Gold Stocks Peak Bleak?

Commodities / Gold and Silver Stocks 2020 Mar 22, 2020 - 08:36 PM GMTBy: Gary_Tanashian

Peak Oil? That was an obvious and widespread promotion while it was in play and did not fool anyone who bothered to step aside from the herd that ran with it.

Peak Terror in broad stock markets? Well, that I don’t discount so readily because this is a system that was a debt-bloated accident waiting for the trigger that turned out to be COVID-19. Terrified casino patrons will pray that the Fed’s bullets are not duds because that is the only way out. That and the still-intact mass confidence in the Keynesian debt scheme that the Fed operates within.

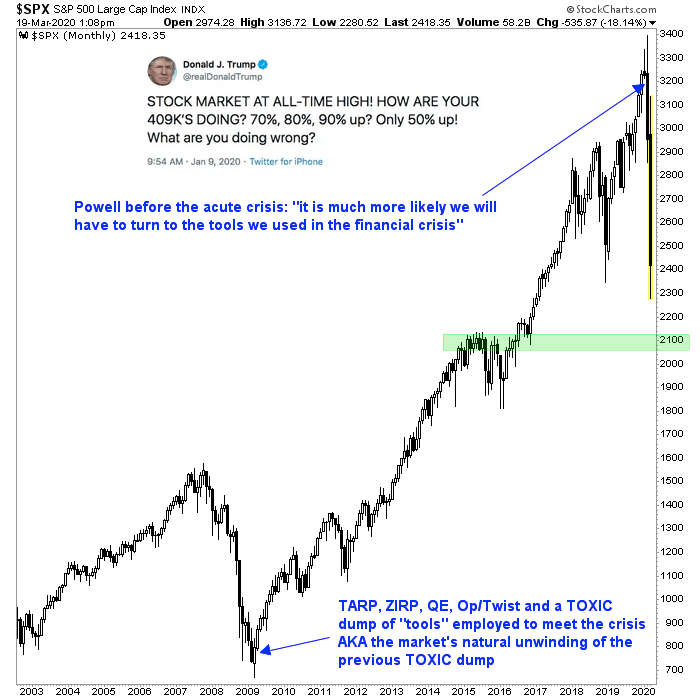

SPX has tanked to the 38% Fib (not annotated on the chart) of the entire policy-manufactured bull market from 2009. While I think there is a big time rally out there ahead somewhere, there is fundamental reason to question the very makings of the bull market and how effective more of those same makings will be. Well before COVID-19 we had SPX due for a manic sentiment blow off and downside reversal. Now the opposite sentiment, Peak Terror, has been slammed into place.

By the way, the green support zone – which corresponds with a 50% Fibonacci retrace of the entire bull market would take back not only half of the bull market, but 100% of the Trump rally touted by the president only 2 months ago, if the crash eventually works its way down to its first clear major support level. Meanwhile, the 38% Fib retrace level could instigate a bounce too.

But that stuff has all been factored. The market always was likely to pull a 38% or 50% retrace (although the trigger came out of left field and its violence has been for the record books). Risk had for months ridden side by side with the stock market and now risk is realized. I am long a few select items (in line with what I perceive will be best suited for the economic destruction being legislated the world over for pandemic containment purposes.

Peak Bleak in the gold bug “community”? Amid a few hearty and perma-bullish souls and an increasing group of bearish gold advisers the gold sector has out-crashed the broad markets and that is tanking sentiment along with it. In the link above you’ll see gold bug casino patrons every bit as frightened as stock market casino patrons.

Not to be overly obvious, but this exact thing happened in Q4 2008 too. I keep this blurb sent by a reader in 2014 on the right side bar for two reasons, only one of which is to promote my stance of that time to nftrh.com visitors and prospective NFTRH Premium subscribers. The other is to remind myself that it’s not easy and there was a lot of pain back then before we got to the pleasure part.

