Stock Market Bull Trend in Jeopardy

Stock-Markets / Stock Market 2021 Mar 03, 2021 - 05:12 PM GMTBy: Troy_Bombardia

What a week it has been! Various markets saw noticeable declines on news of rising yields. The strong upward trend for stocks is finally taking a long-overdue breather and so is extreme sentiment.

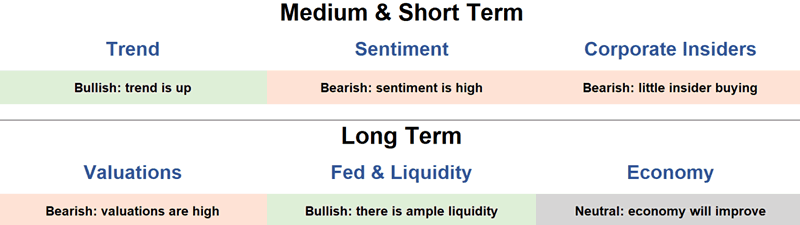

Let’s look at some bullish and bearish factors to give us a better idea of what the markets are doing.

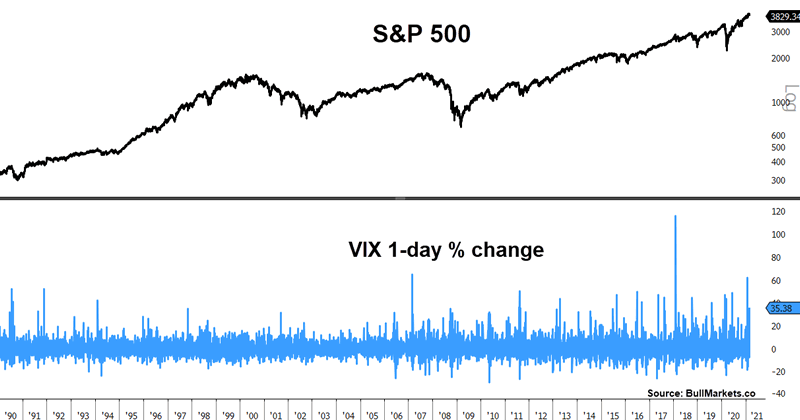

VIX spike

VIX spiked more than 35% on a day when the S&P 500 fell less than 2.5%. This is a nervous market…

This is also an unusual occurrence with only 7 other similar cases since 1990.

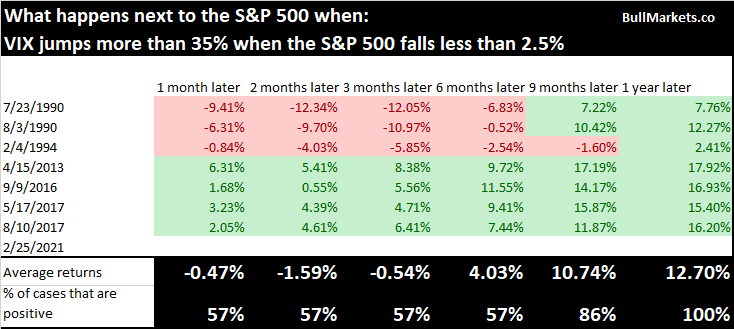

Historically, this was a bullish sign for stocks over the next 9-12 months.

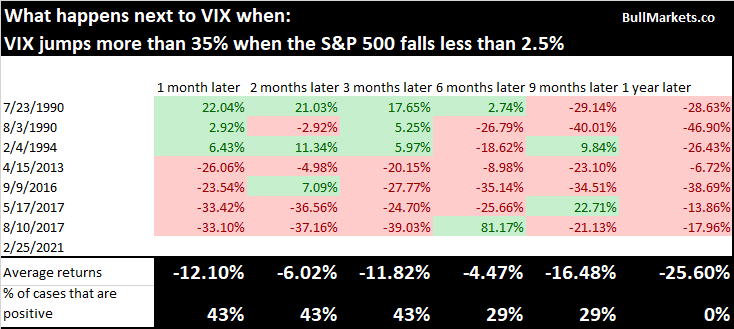

And this was a bearish sign for VIX on every single time frame.

