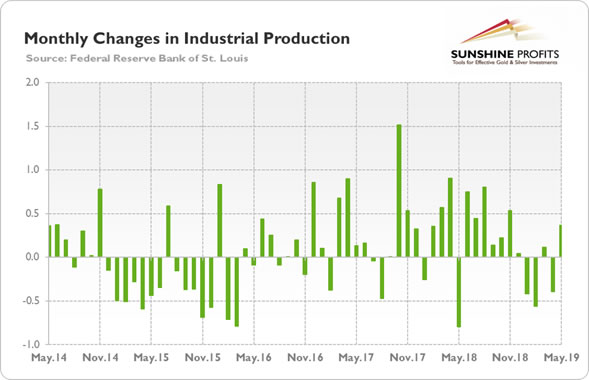

Second, industrial production rose 0.4 percent in May after declining -0.4 percent in April, according to the Fed. It was the strongest monthly increase since November 2018, as one can see in the chart below. Although the growth primarily reflected higher output of automotive products, it was generally well distributed among the many industrial production components.

Chart 1: Monthly changes in industrial production from May 2014 to May 2019.

The gain in industrial production, together with the rebound in retail sales, indicates an important economic improvement in May. It also shows that the worries about the health of the overall economy and the damage of the trade wars have been, at least so far, overstated. Both the consumer sector and industrial production rebounded after the softness in the first quarter. These reports will probably not change the U.S. central bank’s overall assessment of the economy, but they should ease the pressure to act. Hence, the Fed is not likely to cut interest rates at the upcoming meeting. Instead, it should remain in a ‘wait-and-see’ mode.

The Bad

However, on Monday we have seen some negative data coming in. We mean here mainly the fact that the Empire State Manufacturing Index plummeted 26.4 points from 17.8 in May to negative 8.6 in June, according to the New York Fed. It was the first negative reading for the index in more than two years and the largest monthly decline on record. Importantly, the new-orders index sank 21.7 points to negative 12. The index for future business conditions also fell, declining five points to 25.7.

The sharp slide adds to the worries about the state of the US economy. However, the thinking is the decline might be just a temporary drop resulting from Trump’s threat to impose tariffs on Mexico. But with the deal on immigration reached and tariffs suspended, the index may rebound in the near future.

Gold: The Ugly, Seriously?

What does it all mean for the gold? While the Empire State Index plunged, the overall picture of the U.S. economy has improved, as both the retail sales and the industrial production rebounded. Investors better remember that regional indices are based on businesses’ surveys, and can be quite volatile.

Hence, it seems that the current market odds of the Fed’s interest rate cut have swung a little too far. It might be the case that the Wall Street takes the Fed as a hostage, but the financial market is probably ahead of cuts. In the future markets, two rate cuts by the end of this year are already priced in. Not one, but two! It sounds as if we would be already in the recession! When we checked last time, it was not the case. This is why we believe that traders overestimate the dovishness of the Fed.

The same applies to the gold market. The yellow metal rallied at the turn of May and June – partially on dovish expectations about the future Fed’s stance. But what will happen if the Fed fails to meet the market’s expectations? The price of the gold may decline. Just sayin’. We will see soon – stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the link between the U.S. economy and the gold market, we invite you to read the August Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.