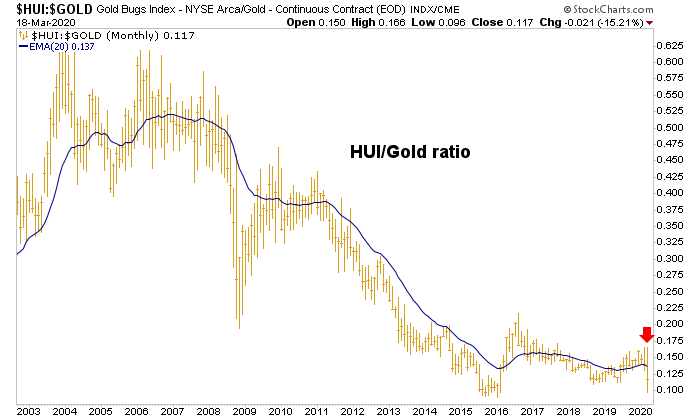

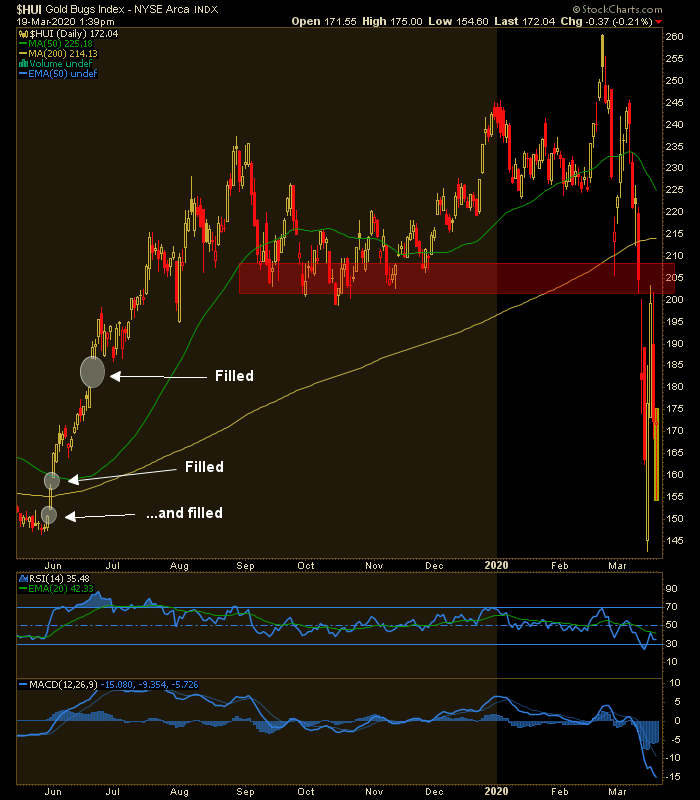

I tell you in black and white here and now that I did not expect this correction in gold stocks to be so deep and intense. I thought that the sector, due to its now excellent value and fundamental propositions would be nothing like 2008’s crash from HUI 630 to the eventual bleakness of the bottom at 100. And so it hasn’t, because while the bugs may soon be approaching Peak Bleak, the current pullback has only gone from HUI 260 to 142 at its low so far; I mean, please. It’s the compact duration that has shocked people. Frogs are trying to jump out of the kettle. At the bear market bottom they were fully boiled, floating dead.

The 2008 case was well earned by bloated gold stock valuations due to the effects of the previous inflation (gold’s ratios flat lined or declined vs. cyclical commodities from 2003 to 2008). Our main caution points this time were the gold and silver Commitments of Traders and the Q4 2019 ‘inflation trade’ that lifted all boats, including the miners’ boat. That is not when you buy gold stocks in bulk for anything resembling a committed hold.

Feeding into the pessimism as far as I can tell are broken indicators like the HUI/Gold ratio (‘the damn gold stocks ALWAYS under perform gold!’ rail the bugs). It’s constructive stance has broken down after all and if you put all your faith an indicator like this you are now jumping out of the kettle.