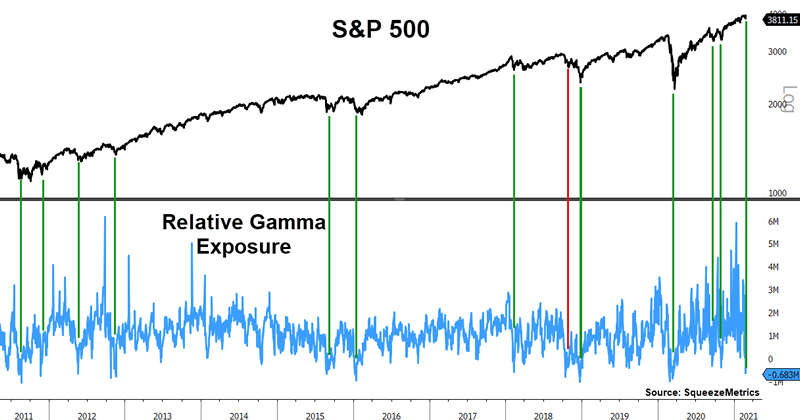

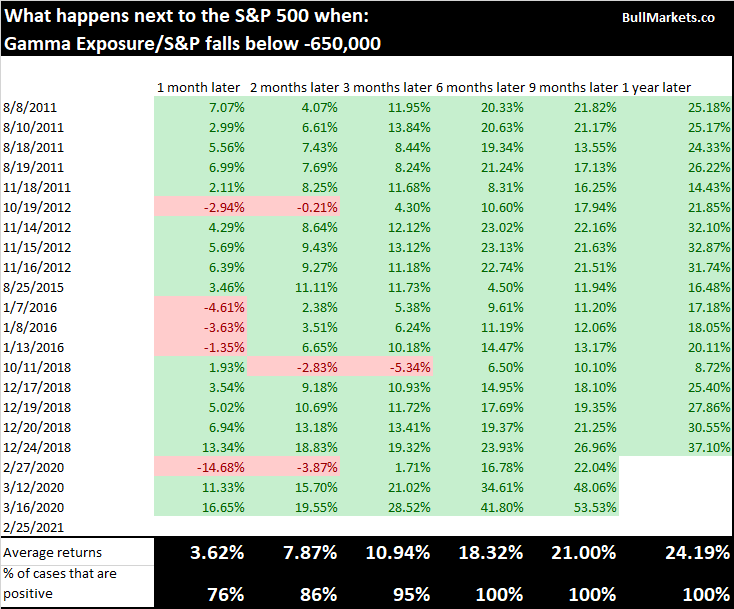

Low Relative Gamma Exposure

Relative Gamma Exposure recently fell to a record low. This indicator divides Gamma Exposure by the S&P 500’s value to account for the stock market’s changing value over time.

In the past, when the relative gamma exposure fell below -650000, this was a very bullish sign for stocks on almost every single time frame.

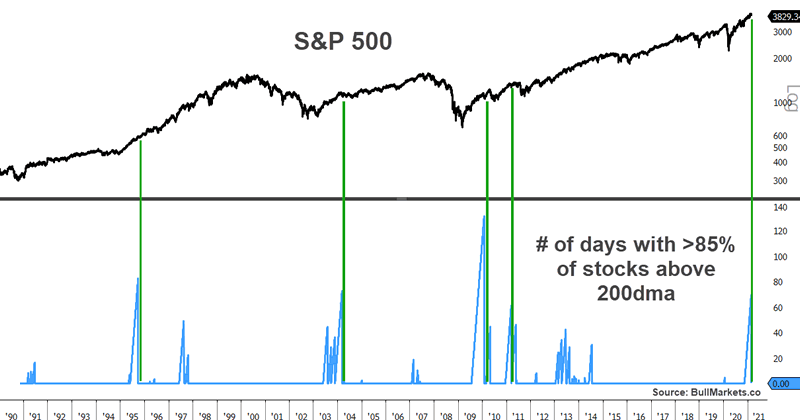

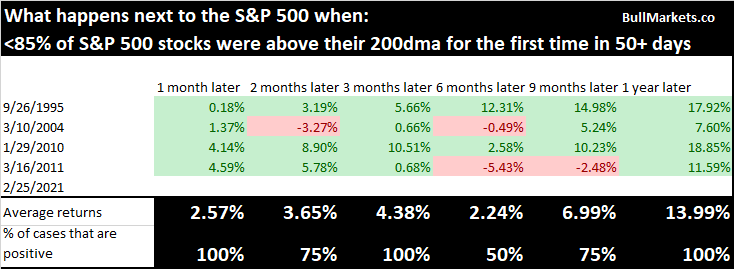

S&P 500 breadth

S&P 500’s incredible 69 day streak with more than 85% of stocks above their 200dma came to an end with the recent market decline.

Historically, such strong momentum could lead to a larger short term selloff, followed by more gains over the next 1-3 months.

