The Oil Crisis Saudi Arabia Can't Solve

Commodities / Crude Oil Jul 01, 2019 - 12:44 PM GMTBy: OilPrice_Com

Saudi Arabia’s CEO Amin Nasr’s message to the press that oil flows to the market are guaranteed, should be taken with a pinch of salt.

Saudi Arabia’s CEO Amin Nasr’s message to the press that oil flows to the market are guaranteed, should be taken with a pinch of salt.

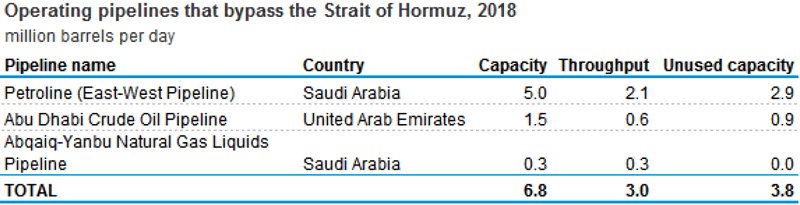

Looking at the current volatility in the Persian/Arabian Gulf and the possibility of a temporary closure of the Strait of Hormuz, the Aramco CEO’s message might be a bit overoptimistic. In reality, Aramco will not be able to keep the necessary crude oil and products volumes flowing to Asian and European markets in the case of a full Strait of Hormuz blockade. Even that Aramco owns and operates a crude oil pipeline with a capacity of 5 million bpd, carrying crude 1,200 kilometers between the Arabian Gulf and Red Sea, much more is needed to keep the oil market stable.

Nasr’s move to stabilize the market is praiseworthy but should be seen as an attempt to quell fears of traders and financial analysts, especially just before the OPEC+ meeting in Vienna next week. Nasr reiterated that Aramco (aka the Kingdom) is able to supply sufficient crude through the Red Sea, reiterating that the necessary pipeline and terminal infrastructure is there. However, what analysts tend to forget, Nasr’s statement is only linked to Saudi’s oil export volumes, which will likely be not higher this summer than around the level this pipeline can support. The real issue, if it comes to a full-blown conflict, is that not only Saudi oil is being threatened.

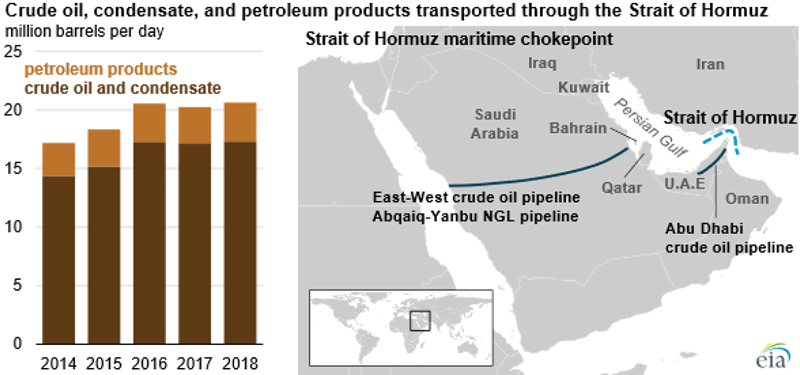

At present, between 20-21 million bpd of crude and petroleum products are transported via the Strait of Hormuz. Saudi exports are a vast part of it, but also the UAE, Iraq, Kuwait, Bahrain, Qatar and Iran, will have to look at additional routes. A closure or military action in the region will cause a temporary disruption for all maritime traffic. Besides the options that are the already on the table, such as the Saudi onshore pipeline and the UAE’s Fujairah pipeline, no other real alternatives are available, as overland trucking or rail transport is minimal. Transferring volumes via the Saudi and UAE’s pipelines is not an option at all, as the total capacity of the two is less than 10 million bpd, representing not even 50% of the current maritime flows through Hormuz. Another thing that should be noted is that pipelines can’t ship crude and crude products at the same time.

Another consequence of a blockade would be that most available VLCCs and other tankers will either be in the Persian Gulf (and blocked) or will not be able to be rerouted. Before the market will have found a solution for this, days and probably weeks will have gone by, and a price spike for all products is to be expected. This will likely also be the case for LNG and other commodity flows.

Few analysts are talking about oilfield security and pipeline availability. Any military advisor will put these options as part of his or her 1st phase military action plan. If Iran were to be attacked, or faces a surgical strike by an opponent, all Arab oil and gas infrastructure will become a legitimate offensive target (at least in the eyes of Tehran and its proxies). Geographically seen, Tehran has been dealt the best cards. Looking at the majority of oil and gas production assets and infrastructure in the Arab world, especially in Saudi Arabia, UAE or even Iraq, everything is in reach of short-distance missiles, fighter jets and even drones. Any move against Iran will result in a full-scale attack on Saudi’s Eastern Province (which produces 80% of all its oil and gas), Abu Dhabi’s offshore oil infrastructure and the regional pipelines. Looking at history, denying energy access and diminishing the opponents stability is a no-brainer in military strategy.

It can be taken for granted that Iran, the Houthis, Hezbollah and others, already have prepared their oil and gas infrastructure strategy. Washington, Riyadh, Abu Dhabi and even Manama, will be frantically looking for answers, but the geographical situation is disastrous.

Quelling fears in the market is the right thing to do, but reality also needs to be addressed. Nasr’s message is that of an oil company CEO, taking all precautions to deal with a calamity. ADNOC’s Sultan will be doing the same. Still, the oil market is at present a victim of geopolitical power projections of emotional leaders superseding rationality. This confrontation is one of a possibly unprecedented order, not for oil (as sceptics again will state) but with oil as a weapon for defeat or survival. The continuing reference to the Iran-Iraq tanker war during 1980-1988 is out of touch with reality. At this time, it is not going to be Iran denying support or trade with Iraq, but a possible Arab-Iranian confrontation, led by the USA if no countermeasures are being implemented.

Asian consumers will need to prepare for severe price hikes in the most optimistic scenario, but also for a shutdown of vast parts of their economy. Hormuz will not be standing on its own, more is to be taken into account, especially proxy reactions in Yemen (Gulf of Aden) or East Med (Hezbollah). Negative repercussions for Europeans are also in the picture. Saudi Arabia can do a lot, but saving the global economy if the Gulf explodes is not one of their capabilities.

Source: https://oilprice.com/Energy/Crude-Oil/The-Oil-Crisis-Saudi-Arabia-Cant-Solve.html

By Cyril Widdershoven for Oilprice.com

© 2019 Copyright OilPrice.com - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

OilPrice.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.