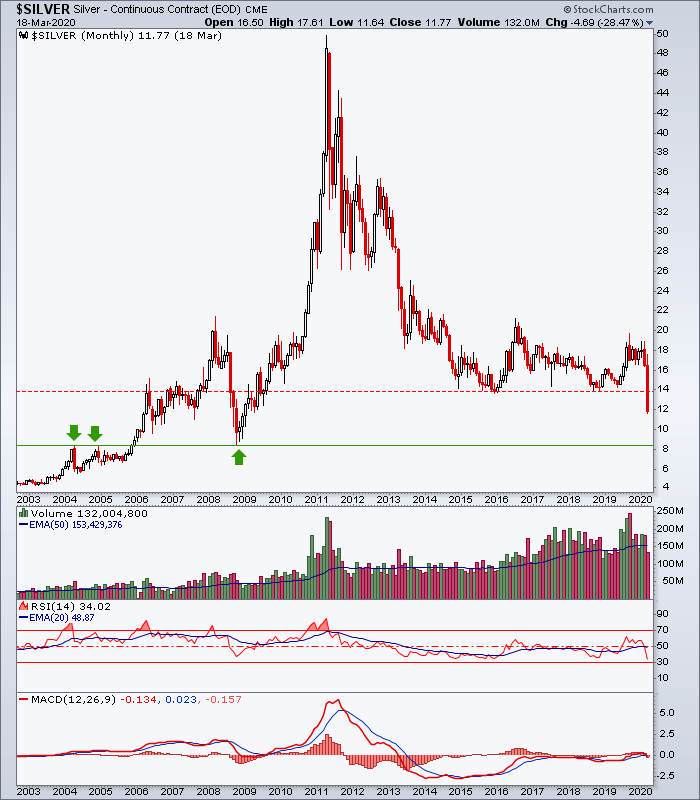

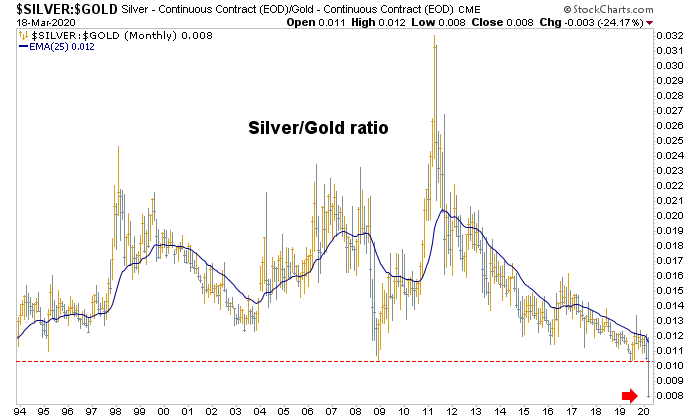

If you just hate that silver is breaking to a new low and theoretically targeting the 8s, you are outta here.

Or the epic failure that is the Silver/Gold ratio, so loudly touted as implying relative value by silver boosters until it became obvious they were wrong, which left only the sounds of crickets. This chart is terrifying silver bugs and other metals-focused ‘experts’ who watch indicators like this. They are inflationists after all, and they have been sent packing by the ongoing deflation scare. The inflation tout is over. It’s PEAK BLEAK.

The problem is not so much broken indicators as it is lack of risk management. I’ll bet that the average bug was feeling really good during the ill-fated Q4 inflation trade, which was by the way failing before anything near acute Coronavirus came about. As in Q4 2008 and even in 2001, the best buys are against the bleakness, the desolation and the fear. You buy heartbreak, and by extension that means you buy the broken indicators. In Q4 2008 everything was broken. Remember?

You also buy the fundamentals and keep your cash in order to do so because you have tuned out the robo-promotions and other singing sirens along the way. Personally, I am able to be a slow and discrete buyer because I took enough profits in Q4 2019 and even into Q1 2020. I actually would welcome lower or higher prices in the short-term. Cash is high. High enough that this macro disaster feels like opportunity. In Q4 2008 during that acute gold stock crash I did not feel so good. Not nearly, as I used the last of my powder at the bottom, after expending much of it too early. We live, we gain experience, we learn. That was a successful time. This could be even more so due to that experience.

So where to on the downside? This post advised on Monday where the bounce was likely going and likely to be resisted. Downside scouting is beyond the scope of this article. Managing your emotions however, is not. So do that! The gold sector is setting up and it may or may not involve more gut wrenching but just as gold miners use tools to dig the stuff out of the ground, we need tools to succeed in this process as well. One of those tools is cash and another is emotional stability. In fact, one leads to the other.

Peak Bleak is actually another term for opportunity in this sector. History says so.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2020 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.