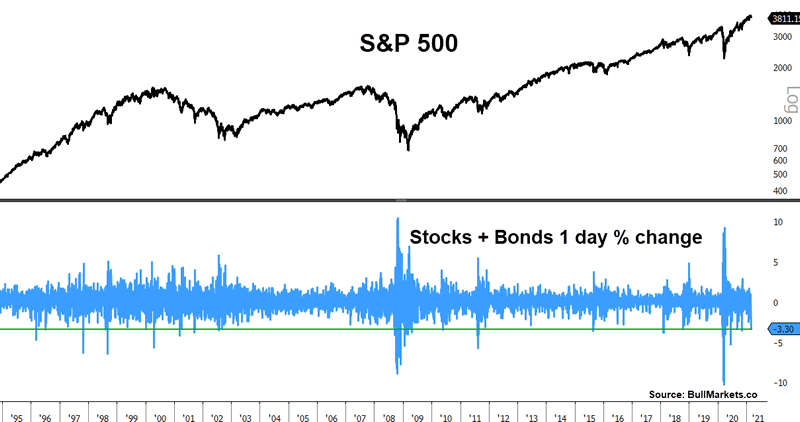

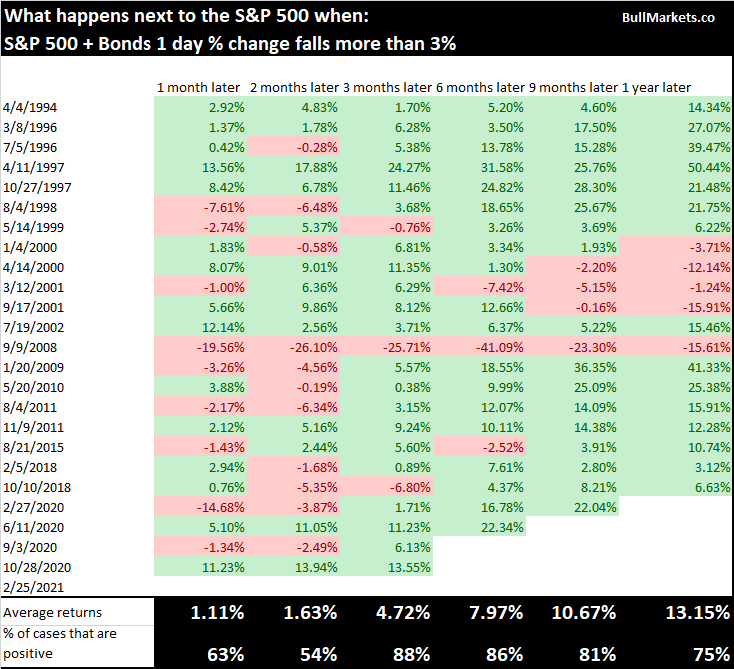

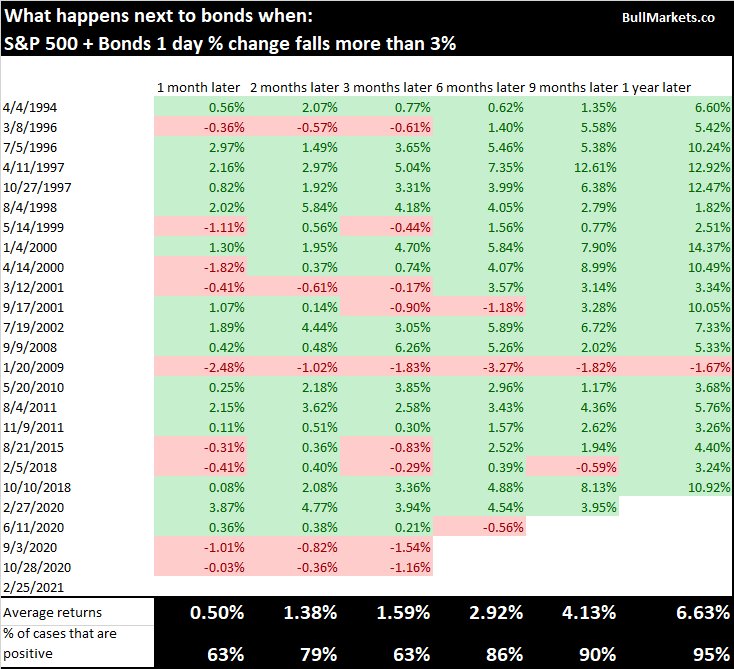

Stocks & Bonds

Stocks and bonds both fell this week, with bonds not acting as much of a safe haven for investors. A 50-50 allocation of stocks and bonds saw one of its worst performing days with a greater than 3% 1-day decline.

When this happened in the past, this was a bullish sign for stocks over the next 3 months.

This was also a bullish sign for bonds over the next 6-12 months.

