Powell and Yellen Sound Upbeat. Don’t They Like Gold?

Commodities / Gold and Silver 2021 Mar 29, 2021 - 10:01 AM GMTBy: Arkadiusz_Sieron

Both Powell and Yellen testified before Congress. They sounded upbeat on the U.S. economy, but gold’s reaction was weak.

Both Powell and Yellen testified before Congress. They sounded upbeat on the U.S. economy, but gold’s reaction was weak.

What a combo! Both Fed Chair Jerome Powell and the U.S. Treasury Secretary Janet Yellen testified before Congress this week. They spoke about the economic response to the economic crisis caused by the Covid-19 pandemic and the Great Lockdown .

In his prepared remarks , Powell sounded rather hawkish , as he noted that “the recovery has progressed more quickly than generally expected and looks to be strengthening.” As well, during the Q&A session, the Fed Chair seemed to be very confident about the economy and the central bank’s monetary policy . In particular, Powell told senators that 2021 was “going to be a very, very strong year in the most likely case.”

He also downplayed worries about higher inflation expressed by some lawmakers, arguing that the environment of low inflation we have observed for years before the epidemic won’t change anytime soon:

We think the inflation dynamics that we’ve seen around the world for a quarter-century are essentially intact — we’ve got a world that’s short of demand, with very low inflation. We think those dynamics haven’t gone away overnight, and won’t.

And Powell dismissed concerns about the supply disruptions as well, saying that “a bottleneck, by definition, is temporary”.

In a sense, Powell is right. A lot of supply disruptions are short-lived. But there are more inflationary factors operating right now, to name just a surge in the broad money supply . So, I’m afraid that he might be too conceited and understated the risk of higher inflation. You know, a lot of economic trends last – until they don’t. I’m referring here to the fact that the macroeconomic conditions change not gradually but rather abruptly. Inflation may remain low as long as inflation expectations are well-anchored, but if they become unanchored, inflation may rise quickly.

Importantly, Powell was also unmoved by the recent rally in the bond yields :

Rates have responded to news about vaccination, and ultimately, about growth (…) In effect there’s been an underlying sense of an improved economic outlook (…) That has been an orderly process. I would be concerned if it were not an orderly process, or if conditions were to tighten to a point where they might threaten our recovery.

Yellen also sounded rather hawkish in her prepared remarks , as she wrote that “we may see a return to full employment next year.” Yellen also admitted that asset valuations are high, but that she wasn’t worried about financial stability, nevertheless: “I’d say that while asset valuations are elevated by historical metrics, there’s also belief that with vaccinations proceeding at a rapid pace, that the economy will be able to get back on track”. However, she argued that economy needed more help to recover fully.

Importantly, Yellen admitted that higher taxes would be likely needed to raise revenues for increased government spending: “But longer run, we do have to raise revenue to support permanent spending”. Tax hikes could be negative for Wall Street and the economy, and thus, supportive for the price of gold.

Implications for Gold

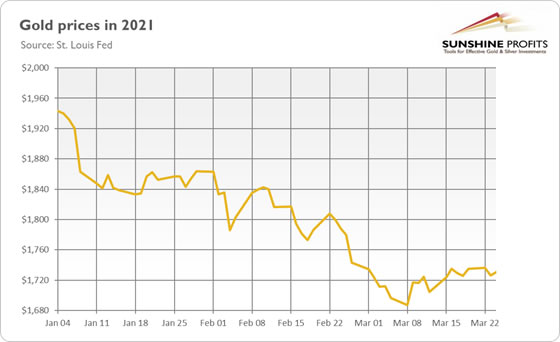

What do Powell and Yellen’s testimonies imply for the gold prices? Well, the two most important economic figures in the U.S. didn’t surprise the markets, so the yellow metal reacted little to their statements, as the chart below shows.

However, as both Powell and Yellen sounded rather optimistic about economic growth this year, their remarks might prove negative for the yellow metal. What can be particularly bad for gold is Powell’s calm stance regarding the rising bond yields. Of course, he could just put a good face on higher interest rates , but gold would prefer a more dovish stance. However, gold’s lack of a larger bearish reaction to rather upbeat testimonies from Powell and Yellen can actually be taken as an optimistic symptom. Anyway, a more accommodative stance of the Fed would be very helpful for the yellow metal.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.