Sentiment Speaks: This Stock Market Makes Absolutely No Sense

Stock-Markets / Stock Market 2021 Nov 17, 2021 - 10:33 AM GMTBy: Avi_Gilburt

People still argue with me about the weight one should give to market sentiment when investing or trading. Yet, when the earnings were announced for AMC this past week, it certainly should make you scratch your head.

AMC stock was just below $8 before Covid hit. When we look at a little closer at today’s company data relative to the pre-Covid era, we realize that AMC has more shares outstanding, more debt, and higher losses post-Covid. Yet, today, the stock is over $40. In the recent earnings report, management even told us that they are not yet at the pre-Covid levels when it comes to their fundamentals. Yet, the stock is 5 times higher.

Many of you would shrug this off to “the madness of crowds.” But, what it highlights is that the only thing that can explain this is market sentiment. So, while many would shrug this stock off as simply being “over-valued,” have you considered what that really means?

Well, it means that based upon standard perspectives of “valuation,” the stock is higher than it should be. But, how often does a stock trade at its “valuation?” If you think about it, it rarely trades at its valuation. During bull markets, it trades well above its valuation and during bear markets it trades well below.

So, what use is traditional “rational” valuation if it really does not help in telling you where the stock is going within an irrational market?

I have outlined my views on this in the past, and you can read more about it in a prior article: How To Analyze Market Sentiment Along With Market Fundamentals

In the meantime, many did not believe the market can rise as high as the 4900SPX next target I have been outlining. Then again, many did not believe we would rally over 4000SPX when we were down at 2200SPX, as I outlined in March of 2020.

Are You As Foolish As Most Market Participants?

And, many are even saying that they hate my being right so often:

In fact, over the summer, I was very clear in my expectation that the market will rally towards the 4600SPX region, and then pullback of 200-300 points, to be followed by a rally to 4900SPX. Well, we topped at 4550SPX, and then pulled back to 4270SPX. And, as long as the market holds over the 4550-75SPX region on this current pullback that I expected last week, we are heading to the 4900SPX region. And, we may even get there by the end of 2021.

Even though we have been extremely accurate in our stock market prognostications for years, I would like to take this opportunity to remind you that we provide our perspective by ranking probabilistic market movements based upon the structure of the market price action, which tracks market sentiment. And, if we maintain a certain primary perspective as to how the market will move next, and the market breaks that pattern, it clearly tells us that we were wrong in our initial assessment. But here is the most important part of the analysis: We also provide you with an alternative perspective at the same time we provide you with our primary expectation, and let you know when to adopt that alternative perspective before it happens.

As I have said many times before, this is no different than if an army general were to draw up his primary battle plans, and, at the same time, also draws up a contingency plan in the event that his initial battle plans do not work in his favor. It is simply the manner in which the general prepares for battle. We prepare for market battle in the same manner.

So, while I will never be able to tell you with certainty how the market will move in the coming weeks, months, and years, I present you with enough information to know where my primary perspective is wrong so that you can adjust in order to take account for the alternative situation. And, until such time that the market proves our primary perspective is wrong, we will continue to follow our primary perspective, which has been guiding us extraordinarily well for years, and is still pointing us to much higher levels in the coming years.

By now, I hope you recognize the difference in our analysis approach, other than the accuracy thereof. We strive to view the market, and utilize our mathematically based methodology, in the most objective fashion as possible, no matter how crazy it may sound. Moreover, it provides us with objective levels for targets and invalidation. So, when we are wrong in the minority of circumstances, we are able to adjust our course rather quickly, rather than fighting the market like many others you may read have been doing during this entire rally off the March 2020 lows.

So, while I hope I am helping many of you in maintaining an objective perspective within this non-linear environment we call the stock market, I want to wish you all well in your future trading and investment endeavors. As of now, I maintain my long-held expectation to see the market in the 6000SPX region in the coming years, of course, unless the market tells us otherwise. But, please approach the market with the respect that a bull market deserves, as surprises usually come to the upside, and we likely have much higher to go before this bull market ends.

I want to end with one final word of warning to the bearish amongst you that believe this bull market is about to come to an untimely demise.

While many of you have been looking for the next crash, or have been fighting this bull market because the fundamentals do not make sense to you, maybe you need to take into consideration how market sentiment has been driving this market. In fact, the market has been moving through our Fibonacci Pinball structure almost perfectly, and has proven what we have been saying all along – the market really does not care about the inflation issues being presented by the media.

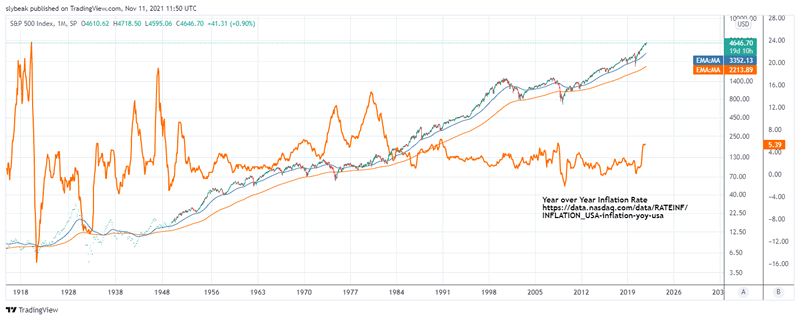

Yet, there are quite a few market participants and authors that still believe and attempt to convince the masses that inflation will kill this stock market. They are amongst the most bearish people out there. Unfortunately, they have never even looked back at what history says about inflation and the stock market. Rather, they simply spew their fear-driven fallacies to the unwitting masses, so many now believe that inflation is going to cause another stock market crash. If one simply looks at history, you would know this to be a fallacy.

But, I will conclude that you should be prepared that the early part of 2022 will likely provide everyone with quite a surprise. I have outlined these views in detail to the members of ElliottWaveTrader.net, and you can feel free to take a free trial to read about my expectations for 2022. Moreover, I will be doing a revised MoneyShow presentation in the coming week if you would like to hear more. You can read about it here.

Avi Gilburt is a widely followed Elliott Wave analyst and founder of ElliottWaveTrader.net, a live trading room featuring his analysis on the S&P 500, precious metals, oil & USD, plus a team of analysts covering a range of other markets. He recently founded FATRADER.com, a live forum featuring some of the top fundamental analysts online today to showcase research and elevate discussion for traders & investors interested in fundamental rather than technical analysis.

© 2021 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.