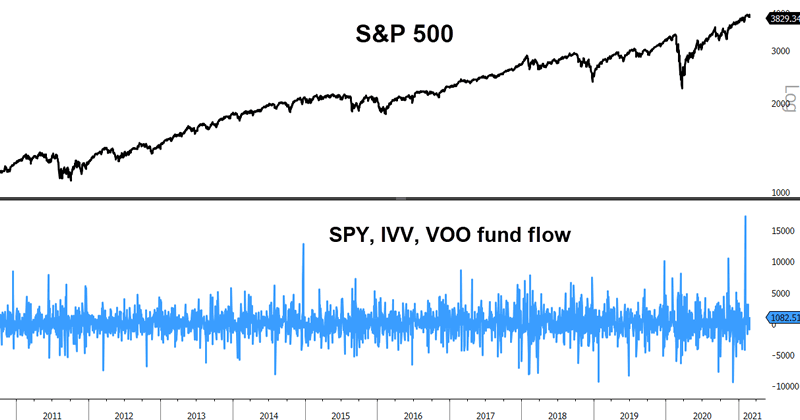

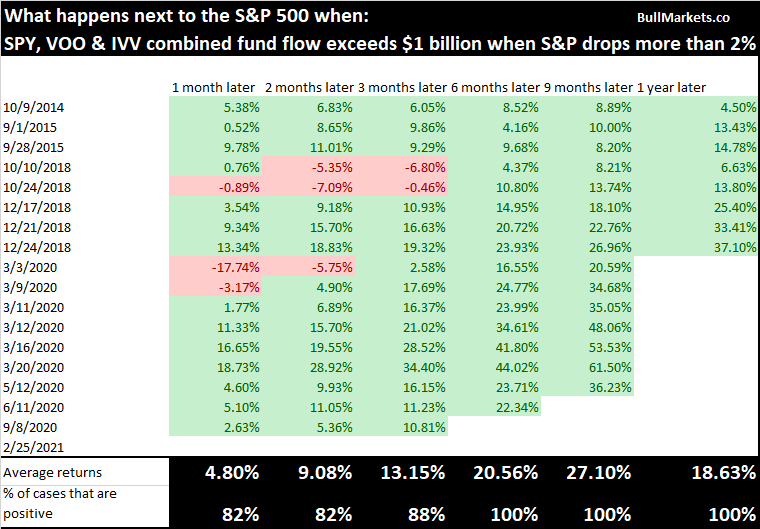

Fund flows

On Thursday, when the S&P 500 index saw a market decline of more than 2%, the S&P 500 ETFs SPY, VOO and IVV still saw inflows of greater than $1 billion.

This was a very bullish sign for stocks on almost every single time frame.

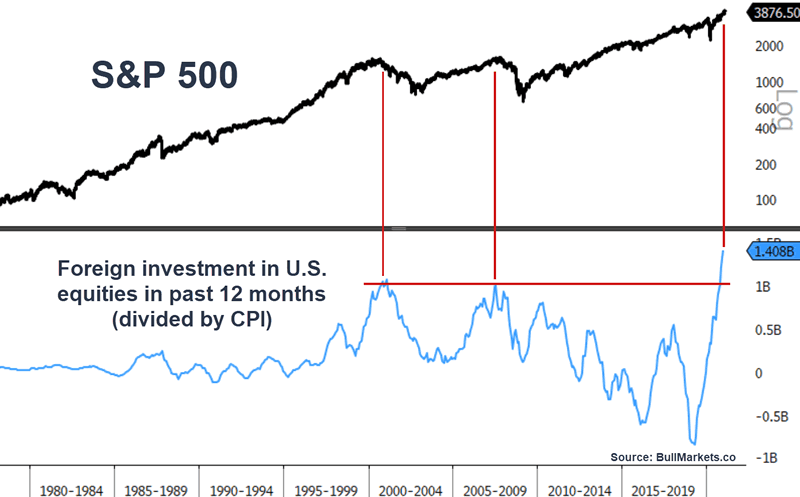

Foreign Investment

As I noted on Tuesday, the past 12 months saw record inflows into U.S. equities from foreign investors. It’s also interesting to note that foreign investment was consistently low until the mid-1990s when globalization really picked up steam.

The chart above demonstrates that foreigners have rushed into U.S. stocks at the fastest pace ever (in real dollars), exceeding prior peaks in early-2001 and 2007.

I would consider this to be a long term warning sign.

Conclusion: market outlook

Here’s how I think about markets based on different strategies & time frames.

- Long term investors should be highly defensive right now. Look for opportunities away from public equities where there is less long term risk.

- Short term trend-focused portfolios should continue to ride the bull trend because no one knows exactly when it will end. However, stay vigilant next week in case market conditions continue to deteriorate.

Copyright 2021 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.