Extreme Ratios Point to Gold and Silver Price Readjustments

Commodities / Gold and Silver 2021 Oct 22, 2021 - 03:44 PM GMTBy: MoneyMetals

Kicking the can down the road is the new national pastime. Every time the government’s bills come due, officials at the Treasury Department find creative ways of paying them with money they don’t have.

One measure of just how overextended the United States has become financially is the debt to GDP ratio. For most of the country’s history, excluding temporary wartime blips, net general government debt tended to be less than 50% of the economy.

As recently as the early 1970s, debt as a percentage of GDP came in at under 25%. By the early 1980s, it grew to over 30% and fiscal hawks became concerned. In the 1990s, it climbed to over 40% and concern started morphing into alarm.

Last year, the U.S. official debt to GDP ratio topped 100% (1:1). In other words, taxpayers owe more than the value of everything they produce.

That spells doom for most countries. The International Monetary Fund issues dire warnings to Third World countries whenever they exceed a threshold of 70% of GDP.

The U.S. is different, apparently, thanks to the status afforded to the Federal Reserve Note as world reserve currency. Up until 1971, that status was backed by a promise to redeem dollars held by foreign governments in gold.

Gold also served to restrain spending and borrowing at the federal level.

But ever since President Richard Nixon rescinded gold redeemability, politicians have been given a green light to run up debt without limit.

If the Joe Biden White House gets all its spending proposals pushed through, an additional $9 trillion will be added to the national debt. Barring a miraculous corresponding surge in GDP, the debt ratio can be expected to continue trending in the wrong direction.

How long officials in Washington can keep kicking the can down the road before kicking it off a cliff is unknown. These are, after all, unprecedented times in which the “lender of last resort” Federal Reserve has virtually unlimited powers.

But the central bank can’t bail out Uncle Sam perpetually without unintended consequences. Staving off a debt crisis may mean triggering a currency crisis.

Gold Is Poised to Outperform the Stock Market

During major financial crises in history, gold has vastly outperformed paper assets.

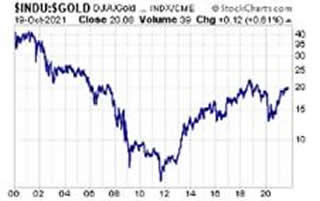

For example, both the deflationary Great Depression and the inflationary late 1970s saw the gold price reach a 1:1 ratio versus the Dow Jones Industrial Average.

The Dow trades at over 35,000 today, about 20 times the gold price.

Were the Dow:gold ratio to revert toward 1:1, either stocks would have to crash, gold would have to launch into a super-spike, or some combination of both.

Were the Dow:gold ratio to revert toward 1:1, either stocks would have to crash, gold would have to launch into a super-spike, or some combination of both.

Given the tremendous inflation pressures currently exerting themselves in the economy, the late 1970s may be the best model for what to expect going forward.

It would mean rising price levels combined with a weak economy (stagflation).

And given that our debt load today is more than four times greater as a share of the economy than it was in the 1970s, investors should brace for the potential of a far greater financial crisis.

In the event that plays out in the form a crash in the value of the U.S. dollar, gold will obviously serve as a premier safe-haven asset.

Silver Is Poised to Outperform Gold

Stefan Gleason is President of Money Metals Exchange, the national precious metals company named 2015 "Dealer of the Year" in the United States by an independent global ratings group. A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC, and his writings have appeared in hundreds of publications such as the Wall Street Journal, Detroit News, Washington Times, and National Review.

© 2021 Stefan Gleason - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.