What's Ahead for the Gold Market?

Commodities / Gold & Silver 2020 Nov 15, 2020 - 10:17 AM GMTBy: The_Gold_Report

Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, look at the macroeconomic factors they believe will move gold higher. The gold market entered a period of increased volatility during the third quarter, usually a positive indicator for the metal. A growing number of investors and analysts recommended the accumulation of gold as it began to move out of the shadows and into the spotlight. Global ETFs have now been net purchasers for 11 months in a row and central banks have also been net purchasers every month of this year except October when two nations liquidated some of their holdings to meet dollar requirements resulting from the COVID-induced economic crisis.

We see a further move higher in gold in the near term as the election log jam begins to clear. The election process curtailed new fiscal stimulus since July when direct transfers to individuals exhausted their Congressional approvals. This pause in fiscal stimulus, which took government transfer payments to an astonishing 25% of household income, coincided with a pause in gold's upward momentum. However, it is very clear that further stimulus is favored on both sides of the House and even a Republican Senate, if there proves to be one, will not prevent trillions more of fiscal stimulus.

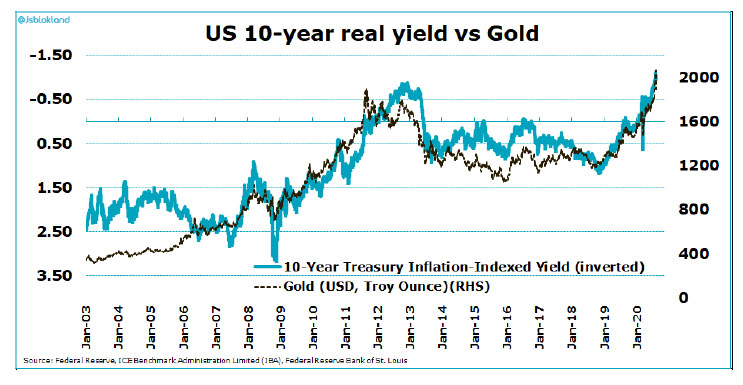

The two main drivers of the gold price are the dollar and real yields. We expect both drivers to be positive in the coming year.

First, the dollar: The Fed will be forced to fund whatever expenditures the Congress approves. Foreign holdings are at 10-year lows as the largest sovereign purchasers became net sellers this year. We therefore expect Fed debt monetization to accelerate in the next few months with a negative impact on the dollar. It was a $3 Trillion expansion of the Fed balance sheet in March and April which, not coincidentally, equaled a sudden increase in the US deficit to $3 Trillion, that unleashed gold from its March low. Debt monetization is a formula for dollar weakness.

As for yields, the market narrative now favors a reflation trade due to the apparent success of the US Operation Warp Speed vaccine initiative. This has provoked the sale of Treasuries as hot money has moved back into stocks, driving up yields. We expect the Fed response to be aggressive: higher yields cannot be allowed to dampen the economic recovery. In our view, the Fed is very likely to cap yields, a policy that can only be implemented by more QE. Capping yields in unison with a reflation narrative means increased inflation expectations and lower real yields…the magic formula for higher gold prices. If yields cannot rise to attract and hold private capital, the Fed must buy more debt and the dollar must fall.

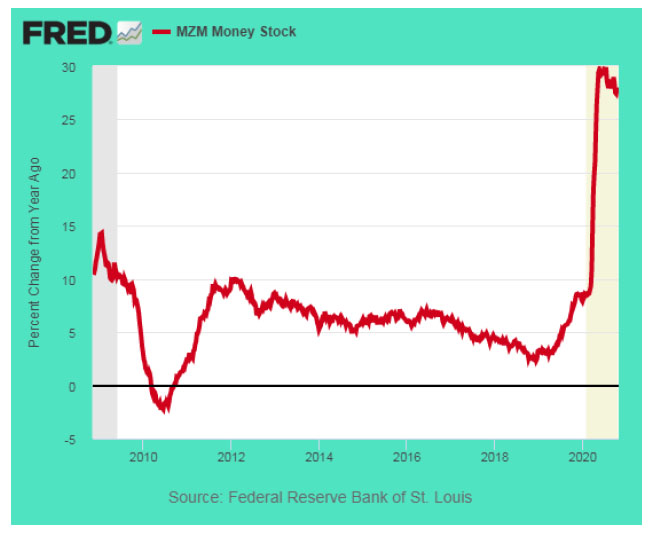

Remember that today's QE is not the QE post Great Recession which corralled the new money in the financial system, resulting in a muted response in terms of money supply growth and inflation. Today's QE is being mainlined into the real economy by way of direct transfer payments to individuals and business, forgivable loans and bailouts. Money supply is expanding at a blistering pace. The die has been cast and there is no turning back. Going forward, gold is the best protection for private wealth and there is not nearly enough of it to serve this purpose at current prices.

In a reflation scenario, inflation expectations rise significantly from low levels. With the rise in nominal yields capped by central bank QE, real yields fall. The relationship between real yields and gold is virtually perfect in recent years.

The growth in MZM money supply...the money available for immediate expenditure...has slowed(!) to 27.5% year over year, down from 30% two months ago, an unprecedented pace of money creation which is temporarily keeping the economy afloat.

This article is the collaboration of Rudi Fronk and Jim Anthony, cofounders of Seabridge Gold, and reflects the thinking that has helped make them successful gold investors. Rudi is the current Chairman and CEO of Seabridge and Jim is one of its largest shareholders.

Disclaimer: The authors are not registered or accredited as investment advisors. Information contained herein has been obtained from sources believed reliable but is not necessarily complete and accuracy is not guaranteed. Any securities mentioned on this site are not to be construed as investment or trading recommendations specifically for you. You must consult your own advisor for investment or trading advice. This article is for informational purposes only.

Disclosures: 1) Statements and opinions expressed are the opinions of Rudi Fronk and Jim Anthony and not of Streetwise Reports or its officers. The authors are wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the content preparation. The authors were not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the authors to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. 2) Rudi Fronk and Jim Anthony: we, or members of our immediate household or family, own shares of the following companies mentioned in this article: Seabridge Gold. We personally are, or members of our immediate household or family are, paid by the following companies mentioned in this article: Seabridge Gold. 3) Seabridge Gold is a billboard sponsor of Streetwise Reports. Click here for important disclosures about sponsor fees. 4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.